Industrial gases a unique segment of the material and chemical sector in global equities

As a follow on from our three-part series of investment opportunities relating to air, we now take a look at the industrial gases segment. Industrial gases are the principal ingredients of air in our atmosphere. The industrial gas companies are a unique segment in the material/chemical sector of the global equities market because they are more defensive than other companies in the material/chemical sector. While at the same time providing an excellent opportunity leveraging into megatrends for growth into the future. This unique risk-reward profile is one are taking advantage of through our Global Infra-Energy Fund that focuses on essential industries within in the infrastructure and energy business segments. Industrial gases have a direct relationship to both these business segments.

What are industrial gases?

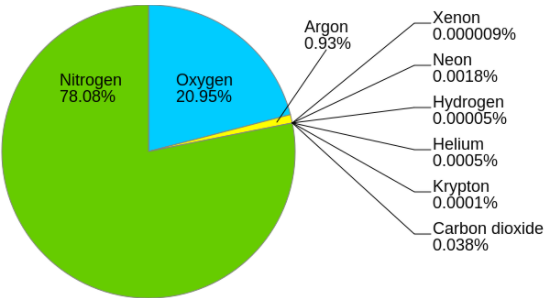

The main industrial gases are the principal ingredients of air (nitrogen, oxygen and argon) along with the noble gases – neon, krypton and xenon- as shown below.

Most of these gases are produced using air separation units (ASUs). An ASU works by chilling and compressing air so that it can be separated into component gases by distillation.

The first ASU built for oxygen production was in 1902, and the first plant for nitrogen recovery using air separation was in 1904 since then till about 1988 air separation has undergone many stages of development and sophistication.

Nitrogen accounted for the largest market share, in terms of value, while oxygen was the most widely used industrial gas, in terms of volume.

Hydrogen, helium and carbon dioxide also comprise significant markets, and while these gases are to be found in the atmosphere, commercial quantities are produced via chemical processes, often from natural gas.

Who are the end-use industries for industrial gases?

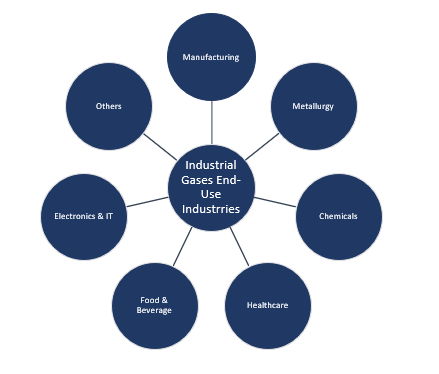

Industrial gases serve many industries, and the end use for industrial gases can be seen in the diagram below.

We have taken a slide from the recent 2Q results presentation of Linde Germany (a core holding of our Global Infra-Energy Fund) to illustrate as the largest player in this industry how its revenue is spread between different end markets -

Business model and delivery method used by industrial gas companies

Industrial Gases are sold through three main distribution channels:

- Tonnage - produced and maintained on the customers site or nearby

- Merchant – delivered in bulk to customer’s storage sites

- Cylinder – packaged smaller for smaller customers

Tonnage refers to the supply of large volumes of gas, both atmospheric (nitrogen & oxygen) and non-atmospheric like hydrogen. Industries served in this segment tend to be capital-intensive such as steel plants, chemical plants, oil refineries and electronics complex. The air gases are produced in gas plants such as ASU or syngas plants while hydrogen is typically produced using a process called steam reforming in which natural gas is used by reacting the steam.

These plants could be dedicated to supplying one main downstream customer (onsite supply) such as Linde has built plants within the Sinopec giant oil refining/petrochemical complex exclusively for such big customer and operated by Linde. These are often done on very long-term contracts.

To improve returns, many onsite plants could be "overbuilt" in terms of capacity, such as in an electronics cluster with many plants of different companies. The gas plants are often connected to a pipeline network so that any unused output can be sold to an alternative customer also connected to that pipeline. The overbuilt plants could also sell excess gas the other two distribution methods.

