Air as a source of wind power generation providing an excellent investment opportunity

Part 3 : Three rising investment opportunities in air, making society more sustainable.

Welcome to our final article in our three-part series focusing on the three rising investment opportunities in air, making society more sustainable. The last investment opportunity is air in the form of wind as another significant source of power generation, which we believe will be very attractive over the coming ten years and beyond. Wind power is a sustainable power source that is becoming a critical component of the renewable energy mix. We believe the companies related to the wind power generation industry are at a phase in their life cycle where they are starting to provide favourable to returns to investors and are at the beginning of their life cycle for long-term economic growth.

Where does wind power sit in the current power generation mix?

Wind power provides a substantial share of electricity in a growing number of countries. It is the fastest-growing segment among various renewable sources, which also include hydropower (still by far the largest), solar, geothermal and biomass. The share of renewables collectively in global electricity generation has jumped to nearly 28% in Q1 2020 from 26% in Q1 2019. According to the IEA last review, Renewable Energy has so far been the energy source most resilient to COVID 19 lockdown measures

What are the benefits of wind power

The first benefit is that wind power is currently the cheapest source of large-scale renewable energy. It involves generating electricity from the naturally occurring power of the wind. Wind turbines capture wind energy within the area swept by their blades. The spinning blades drive an electrical generator that produces electricity for export to the grid.

The second benefit is that wind is a plentiful and sustainable form of energy. The natural movement of air created by the atmosphere generates the wind. The generation of wind does not emit any carbon dioxide into the atmosphere like other fossil-fuel energy sources making it perfect candidate for power generation into the future to combat global warming.

The leading countries generating wind power

In terms of installed capacity, the leading nations are China and the United States with Germany not too far behind. The top 10 countries in terms of installed capacity are:

| 2019 addition GW | Jan 2020 cumulative total GW | ||

|---|---|---|---|

| 1 | China | 26.8 | 236.3 |

| 2 | US | 9.1 | 105.6 |

| 3 | Germany | 2.2 | 61.5 |

| 4 | India | 2.4 | 37.5 |

| 5 | Spain | 2.3 | 25.8 |

| 6 | UK | 2.4 | 23.5 |

| 7 | France | 1.3 | 16.6 |

| 8 | Brazil | 1.0 | 15.5 |

| 9 | Canada | 0.6 | 13.4 |

| 10 | Itlay | 0.02 | 13.3 |

In terms of a percentage of electricity of the national energy produced the leader and standout country is Denmark. Wind energy met an estimated 47% of Denmark’s electricity demand in 2019 and accounted for nearly 57% of the country’s total generation. Denmark is not the only country that is leading the charge other countries in Europe were generating above 20 % in wind generation as a percentage of their national demand for all of 2019. These countries included Ireland (32%), Portugal (26.4%), Germany (21.8%) and Spain (20.9%).

On the local front, wind energy is also playing a growing role in Australia, which again saw records for both installations and output in 2019. Australia brought online more than 0.8 GW of capacity for a total approaching 6.3 GW. Wind power surpassed hydropower in 2019 to become Australia’s largest renewable source of electricity, producing 19.5 TWh, or 8.5% of the country’s total generation.

Growing wind power generation capacity

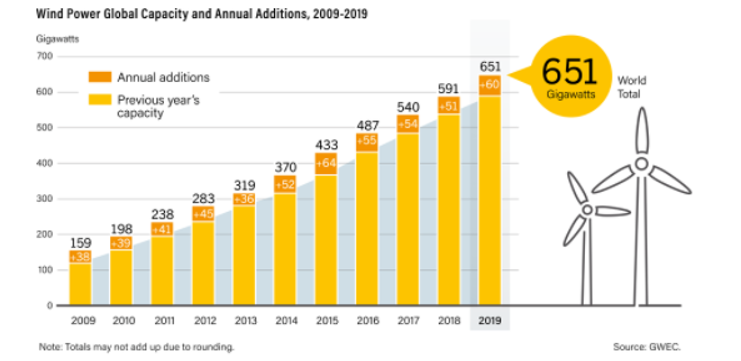

The growth in 2019 for wind power generation was the second-best year. The global wind power market expanded 19% in 2019, with around 60 GW of new capacity added to the world’s electric grids (including more than 54 GW onshore and over 6 GW offshore). This increase was the second-largest annual increase in capacity ever and followed three consecutive years of decline after the peak in 2015 (63.8 GW).

