Companies solving air pollution providing an excellent investment opportunity

Part 1 : Three rising investment opportunities in air, making society more sustainable.

Air is another essential component of life on earth the same as water. Similar to our water investment theme we believe the investment theme of air will be very attractive in the coming decade and beyond. While in the short-term, responses to the COVID-19 health crisis have highlighted the positive long-term trend. Over a three-part series of articles, we will explore the investment opportunity in global equities relating to air. This article, Part 1, will focus on the problem of air quality and pollution, followed by air conditioning, and ending with air as a power source.

The growing problem of air quality and pollution

Air pollution and deteriorating air quality is a global challenge facing all countries as The World Health Organisation (WHO) estimates that air pollution contributes to seven million deaths per year! That’s more than AIDS, tuberculosis, and malaria combined. Air pollution is not only harmful to humans but the health of our entire ecosystem. Its impacts on humans include the heart (caused by, e.g. carbon monoxide), lungs (due to nitrogen and sulphur oxides) or both (e.g. particulates). The impacts on the environment include reduction of photosynthesis (e.g. ozone); damage to foliage and growth (e.g. sulphur dioxide) and the depletion of water and soil quality (e.g.particulates).

Air pollution primary sources

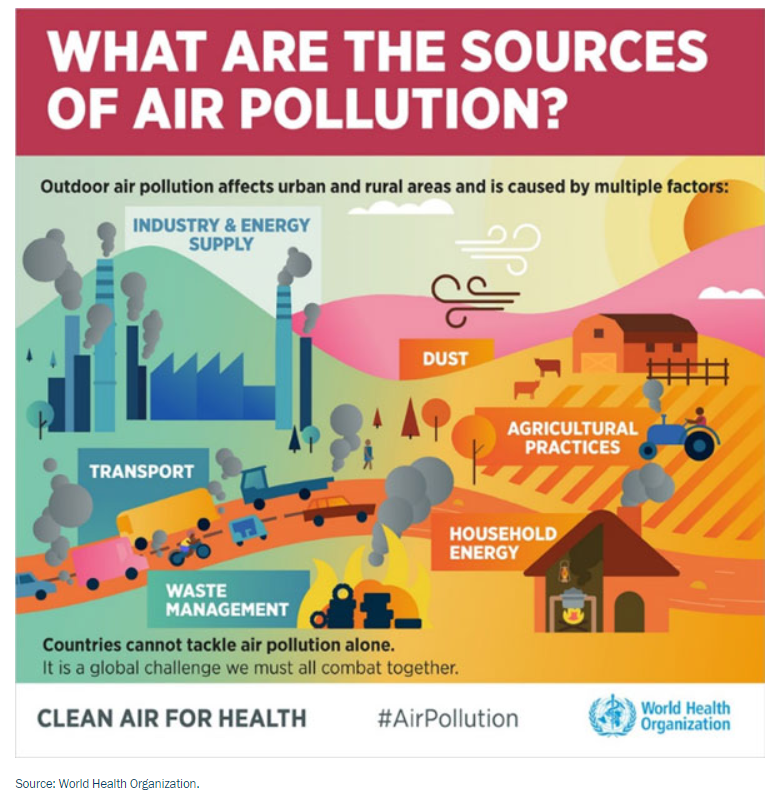

A presentation slide by WHO provides best outlined forthe primary sources of air pollution.

Causes are both natural and man-made-the former mainly dust, thus predominantly the latter - a combination of the combustion of non-renewable fuels (as in all types of vehicles) heavy industry and agricultural practices. Further, the impact of air pollution is most acute in densely populated megacities surrounded by industries and old power plants made worse by traffic congestion.

What is the solution?