Merchant refers to the supply of industrial and medical gases, usually in a liquid phase. Volumes are intermediate between tonnage and cylinder. Customers are usually served by cryogenic tankers (which resemble a petroleum truck) but can be moved on ships and railcars. The product is delivered to a customer where it fills vacuum insulated storage tanks at the customer’s site. The tanker and storage vessel are usually owned and maintained by the gas supplier.

Transportation costs limit the optimal served market size for the bulk liquefied and the packaged (in cylinders) oxygen/nitrogen markets, serving mid- and small-sized merchants, to around 200 km or less from the ASU.

Speciality gases such as argon have relatively high value but lower volumes than bulk oxygen and nitrogen. Hence, these are typically transported over much longer distances.

Typical customers include hospitals, metal works, glassworks and small chemical manufacturers etc.

Cylinders contain about 270 cu ft of gas and are mostly for smaller volume users. They can be joined together for applications with larger volume requirements. The distribution zone is generally limited to a 50-75 mile radius. The price could be up to 100 times more than for tonnage gases, reflecting the filling and transportation costs. But the gas companies also enjoy rental payments on the cylinders which provide a stream of income even if the rate of consumption declines.

Typical customers include laboratories, home healthcare and other medical applications, electronics beverage dispensing and refrigerants.

Size of the market and future growth

The global industrial gases market size was valued at USD 87.3 billion in 2019.