Offshore wind power plays an increasingly important role in the global market, accounting for a record one-tenth of additions in 2019. This year’s newly installed wind power capacity increased the global total by 10% to around 651 GW overall (621 GW onshore and the rest offshore).

The rapid growth in 2019 was primarily due to surges in China and the United States in advance of policy changes and to a significant increase in Europe, despite a continued market contraction in Germany. For the 11th consecutive year, Asia was the largest regional market, representing more than 50% (down from 52% in 2018) of added capacity, with a total exceeding 292 GW by the end of 2019. Europe (24%), North America (16%) and Latin America and the Caribbean (6%) accounted for most of the rest of the year’s installations.

Within Asia, other than China and India in the top 10, the other top countries are Turkey with nearly 0.7 GW added for a total exceeding 8.1 GW, Japan (adding about 0.3 GW for a total of 3.9 GW) and Thailand added 0.3 GW for a total of 1.5 GW.

After Asia, Europe installed the most capacity of any region during 2019. All of Europe added nearly 15.4 GW of new wind power capacity. This increase is 27% more than in 2018 but 10% less than the record in 2017, bringing the total to 205 GW. Most of this was in the EU-28, which installed roughly 13.2 GW (9.6 GW onshore and 3.6 GW offshore) or net additions of 13 GW (accounting for decommissioning), for a year-end total of 192.2 GW (170.2 GW onshore and 22.1 GW offshore). Wind energy accounted for 15% of the electricity the EU-28 consumed in 2019.

China’s generation from wind energy was up nearly 11% (to 405.7 TWh), and wind energy’s share of total generation continued its steady rise, reaching 5.5% in 2019 (up from 5.2% in 2018.

Growth trend continues for 2020 and beyond.

According to IEA, the increase in wind power will be the most in absolute generation terms among all renewables. A windy start of the year from January to March in many regions and substantial capacity additions last year is expected to give a boost to wind generation in 2020. Some essential policy deadlines require developers to commission projects by the end of 2020. In China, all wind projects need to be commissioned by the end of 2020 to qualify for feed-in tariff subsidies. In the United States, wind developers are in a similar situation, as they are required to ensure projects are operational by the end of 2020 to receive production tax credits. Despite such policy deadlines, however, uncertainty remains over capacity growth this year because of possible delays.

Global Wind Energy Council or GWEC's forecast sees cumulative capacity to reach a total of 817 GW by the end of 2021

Even if there are delays with US and Chinese companies not meeting deadlines for tax credits due to COVID-19 related delays, there are some key factors that are driving growth for more capacity to come online:

1.Economies of scale.The cost of installing wind farms is coming down due to the development of more and more projects. The leading US renewable energy producer NextEra Energy expects that near-firm wind and solar will be cheaper to build than all but the most efficient natural gas power plants within the next five years. In its view, the near-firm wind will cost between $20-$30 per MWh, while near-firm solar will be between $30-$40 per MWh, which puts them at or below the cost of natural gas at $30 to $40 per MWh.

2. Technology advancement. Technological advances in the sector mean that wind turbines are now larger, more efficient and make use of intelligent technology. Rotor diameters and hub heights have increased to capture more energy per turbine. The advancing technology means that fewer turbines are needed to produce the same power, and wind farms have the increasing sophisticated adaptive capability.

3. Global warming. Wind power generation is tackling the global problem of global warming that is caused by the usage of fossil-fuel power generation that emits carbon dioxide into the atmosphere. Wind power generation can replace fossil-fuel power generation removing excess carbon dioxide.

4. Investment returns. Wind power generation has needed government subsidies to make the projects viable in the past. However, we are now seeing with Orsted's new wind farm projects no longer need government subsidies to make them commercially viable.

Where are the investment opportunities?

