AI-driven boom - looking beyond the Technology sector that has created the most value in the first wave so far

Introduction

In this article, we take a look at sectors/companies benefiting from the Generative AI (GenAI) that are outside the technology sector.

We analysed what we can learn from the experience in the US and how this approach could be applied to the Asian region.

We begin with generative AI (GenAI)-driven datacentre electricity demand boom and finish with the energy mix that will continue to drive this growth.

We believe that US datacentre growth has three features: high in energy-consumption, interconnection-vulnerable and region-specific, which generate three AI diffusional energy theses based on efficiency/density (internal power/cooling), infrastructural support (grid and transformers) and availability (PPAs in hyperscaler clusters for utility companies).

Consensus forecasts point to 2030 datacentre electricity demand of 900-1,100TWh globally (2-4% of total global power demand) and 300-400TWh for the US (6-8% of the US total), with a small part in total usage for AI. Yet, these estimates have yet to consider the most recent AI take-off, with Barclays projecting data centre electricity use of US power generation could be above 5.5% in 2027 and more than 9% by 2030(likely necessitating the offloading to Rest of the World regions, especially Asia).1

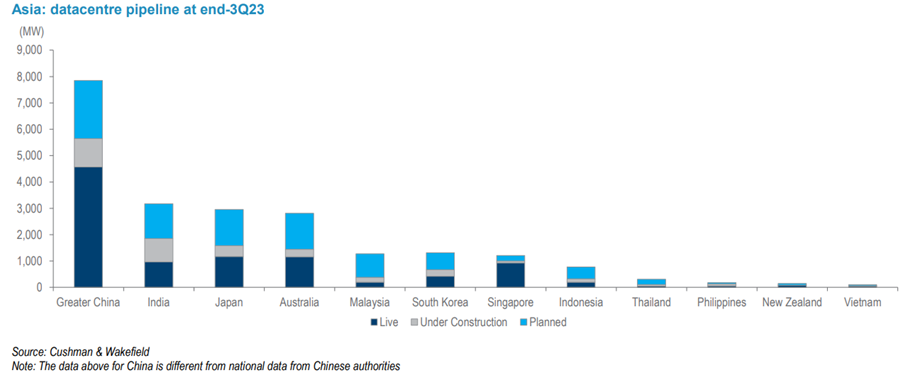

For Asia, we can expect datacentre growth (2.2x vs. pipeline) to be comparable to the US (2.5x). Singapore and Malaysia stand out, with datacentres potentially accounting for >10% of their total electricity consumption. We also see datacentre growth accelerating in the two markets given their mild geopolitical/natural risk exposure and high connectivity to India/China, while the future shift towards AI inference and edge-computing will present even more opportunities for the region.

The US experience

Three features of US GenAI driven datacentre growth, which is at the core of the share-price rally is GenAI-driven datacentre development;

- energy-consuming

- interconnection-vulnerable, and

- region-specific.