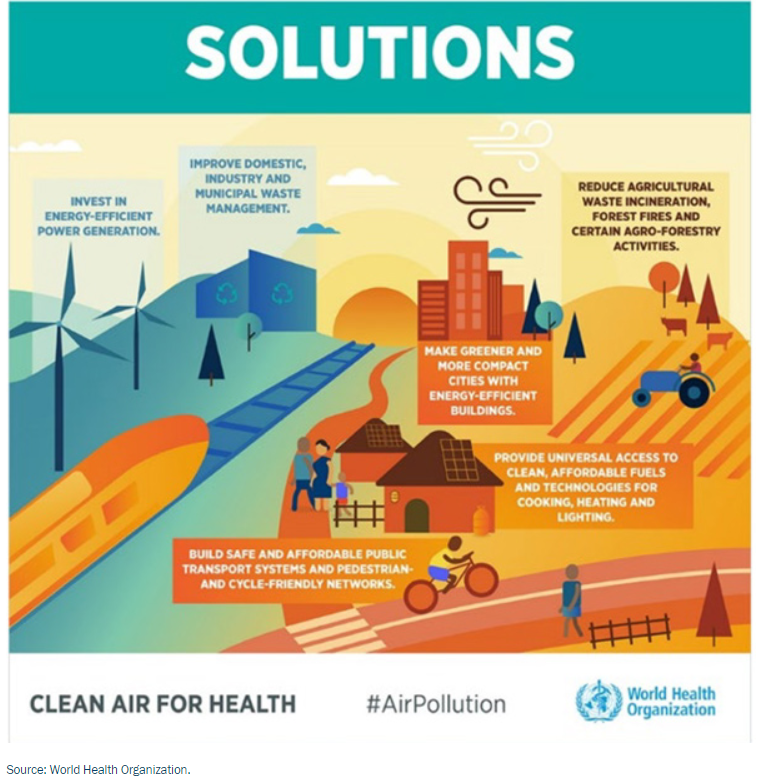

A presentation slide by WHO provides best outlined for better air quality and the removal of air pollution.

A key solution is to reduce air pollution in megacities. Beijing was notorious for its air pollution, as was Mumbai, New York and Los Angles. China and followed by India is the key focus when discussing air pollution due to the sheer size of their population. The Chinese government is making a serious effort to combat air pollution and to create a new vision of China as a green economy.

China now has a distinct Air Pollution Plan 2018-2020, in that plan China clarified "serious consequences" of violating environmental protection laws, and has a target of generating 31% of power from non-fossil fuel sources by 2020. The jury is still out if China can achieve these targets, but the new legislation is accelerating the trend for cleaner air.

The Three-Year Action Plan contains specific targets for reducing emissions of sulphur dioxide and nitrogen oxides by 2020, with both to decrease by at least 15% compared with 2015. For cities that have not met the existing PM2.5 (Particulate Matter) standards, their urban concentration of PM2.5 targets needs to decrease by at least 18% compared with 2015. China is targeting the annual numbers of days with fairly good air quality to increase to at least 80%, and highly polluted days to decrease by at least 25% compared with 2015.

China is by no means the only country tackling the issue, many governments around the world are making commitments such as enacting several legislations and setting targets to combat air pollution.

The other critical solution is to reduce transport activities that use non-renewable fuels that emit pollution. Vehicles on city roads are the primary user of such fuels. Still, cars are not the only source of air pollution in this form; ships operating in our oceans are another polluter. Ships emit sulphur dioxide into the atmosphere by using bunker fuels, which are virtually any fuel oils used by vessels. To gauge the size of the problem, you only have to consider shipping accounts for about 10% of the world's oil demand in the transportation sector.

The new regulations, known as IMO (IMO stands for International Maritime Organisation) 2020, mandates a maximum sulphur content of 0.5% in marine fuels globally. The driver of this change is the need to reduce the air pollution created in the shipping industry by reducing the Sulphur content of the fuels that ships use.

Companies solving the problem are providing an investment opportunity.

Air pollution is a serious global problem, and solving the issue begins with monitoring air pollution. The high cost of equipment and lack of government funding for research has stalled the adoption of monitoring systems. However, we are starting to see companies solve the low take-up rate by developing affordable yet accurate instruments to provide actionable data, a crucial ingredient to the global air pollution solution.

According to MarketsandMarkets™, the air quality monitoring system (AQMS) market will grow from US$4.3 billion in 2019 to US$6 billion by 2025, at a compound rate of 5.6% during the forecast period. The Particulate Size market will grow from US$356 million in 2020 to US$465 million by 2025. The total environmental monitoring market (inclusive of not just air but water, soil and noise) is estimated to grow to US$17.2 billion by 2025. Leading players in the air emissions monitoring market worldwide (covering particulates and ambient gas emissions) are the likes of Thermo-Fisher Scientific, Danaher, GE and Honeywell from United States, Siemens and Merck KGaA from Germany, and Horiba of Japan.