The market segments that will benefit and are in the best position to prosper from the tailwinds of this long-term trend of wind power generation are:

- Wind power equipment companies – manufacturers of wind turbines

- Wind-farm developer/Utilities

Top 10 Wind Turbine Manufacturer in the World 2020

| Company | Country | Total Capacity (GW) | |

|---|---|---|---|

| 1 | Vestas | Denmark | 9.6 |

| 2 | Siemens Gamesa | Spain | 8.79 |

| 3 | Goldwind | China | 8.25 |

| 4 | GE | US | 7.27 |

| 5 | Envision | China | 5.78 |

| 6 | MingYang | China | 4.50 |

| 7 | Windey | China | 2.06 |

| 8 | Nordex | Germany | 1.96 |

| 9 | Shanghai Electric | China | 1.71 |

| 10 | CSIC | China | 1.46 |

From the table above, you can see the group is dominated by the first four, which have similar levels of capacity. This group are known as the big four and include Vestas of Denmark, Goldwind of China, Siemens-Gamesa of Spain and GE of US. Also, six of the top ten are based in China, three in Europe and only one in the US.

The recent market consolidation in this space, which validates the emergence of a megatrend as we are starting to see a land grab with the longer-term vision from companies in this segment. The recent consolidation we have seen is:

- The merger of Gamesa Spain with Siemens Germany resulting in the formation of Siemens Gamesa operating and listed in Spain with Siemens holding a 67% share, in the upcoming spin-off of Siemens Energy from Siemens, it will be part of the new “Siemens Energy

- The merger of Acciona Spain and Nordex of Germany, the latter is now 36.5% held by Acciona.

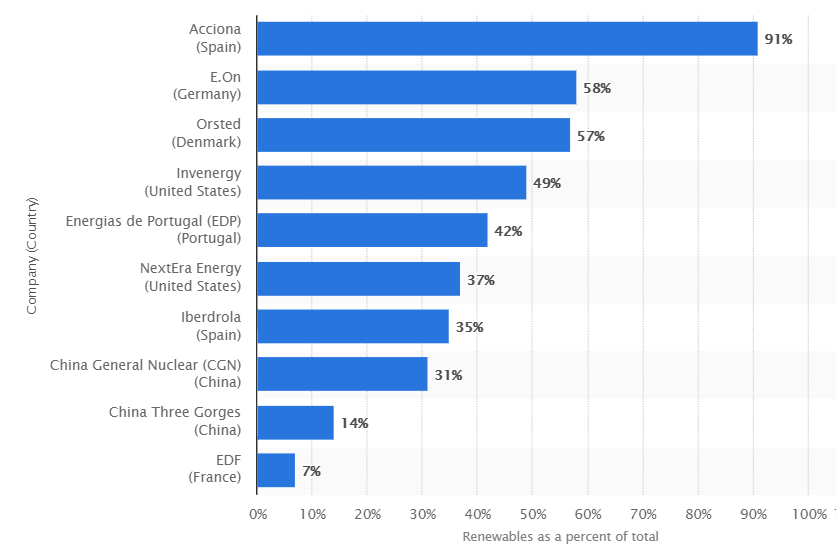

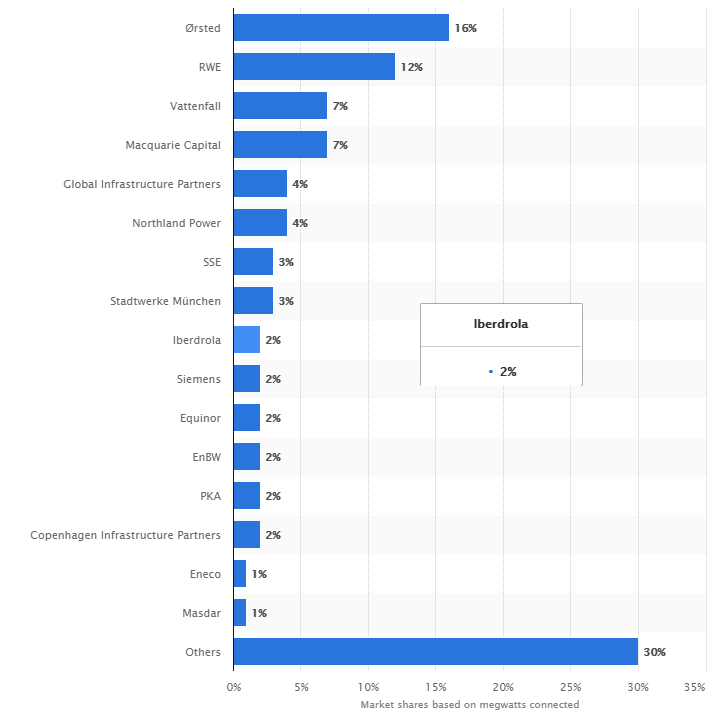

The second market segment that we see investment opportunity is the in leading global utilities that have made the early decision to transition power generation away from fossil fuels in their energy mix. Two charts listed below provide a snapshot of the utilities that are leading the charge in the renewable energy power generation and offshore wind power generation:

Leading global utilities based on the share of renewable capacity in 2019

Source: Statica

Market share of offshore wind farm developers by cumulative capacity in Europe in 2019

Source: Statica

The real trailblazer of the group is Orsted of Denmark, which built its first wind farm in 1991, and this early vision is starting to pay dividends with them being number three in renewable capacity and number one for offshore wind farm developers. In 2020, the global leader in offshore and onshore wind power generation is Iberdrola of Spain with 18 GW.

Similar to wind turbines manufacturing segment, we are starting to see some corporate action and consolidation in the utility sector, providing a further signal of future growth for the industry. The recent corporate activity and consolidation include:

- Iberdrola recently acquired Infigen, the leading pure renewable play in Australia for A$841 million

- RWE last raised EUR 2 billion via capital increase primarily aiming to grow its renewable, Goldman Sachs forecast its renewable capacity could double by 2024 and triple by 2030

- Dominion Energy of the US in July sold its gas transmission-and-storage assets for $9.7 billion to Berkshire Hathaway to shift focus to providing renewable energy. Dominion Energy is building the largest offshore wind project off the coast of Virginia in the US with 2600 MW capacity and aims to achieve a net-zero target by 2050 for both carbon and methane emissions.

More recent moves in September, we have seen big oil & gas making big moves into the offshore wind sector. The moves include:

- 1 September 2020 - Total with partner Macquarie into offshore Korea form a 50:50 partnership to develop five large floating offshore wind projects with a total capacity of 2300 megawatts.

- 10 September 2020 - BP announced acquires a 50% stake in an offshore wind power project from peer Equinor Norway in the offshore US for US$1.1 bn

How is RC Global playing the investment opportunity?

We have a preference for the second group (i.e. the utilities) for its more attractive dividend yield and also over the years as the competition intensified among the equipment manufacturers driving costs down to benefit of the users more than the makers.

Our Wind Energy or Power portfolio within the Global Infra-Energy Fund has six stocks, and five are utilities and one an equipment maker. Four of the utilities are in Europe, which includes Enel, Iberdrola, Orsted and RWE, and one in the US which is Dominion Energy. Our one holding in an equipment maker Siemens of Germany who is the controlling shareholder of the second-largest wind turbine manufacturer Siemens-Gamesa.

These stocks account for approximately 10.5 % of the Global Infra-Energy Fund. They have provided outperformance to the fund, even in the recent times of uncertainty with COVID-19 crisis.

Average metrics of our 5-stock "Wind Power" portfolio within the Global Infra-Energy Fund .

| Market Cap | $72 | US billion |

|---|---|---|

| FY1 | PE | 24.3X |

| FY1 | EV/EBITDA | 12.8X |

| FY1 | Free Cash Flow Yield | 2.0% * |

| FY1 | Dividend Yield | 2.4% |

| FY1 | ROE | 10% |

| FY1 | Net debt/EBITDA | 2.9X |

Key Takeaway

The investment opportunity of air as a source for wind power generation and the final opportunity highlighted in a three-part series relating to air is a significant investment opportunity to provide returns over the next ten years and beyond. More importantly, the timing of the opportunity for wind power generation is now, and due to the following critical factors:

- Wind power generation is one of the permanent solutions for solving the growing problem of global warming, which is caused by power generation sourced through use of fossil-fuels. Wind power generation is a sustainable source that does not emit carbon emissions and is becoming more commercially viable.

- Strong growth profile with momentum due to the effects of economies of scale, technology advancement, heighten concern of global warming, and successful projects in place.

- Significant players seeing the value in wind power generation, these players include governments, investment banks, and big oil & gas companies.

- The global equities markets are providing good exposure to this investment theme with well-capitalised companies listed on the major indices.

- The large capitalised companies are not at excessive prices when you take into consideration that wind power is one of the fastest-growing segments within the renewable energy space

Like what you're reading? Subscribe to our top stories.

Follow us on Medium, Twitter, YouTube, and Linkedin.

Roy Chen

Chief Invesment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.