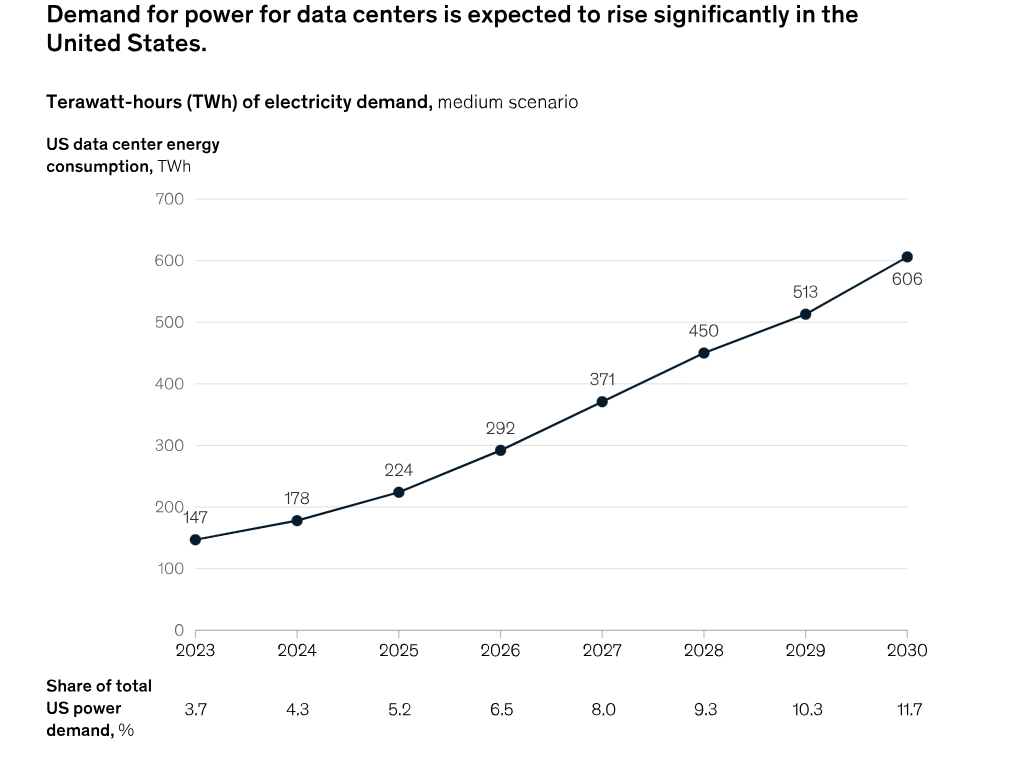

GenAI development is driving rapid electricity-consuming datacentre built-outs. A recent March 2024 report from McKinsey & Company estimated that US datacentre energy consumption will increase at a 15% CAGR over 2023-30, driven largely by GenAI-related demand, with datacentres accounting for 8.1% of total US power demand by 2030E (from 3.9% in 2023)2 . BCG estimates US datacentre energy consumption to rise from 126TWh in 2022 (2.5% of total US power demand) to 335-390TWh in 2030 (6.5-7.5% of the total US power demand)3 . While estimates may vary, there should be no disagreement over the notion that “both training and inference for GenAI are highly energy-consuming”. Investors should also note that these estimates were made before the introduction of Blackwell by Nvidia, meaning that the data presented could be too conservative now.

Looking at the performance of US Utilities first

highest share-price growth YTD outside of the technology sector is the utility names with exposure to datacentre electricity demand.

Given 1) the serious interconnection queue in the US, especially for renewable projects, and 2) the expected datacentre unit capex cuts thanks to the introduction of new GPUs (i.e., Nvidia’s Blackwell), we see investors expecting datacentre developers to pay for electricity at a premium to spot prices or via elevated PPA prices to ensure timely power supply for the future commissioning of datacentre operations. In particular, investors prefer Utilities that are: 1) Clean: offering clean energy or energy sources that are at least not dirty. 2) Unregulated: having unregulated exposure, which implies an electricity tariff upside. 3) Stable: offering stable baseload-like electricity supply preferred for 24/7 operations.

Consequently, several nuclear IPPs, including Constellation Energy (CEG US) and Vistra (VST US), have been the most sought-after by investors so far.

Who are the early winners?

For 2023, the top performers have been:

| Change % | MC @30 Dec 2023 | |

|---|---|---|

| Vistra | +70.7% | $13.77 billion |

| NRG Energy | +69.2% | $11.62 billion |

| Constellation Energy | +37.2% | $37.3 billion |

For 2024, the top performers for the first half-year have been:

| Change % | MC @30 Jun 2024 | |

|---|---|---|

| Vistra | +124.7% | $30.3 billion |

| Talen Energy | +73.5% | $5.88 billion |

| Constellation Energy | +71.9% | $64.55 billion |

| NRG Energy | +52.6% | $16.4 billion |

| Public Service Ent | +22.6% | $36.4 billion |

As highlighted above, our research of utilities in power generation and part of the Global Infra-Energy investment universe showed two names that are early winners, and both are nuclear power utilities.

Constellation Energy (CEG) sits at the confluence of two megatrends: the energy transition and artificial intelligence. Constellation Energy is a nuclear energy powerhouse, producing roughly 10% of all clean and renewable energy in the U.S. Constellation Energy’s nuclear power facilities, alongside its smaller hydro, wind, and solar units power the equivalent of 16 million homes. The company was a spin-off in 2022 from Chicago-based utilities Exelon Corp.