Energy-efficient power generation, which includes all forms of renewable energy sources, such as, hydro,wind, solar, and biomass, together this group contribute to the solution by reducing air pollution when generating power. The increased usage of energy-efficient power generation is set to continue, as in some cases, solar is proving to be the cheapest form of energy.

Related investment opportunities in reducing air pollution include electric vehicle manufacturers and enablers, as well as those reducing emissions from conventional engines using catalysts. Several companies are active players in both markets, thus able to benefit from efforts to reduce pollution from current vehicles, and from the accelerating transition to electric vehicles – BASF (Germany), Umicore (Belgium), and Johnson Matthey (United Kingdom) are three leaders in this space.

In tackling the pollution caused by the shipping industry, the International Maritime Organisation (IMO) introduced IMO 2020 so from January 2020 mandates a maximum sulphur content of 0.5% in marine fuels globally. To comply with IMO 2020 all ships have three choices – installing scrubbers, switch to deficient sulphur fuel oils or convert ships to using LNG as fuel. If it were not for COVID-19, oil refiners who had implemented the production of very low sulphur fuels would have been winners. The complex oil refiners, such as Phillips 66 (United States) and Nestle (Finland), are the stand out beneficiaries of the IMO mandate because their refineries are already producing low sulphur fuels through previous refinery upgrades. Also, they have converted some of their refineries to produce renewable fuels, which includes renewable diesel that produces 85 % less sulphur than ultra-low sulphur diesel. In Nestle’s case, 25% of their revenue is coming from renewable fuels, making them a world leader. Phillip 66 is in the process of converting their California refinery to produce renewable fuels. Phillips 66 is a current holding, and Nestle has been a previous holding in our Global Infra-Energy Fund. Three major players dominate the market for making scrubber for ships. They collectively command more than 50% market share – Wartsila Finland, Alfa Laval Sweden and Yara Marine, a subsidiary of Yara International, the Norwegian fertiliser giant. The last two companies are investment holdings in our Global Infra-Energy Fund.

The US International Trade Administration sees environmental technology as a $66 billion opportunity, and we estimate the investable universe (excluding those in alternative power generation) is well over US$950 billion. - RC Global

At RC Global, companies that are solving the antipollution problem are providing an attractive investment thesis because of the size of the problem, and long-term growth is being driven by both the public and private sectors to solve the issue. Currently, 10%* of our Global Infra-Energy Fund’s portfolio benefits from the exposure. The exposure does not include energy-efficient power generation that we hold as well. The antipollution holdings include:

- Environmental monitoring - Honeywell and Emerson Electric (US), Siemens (Germany).

- Electrical Vehicles Enablers, ship conversion, and clean fuels – Alfa Laval (Sweden), Yara (Norway),Energy Absolute (Thailand), and Phillips 66 (US)

Average metrices of our 8-stock “Antipollution” within the Global Infra-Energy Fund .

| Market Cap | $42.1 | US billion |

|---|---|---|

| FY1 | PE | 17.9X |

| FY1 | EV/EBITDA | 12.2X |

| FY1 | Free Cash Flow Yield | 7.6% * |

| FY1 | Dividend Yield | 2.9% |

| FY1 | ROE | 15.0% |

| FY1 | Net debt/EBITDA | 1.9X |

Note:This portfolio excludes the “renewable energy” component of the Fund’s diversified utilities holdings

Key Takeaway

An excellent long-term investment opportunity has emerged in air-related business segments that are focusing on improving air quality and reducing pollution. The key factors making this investment theme attractive are:

- The air pollution problem is a major one for society, which is being recognised by governments who are implementing initiatives that are creating a market for companies to solve.

- There is a long-term growth trend with maintaining air quality due to increasing urbanisation and rising living standards that will increase pollution if left unchecked.

- There is a sizeable investment universe within the global equities market that provides leverage into this investment theme.

- Companies within the investment universe are at reasonable prices with high cash flow yield and strong balance sheets.

- The solutions for reducing pollution are proving to be environmentally friendly and sustainable for our society, which is reducing future risk.

Roy Chen

Chief Invesment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.