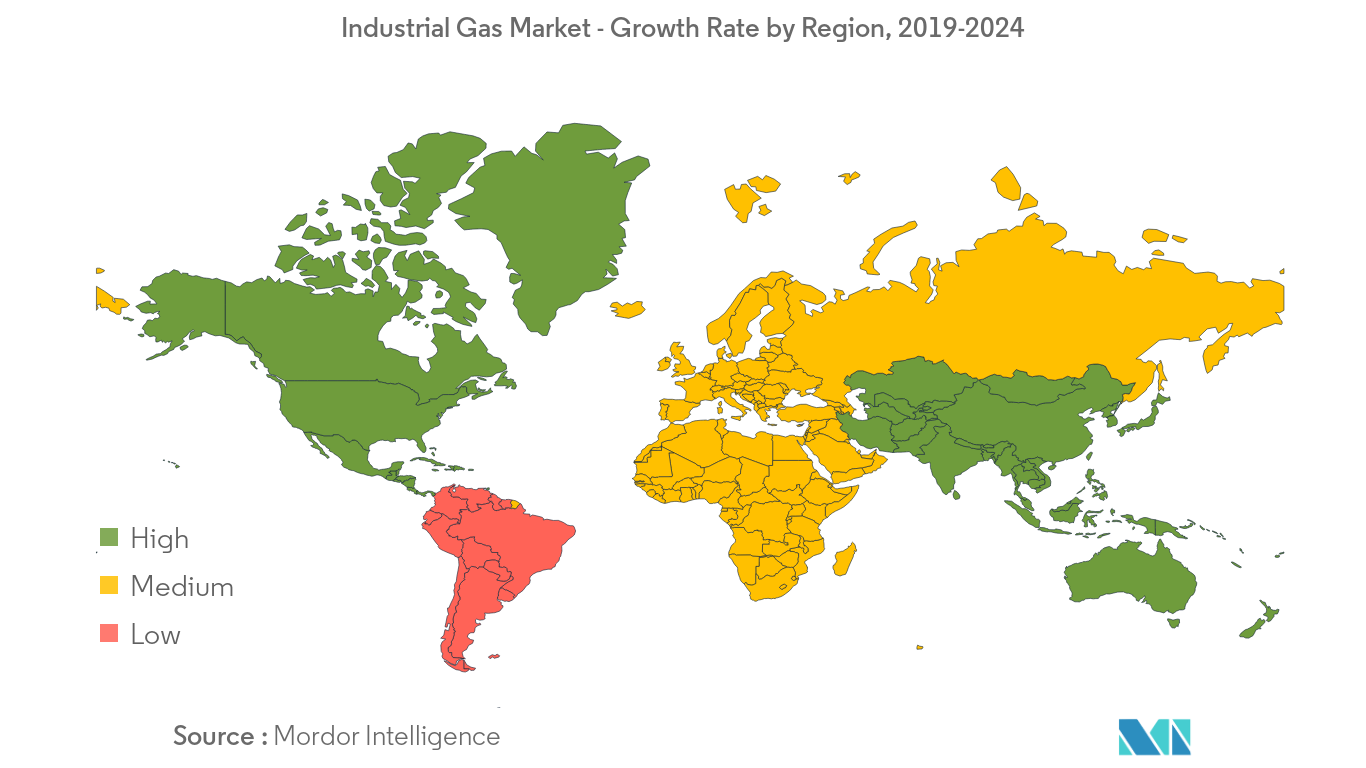

Asia Pacific is the largest regional market for industrial gases owing to the growth of several associated end-user industries in this region. Asia Pacific, apart from being the largest market, is expected to be the fastest-growing regional market for industrial gases. In terms of demand, Asia Pacific was followed by North America and Europe. However, these regional markets are anticipated to lose out some of their market share to the other emerging markets such as Asia Pacific and Latin America.

Source: Mordor Intelligence

The key drivers for industrial gases are increasing urbanisation and industrialisation coupled with increasing application of industrial gases in various industries such as healthcare, metals and mining, and food and beverage are further expected to influence the market for industrial gases in the coming years. Industrial gas is an important segment that contributes to an economy's progress.

The global industrial gases market size is expected to reach USD 134.3 billion by 2027, registering revenue-based CAGR of 5.5% over the forecast period, according to a new report by Grand View Research, Inc. The market is expected to witness substantial growth owing to increasing demand for industrial gases in manufacturing and healthcare sector.

Some of the key findings within the market

China is the largest market across the globe while India is projected to be the fastest-growing market at revenue-based CAGR of 7.6% during the forecast period, owing to significant growth of food and beverage, pharmaceutical, and manufacturing sector in Asia Pacific.

Nitrogen is projected to expand at the highest CAGR during the forecast period owing to its applications in the medical and pharmaceutical industry, in the extraction of air from mines, and in blast furnaces and other furnace applications.

The healthcare segment emerged as the fastest-growing application segment and accounted for approximately 18% of the total revenue share in 2019 owing to its high demand for industrial gases such as nitrogen and oxygen in the medical and pharmaceuticals industry.

What is the investment universe for the market?

Classified by GICS under the Material Sector and Chemical sub-sector, if we look at the Top 10 chemical companies by ranked by market cap, industrial gases companies occupy three out of the top four spots as shown below.

The Top 10 Companies in the Global Chemical Industry

Ranked by market cap in US$ billion as at 25 September 2020

| 1 | Linde | Germany | 122.3 | Industrial Gases |

| 2 | Air Lquide | France | 74 | Industrial Gases |

| 3 | Sabic | S Arabia | 71 | Diversified Chemical |

| 4 | Air Products & Chem | US | 64.2 | Industrial Gases |

| 5 | Ecolab | US | 55.9 | Indusrial Gases |

| 6 | Shin-Etsu Chemical | Japan | 55 | Diversified Chemical |

| 7 | BASF | Germany | 52.9 | Diversified Chemical |

| 8 | LG Chemical | South KOrea | 39.7 | Diversified Chemical |

| 9 | Du Point | US | 40.4 | Diversified Chemical |

| 10 | Givaudan | Switzerland | 39.2 | Fragrance & Flavour |

Over the last 14 years we have seen a lot consolidation in the industrial gas sector and the table below highlights the significant merger and acquisitions of this time.