CEG has already landed nuclear deals with Microsoft to power some of its AI datacentres. Nuclear energy provided 50% of America’s carbon-free electricity in 2023, making it the largest domestic source of clean energy. The U.S. co-led in 2023 a coalition of over 20 countries that pledged to triple nuclear energy capacity by 2050. Constellation was already benefitting from the nuclear-focused aspects of the IRA, which essentially provides a price floor for nuclear power. Constellation is poised to improve its current nuclear power plants and expand into the next generation of nuclear technology. Constellation was one of the top S&P 500 performers in the first half, and CEG is still up 200% in the past two years. CEG has fallen over 25% from its May records.

Similar to Constellation Energy, Vistra (VST) is another nuclear power utilities that have performed extremely well-Vistra shares soared roughly 125% during the first six months of 2024, lagging behind only Super Micro Computer and Nvidia as shown above, Google, Amazon, Microsoft, and other tech companies are racing to land energy deals with Vistra for nuclear, battery storage, solar, etc. Vistra shares soared roughly 125% during the first six months of 2024, lagging behind only Super Micro Computer and Nvidia.

The RC Global Investment team noted another well-established Utilities not in the above list is actually a potential future outperformer.

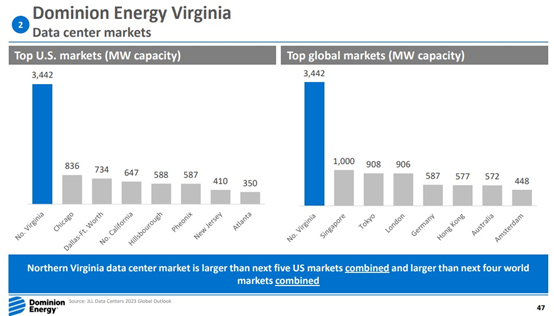

Dominion Energy- it took the company 115 years from its founding to reach its current level of power delivery. Dominion Energy is experiencing commercial load growth driven by demand from data centres. Attractive customer growth across its Virginia and South Carolina service areas is also boosting demand for its services. In aggregate, the company has connected 94 data centres with over 4 gigawatts of capacity over the last five years in Northern Virginia. The company connected nine new data centres year-to-date through to July and expects to connect an additional 15 data centres in 2024. Strong load growth is expected to boost the earnings of the company, and it projects an operating earnings annual growth rate range of 5-7% through 2029. “The pace of growth is so rapid, driven by data centres, that we’re on pace to double our system load in the next 15 years,” according to Dominion at a recent presentation.

Dominion Energy is entrenched in electricity and natural gas provision. With operations spanning electricity generation, transmission, and distribution, plus natural gas storage and distribution, it plays a critical role in energy infrastructure, including renewable, with substantial investments in solar and wind projects marking its commitment to sustainable energy. In a later section, we highlighted the region-specific nature of AI-power demand in the US and Dominion, as the leading utilities of Virginia -is right in the hub of the nation.

After the utilities sector - two groups in the industrial sector also benefited.

The first type is internal power and cooling providers for data centres

These companies are the obvious winners as they can ride directly on the growing order backlogs of increasing datacentre new builds. Datacentre owners also aim for improved energy efficiencies to reduce costs, make new projects feasible, and reduce potential electricity usage conflicts with local communities and other industries.

These companies are the obvious winners as they can ride directly on the growing order backlogs of increasing datacentre new builds. Datacentre owners also aim for improved energy efficiencies to reduce costs, make new projects feasible, and reduce potential electricity usage conflicts with local communities and other industries.

Key US equities riding on this theme include Vertiv (VRT US), Xylem (XYL US), and Carrier Global (CARR US).

Within this group, we highlight Vertiv as a prime example of the demand generation for power and cooling providers. It was spun off from Emerson Electric, sold to private equity in 2016 and in 2020, changed its name to Vertiv, and went public via a special purpose acquisition company (SPAC).

In March 2024, during Nvidia's annual weeklong GPU Technology Conference, it was announced that Vertiv was entering the Nvidia Partner Network. That relationship really electrified the stock price - the stock has risen 80% in 1H 2024.

Vertiv engineers and manufactures power delivery and management systems for datacentre servers (the computing units that sit in pull-out drawers in data centre racks). As with all electrical systems, more energy use means more heat, a harmful side effect of powerful new AI servers. Vertiv engineers the cooling systems, too. Being added as one of Nvidia's key consultants in power and cooling systems obviously has investor optimism flying high, given how fast Nvidia is growing. Vertiv has secured a position in the datacentre supply chain, especially because AI is fuelling Nvidia’s demand.

The second type is infrastructural support - grid and transformers

This group benefits from the ongoing demand for grid upgrades. Already benefiting from the demand for grid upgrades in the energy transition in the US since 2020, the datacentre electricity demand growth story has given these names another leg-up.

Eaton (ETN US) and Schneider Electric France are two examples in this space. Eaton shares have risen 30% in 1H 2024 and Schneider Electric more modestly +23.4% in 1H 2024.

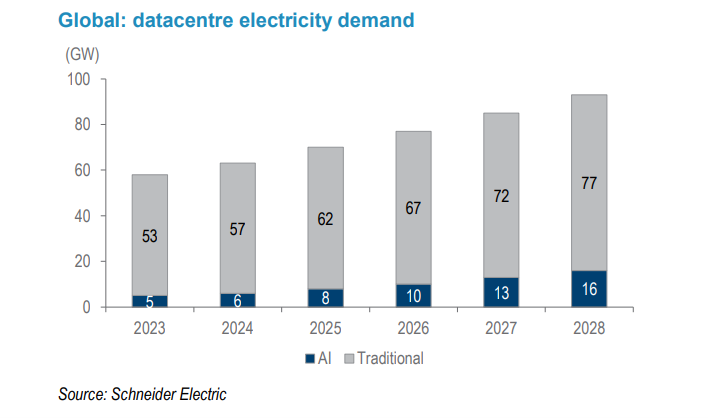

Here is a recent slide from Schneider Electrical highlighting the unprecedented trend in datacentre demand:

Source: Schneider Electrical

Region-specific nature of data centres in the US

Hyperscalers in the US are clustered in certain areas, leading to an expectation of a much tighter electricity balance in some states than in others

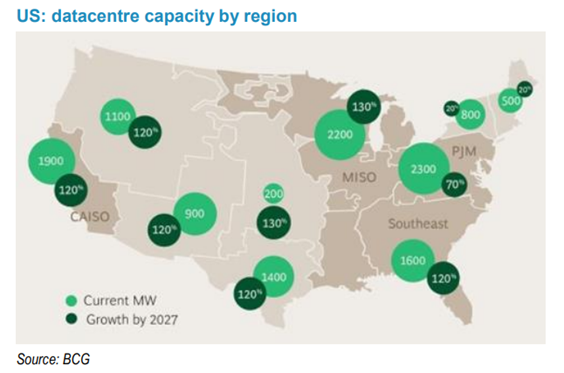

The US datacentre electricity demand is region-specific. We note that datacentres are clustered around several states in the US. According to BCG, >60% of US datacentres will be within the four major grids, namely MISO, CAISO, PJM and Southeast, by 20274 . As such, we believe energy companies focusing on the four major grids will face both challenges and opportunities from datacentre growth.

The No. 1 datacentre hub in the US (and the World) by a huge margin is Virginia; as shown below, it is larger than the next four combined (Singapore, Tokyo, London and Germany).

Source: BCG

Source: Dominion Energy

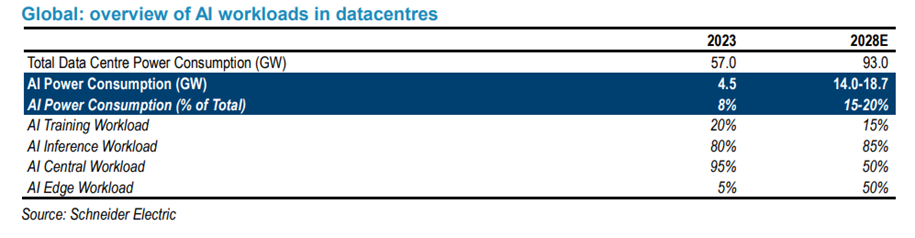

If we only consider GenAI, its share of global power demand will be (much) lower. Despite the solid growth expected for GenAI, it will still account for a minority of datacentre capacity. According to Schneider Electric (SU PA), AI-related datacentre demand will increase at a 26% CAGR over 2023-28E, outpacing the 7% growth in datacentre demand in traditional areas. Yet, AI-related demand will still account for only a minority of (15-20%) datacentre workloads by 2028E, despite rising from 8% in 2023, as per Schneider Electric.