| Apr 2019 | IMM Private Equity | Linde Korean assets | $1.2 bn |

| Sept 2018 | Messer/CVC | Linde US/SA | $3.3 bn |

| July 2018 | Taiyo Nippon Sensor | Praxair Europe assets | $6 bn |

| May 2017 | Merger of Linde Germany | & Praxair US for | $75 bn of deal value |

| Nov 2015 | Air Liquide | Airgas US | $13.4bn |

| July 2012 | Linde | Lincare US | $4.6bn |

| May 2006 | Linde | BOC UK | $14.4bn |

Over the past two decades, Air Liquide has completed a number of mid-size acquisitions of deal value less than $1 billion, these included Messer Griesheim industrial Gas business in Germany ($2.68 bn in 2004), but sold its smaller industrial gas business in Germany to Praxair for $0.5 bn also in 2004, other mid-size acquisitions of deal value less than $1 billion- acquired Linde’s Japan Air Gases in 2007 for $0.777 billion, Lurgi in Germany for $0.55 bn also in 2007, a couple of health care entities for $0.56 bn in 2012.

Linde on the other-hand completed the two biggest deals, its 2006 acquisition of BOC (British Oxygen) and the 2017 big merger with Praxair of US, in between a smaller deal to acquire Lincare in the US.

What are the key investment attractions of industrial gases segment?

Defensive nature of the business

In times of turbulence and uncertainty, such as the global health crisis, the industrial gas companies have the most defensive characteristics with in the material sector. The defensive characteristics include:

- Very high barriers of entry for the new players. The reliability in industrial gas plants is absolutely critical; if a gas plant fails, the whole process it serves need to shut down. Hence track record of the top tier companies makes penetration for new entrants extremely difficult.

- The industry is now highly consolidated with better ownership over pricing-points and quasi-oligopolistic industry structure.

- A diverse customer base and the end markets that removes the risk customer and end market dependency

- Contract nature of supply is long-dated. About 25% of the sales are in the onsite/tonnage, and these contracts quite often are for 10-15 years with a take or pay clause.

- Limited raw material exposure with vital inputs to the production processes being air and energy reducing price pressure or avoiding price shock on cost of goods sold.

Essential Layer

A small cost in the value chain, but an essential component Industrial gas companies benefit from having a product that in many cases is necessary for their customer's products/applications and yet is relatively cheap compared to the cost pf that end product or application. An example is the CO2 being sold to beverage companies where the CO2 represents a fraction of the cost of a can of coke, yet it is essential to the value of the product.

Sustainable Growth

The companies have stable growth that will be driven over the longer-term by growing urbanization around the world and more applications being applied for industrial gases, especially in the healthcare, energy, and infrastructure spaces

Financial Discipline

The industry has good financial discipline that has proven to be one of its hallmarks. The financial discipline can be seen through strong free cash flow, high ROE, and low levels of long-term debt.

A wildcard in the upside

Lastly, we would also highlight that the top industrial gases companies, in particular, the top two Linde Germany and Air Liquide France are key players in the push to make “green” hydrogen a viable fuel for many applications – both have the history and the technologies dealing with hydrogen.

The key attractions highlighted above have led to us to hold in our Global Infra-Energy Fund portfolio the top two of the three global giants in the sector – Linde Germany (MC=$122 billion) and Air Liquide France (MC=$74 billion), as well as the smaller player in Air Water Japan (MC=US$3 billion) - together they account for approximately 5% of the portfolio.

Average metrics of our 3-stock Industrial Gas" portfolio within the Global Infra-Energy Fund .

| Market Cap | $66 | US billion |

|---|---|---|

| FY1 | PE | 23X |

| FY1 | EV/EBITDA | 12X |

| FY1 | Free Cash Flow Yield | 4.2% |

| FY1 | Dividend Yield | 2.2% |

| FY1 | ROE | 10% |

| FY1 | Net debt/EBITDA | 2.2X |

Key Takeaway

The industrial gas segment provides an excellent risk-reward profile for investing in the materials sector because of the long-term growth opportunities, resilient characteristics of the leading companies with in the industry, and the essential nature of the products they deliver. This unique investment opportunity is a perfect in the current market with uncertainty of future global economic growth, as they will remain resilient in times of turbulence but ready for upturn in economic growth.Like what you're reading? Subscribe to our top stories.

Follow us on Medium, Twitter, and Linkedin.

Roy Chen

Chief Investment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.