Source: Schneider Electrical

Source: Schneider Electrical

Electricity consumption from data centres/AI associated segments is likely to double by 2026. They consumed an estimated 460 terawatt-hours (TWh) in 2022, with total electricity consumption could reach more than 1,000 TWh in 2026. This demand is equal to that of the electricity demand of an entire country of Japan.

Another group of beneficiaries are the datacentres operators and owners

As Nvidia’s AI chips and systems become more powerful and ubiquitous, the computational demands on datacentres and networking infrastructure grow exponentially. Tesla’s plan to deploy 85,000 Nvidia GPUs by the end of 2024 is just one example.

This infrastructure primarily consists of hyperscale datacentres — massive, highly sophisticated facilities designed to support the enormous computational needs of AI and other data-intensive technologies. Unlike traditional data centres, hyperscale facilities are built to accommodate tens of thousands of servers and can rapidly scale to meet increasing demand. These facilities represent a fundamental shift in datacentre architecture and management. They are designed to be modular and scalable, enabling rapid expansion as demand grows. This flexibility is crucial for supporting the unpredictable and often explosive growth of AI workloads.

Hyperscale data centres are strategically located to optimise for factors like energy costs, network latency and natural disaster risks. They often form the backbone of cloud-computing services, providing the raw computational power needed for AI training and inference at scale.

Due to systemic changes in supply and demand, the hyperscale datacentre market is on a trajectory of explosive growth, with projections indicating it will grow to $262 billion by 2032 from $45 billion in 2024. This represents a compound annual growth rate (CAGR) of 24.7%, underscoring the sector’s immense potential.

As the AI boom accelerates, infrastructure providers are positioned to reap substantial rewards. Ranging from global leaders in digital infrastructure to specialised datacentre operators and IT solutions providers, these companies are building and maintaining the critical infrastructure that powers AI advancements. From operating vast networks of datacentres to providing cutting-edge networking solutions, these businesses are the picks and shovels of the AI gold rush and stand to benefit from the growing demand for robust, scalable AI infrastructure.

The top 2 datacentre REITS in the US are:

- Equinix (EQIX): A global leader in digital infrastructure, Equinix operates 260 datacentres in 71 major metro areas across the Americas, Asia-Pacific and EMEA (Europe, Middle East, and Africa) regions.

- Digital Realty Trust (DLR): Digital Realty owns and operates more than 300 datacentres across six continents. The company provides scalable and optimised network architectures essential for AI and other demanding applications.

Other companies that provide comprehensive datacentre infrastructure solutions, including servers, storage, and networking systems, such as IBM, DELL and HP, are also beneficiaries.

Can the US power system cope with the exponential growth of power demand?

The US power system is unfit to digest a significant surge in power demand from datacentres. Likely contrary to many investors’ impression, US electricity demand has plateaued at c.4,000TWh (aka c.4PWh shown in the chart below) since 2010 despite ongoing economic growth, mainly thanks to energy efficiency improvements.

Despite the largely flat national electricity demand, the US power system is already facing huge challenges in transitioning from fossil to cleaner fuels, as the current grid infrastructure is unfit to handle intermittency projects. According to Lawrence Berkeley National Lab, the situation is deteriorating, with a “typical project built in 2022 taking five years from interconnection request to commercial operations, compared to 3 years in 2015.

We believe the Offloading of datacentre workloads from the US to Asia appears possible if the situation in the US does not improve. So far, there has already been market talk, mostly since March 2024, about training OpenAI GPT-6 across US states, as clustered training in a single state could trigger a grid collapse. Such regional training is still taking place within the US rather than across countries. Yet, if exponential datacentre demand growth persists while US power capacity development remains hindered by interconnection issues (we see both as likely), we foresee a potential positive spill-over to Asia as tech giants start offloading datacentre workloads to Asian countries. We are not sure if the most energy hungry AI workloads would be offloaded from the US to Asia or just the traditional workloads. On the one hand, we think AI training workloads may be suitable for offloading to Asia due to low latency requirements. On the other hand, the current Nvidia Infiniband technology may not be mature enough for long-distance connectivity.

Regional Focus - From the US to Asia

We foresee datacentre growth in Asia being rapid and moving in parallel with the US. Cushman & Wakefield estimate 2.25x growth potential in datacentres for Asia based on projects announced so far, with its 13.28GW development pipeline. This growth will be largely in line with the 2.47x upside for the Americas and ahead of the 2.05x upside for EMEA, according to Cushman & Wakefield.

Source: Cushman & Wakefield Note: The data above for China is different from national data from Chinese authorities

We see a “best-is-yet-to-come” scenario for datacentre development in Asia. While we already note a robust datacentre capacity pipeline in Asia, we believe the best is probably yet to come. Investors should note that Asia is still in the early stage of exponential growth in the AI datacentre. We think it is reasonable for more global tech giants to strengthen their footprints in Asia later this year. Indeed, we have seen some exciting announcements on datacentre development in Asia made only recently, for example:

- 19 March 2024: YTL Group (a conglomerate in Malaysia) announced the development of the first AI cloud in Malaysia with Nvidia’s latest Blackwell GPU.

- 1 April 2024: OpenAI plans to open an office in Tokyo in April 2024, its first office in Asia.

- 6 April 2024: Microsoft acquired land in Johor, Malaysia, for datacentre development. 10 April 2024: Microsoft said it will invest USD2.9bn for datacentre development in Japan

Datacentre development will be highly uneven geographically. A lot of projects in Asia have likely yet to be announced.

A shortage of computing power has been noted in the US, and electricity may be next. Goldman Sachs, Barclays, BCG, SemiAnalysis, and EPRI forecast that datacentre power demand will be between 4.00 % and 9.1% of US power generation by 2030 5. McKinsey & Co have a more aggressive forecast, accounting for a startling 11.7% of US power generation and would represent 23% CAGR between 2024 and 2030 6.

Source: Mckinsey & Co

Our judgement is that the estimate may become a reality, but without an energy technological breakthrough, it may not be possible for the fragile US power grid system to support an additional 11.7% of power consumption driven by datacentre demand.

On 9 April 2024, the CEO of Arm (ARM US) even stated that “by the end of the decade, AI datacentres could consume as much as 20% to 25% of US power requirements. Today that’s probably 4% or less.” 7

Offloading of datacentre workloads from the US to Asia makes sense if the situation in the US does not improve.

A country’s power system is most likely to be disrupted by the datacentre boom if a high proportion of national electricity output is consumed by datacentres. This implies that these countries also have the strongest need to upgrade their electrical power systems in response to the trend. Daiwa benchmarked the power consumption of each country based on datacentre pipeline data from Cushman & Wakefield against the 2022 national electricity consumption of each of these countries 8. Its analysis finds that Singapore, Australia, and Malaysia are among the top 3 countries in terms of exposure to datacentre electricity demand.

The New Epicentre of Southeast Asia

Both Singapore and Malaysia are highly exposed to datacentre electricity demand.

We expect Singapore to look to neighbouring Malaysia for regional datacentre development. With electricity availability continuing to be a headache for Singapore’s future datacentre development, we expect Singapore to seek collaboration with Malaysia. Recent news suggests a new Special Economic Zone between Singapore and the neighbouring state of Johor will be implemented very soon. Hence, we believe investors will focus more on the datacentre segment in Johor, the southernmost Malaysian state that is just across from Singapore, and we suggest that investors consider the integrated development of datacentres in Singapore and Johor. Klang Valley around the capital Kuala Lumpur could form the next cluster.

Malaysia only had 196MW of datacentres in operation as of end-3Q23, but it has a further 190MW under construction and 888MW planned, according to Cushman & Wakefield. Meanwhile, data as of August 2023 from Tenaga Nasional Berhad paints an even more encouraging picture, suggesting a 4,945MW datacentre pipeline from 6 operators (Yellowwood Properties, SIPP Power, GDS IDC Malaysia, AirTrunk Malaysia, K2 Strategic and Princeton Digital Group). For investors’ reference, c.5GW datacentre capacity is equivalent to c.36TWh, which is equivalent to 27% of Malaysia’s power generation in 2022

With a planned IT load of around 1,400MW coming online by 2029, Malaysia will become one of the largest data centre hubs in Asia.

Tenaga Nasional Berhad (TNB) has already received applications for potential energy demand of 2,000MW from 10 datacentres.

Along with its geographical advantage, Malaysia has a clear cost advantage thanks to government subsidies, abundant land and water, the lowest electricity tariffs globally, and natural gas resources. We expect this core edge over costs to help Malaysia attract datacentre investment, along with its geographical advantages, including its proximity to Singapore and high subsea cable connectivity with India and China.

While not ignoring the opportunities in other Asian countries, we believe Malaysia is the No.1 beneficiary.

What are the best investment opportunities in Malaysia?

Similar to the case of the US, in which we have witnessed the first wave of winners among the utilities, in Malaysia, YTL Power (Utilities) has gained the most.

It gained +90% in 1H 2024 after a gain of +250% in 2023. It made a deal with Nvidia, which electrified the stock. The company bought one of the power generation utilities sold by Singapore over a decade ago; hence, it’s a play for both Malaysia and Singapore.

After the rise of YTL Power (similar to Constellation in the US), investors are now looking more at the national electricity company Tenaga. We also like another not so obvious Chinese IPP that bought one of Singapore's utilities - Hueneng Power International China. Hence, it is a play on both China and Singapore.

Other Malaysian companies on our watchlist are

- Gamuda, IJM and YTL Corp (parent of YTL Power), all of which are engineering & construction companies active in the datacentre build-out growth

- Telekom Malaysia - large datacentre owner in the country

Our watchlist table shows others in the Asian Pacific region, including Australia that are beneficiaries of AI outside the tech sectors.

They include mainly companies from - Utilities, Industrials (Engineering & Construction, also Capital Goods for Japan), Telecommunications Services and REITs/Companies holding datacentres.

Power Generation for the Utilities

While many investors focus on renewable energy, particularly wind and solar, as the primary power source for the transition to zero-emissions power generation, it's important to remember the critical role of a stable power base in the rapid growth of AI datacentres. While AI datacentres aspire to use as much renewable energy as possible, the reality in the near term is that they need to rely on reliable baseload power options that are clean or have the lowest emissions and are cost-competitive. In this context, the case for natural gas and nuclear power becomes even more compelling in the near term. Natural gas, the cleanest fossil fuel source, can provide baseload power or combine with wind and solar as a backup power source to make the combination available 24/7, ensuring reliable uptime for AI datacentres. Nuclear power emits zero-emission and has emerging capacity with the recommissioning of older plants and new build-out in emerging markets.

Gas-fired generation

We believe the gas turbine combined cycle (GTCC) industry will play a more important role in the global energy transition than the market expects. The industry is currently in a sweet spot due to 1) The availability of low-cost natural gas on a global scale. 2) COP28 endorsement of GTCC in the energy transition. 3) The likelihood of an unexpected uptick in GenAI electricity demand. 4) Deteriorating grids driving demand back to baseload power.

While many investors are still focusing on renewable/nuclear for now, we expect to see accelerated GTCC build-outs given the geographical and socio-political constraints for renewable/nuclear power. Daiwa estimates suggest that global GTCC demand would surpass 50GWpa, which is currently in the 40-50GWpa range 9.

Why gas turbines? We believe the gas turbine industry, especially that for heavy-duty and aero-derivative turbines, has a stable market landscape (basically a triopoly with GEV, MHI and Siemens Energy) due to its high entry barrier. We expect these players to benefit from profit growth going forward, thanks to margin expansion for new gas turbine sales and higher average utilisation for existing servicing fleets than in the past. Leading gas turbine makers are also deeply involved in manufacturing power equipment across grid, wind, nuclear, etc. We see a scenario of “proxies being better than the sector,” with investors having a well-hedged risk profile when investing in these names that are materially exposed to non-renewable (such as gas and nuclear), renewable (such as wind and solar) and grid technology.

Who are the winners in the case of gas-fired power generation?

- GE Vernova US (GEV),

- Mitsubishi Heavy Industry (MHI) Japan

- Siemens Energy Germany

These top 3 not only benefit from gas power generation but also nuclear and wind for GE Vernova and Siemens Energy.

As with uranium miners providing the fuel for nuclear power, for natural gas the biggest gas producer in the US is EQT. (Market Cap = US$19.6 billion). Petronas Malaysia (unlisted) is the largest gas producer in SE Asia.

Nuclear Power Renew Interest

As companies in the space look to safeguard energy security while reducing greenhouse gas emissions, nuclear power is back in demand again.

At the COP28 climate change conference that concluded in December 2023, more than 20 countries signed a joint declaration to triple nuclear power capacity by 2050. Achieving this goal will require tackling the key challenge of reducing construction and financing risks in the nuclear sector. Momentum is also growing behind small modular reactor (SMR) technology. The technology’s development and deployment remain modest and are not without its difficulties, but R&D is starting to pick up.

Asia remains the main driver of growth in nuclear power, with the region’s share of global nuclear generation forecast to reach 30% in 2026. Asia is set to surpass North America as the region with the largest installed nuclear capacity by the end of 2026. More than half of the new reactors expected to become operational during the outlook period are in China and India. Nuclear power has seen particularly strong growth in China over the past decade, with capacity additions of about 37 gigawatts (GW), equivalent to almost two-thirds of its current nuclear capacity. This resulted in China’s share in global nuclear generation rising from 5% in 2014 to about 16% in 2023.

In Asia, the most obvious one is China’s CGN Power, one of the two Chinese pure-play nuclear power utilities.

Part of the nuclear power value chain is uranium miners, of which the two largest listed are Kazatomprom (MC=US$10 billion) and Cameco Canada (MC=US$19.4 billion)

Final Conclusion

- While the IT sector has benefited the most and caught the attention of investors from the boom in AI, there are winners from other sectors as well – in this article, we mainly concentrate on Utilities and Industrials -both feature highly in our investment universe

- We noted that the Utilities sector in the US had its worst year in 2023 since 2018, as the S&P 500 Utilities fell 10% versus the overall benchmark, which went up 24%. The risk-reward became compelling as interest rates peaked, but the biggest sentiment change came from the surging power demand from datacentres required for AI expansion.

- Industrial equipment needed by datacentres became the next obvious choice to ride the AI boom.

- Utilities growth cannot rely on just renewables and nuclear energy even as countries embark on the transition to meet lower emission targets, natural gas is the most preferred fossil fuel needed to meet the demand growth.

- While the US is leading the world in AI Gen power demand growth, we believe SE Asia is ideally positioned to benefit from the spillover from the US.

- The table in the appendix summarises the names in our watchlist (many of which are already in the portfolio) for both the US and Asia Pac.

Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the Global Infra-Energy Fund

References

- Barclays, Artificial Intelligence is hungry for power, August 2024

- McKinsey & Company, The state of AI in early 2024: Gen AI adoption spikes and starts to generate value

- BCG, The Impact of GenAI on Electricity: How GenAI is Fueling the Data Center Boom in the U.S, 2024

- BCG, The Impact of GenAI on Electricity: How GenAI is Fueling the Data Center Boom in the U.S, 2024

- EPIR, Powering Intelligence Analyzing Artificial Intelligence and Data Center Energy Consumption, 2024

- McKinsey & Co, How data centers and the energy sector can sate AI’s hunger for power, September 2024

- The Register, Arm CEO warns AI's power appetite could devour 25% of US electricity by 2030, April 2024

- Daiwa, Vietnam datacentre sector- Promising growth outlook in a relatively small market size environment and favourable market conditions, September 2024

- Daiwa, Vietnam datacentre sector- Promising growth outlook in a relatively small market size environment and favourable market conditions, September 2024

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.