Automation and Robotics, Flourishing in times of COVID-19

Robots have been replacing humans in certain jobs for some time, but the COVID-19 crisis is accelerating the process. We believe the increasing use of automation is one of the most sustainable investment mega-trends in the coming decade and beyond. Investors should capitalise on this trend and this article aims to explore the outlook of this exciting theme.

The International Federation of Robotics (IFR) uses the International Organization for Standardization’s (ISO) definition to explain that a robot is "an automatically controlled, reprogrammable, multipurpose manipulator programmable in three or more axes, which can be fixed in place or mobile in industrial automation applications. This definition makes it pretty clear that robotics is actually a subset of factory automation. Automation and robotics are vital to improving the efficiency of production in many sectors of the economy.

We are also witnessing the building of smart systems that involves the convergence of the real and digital world, thanks to the proliferation of connected sensors and cameras, ubiquitous wireless networks, communication standards and the activities of humans themselves. Firms are all embracing new technologies which could disrupt the entire economy. Covid-19 may have slowed down some of the developments as factories are shut and economic activity has lost momentum, but we believe the longer-term trends of automation and digitization are intact, due to structural trends like demographic changes, the drive for productivity gains, and rising labour costs in emerging markets.

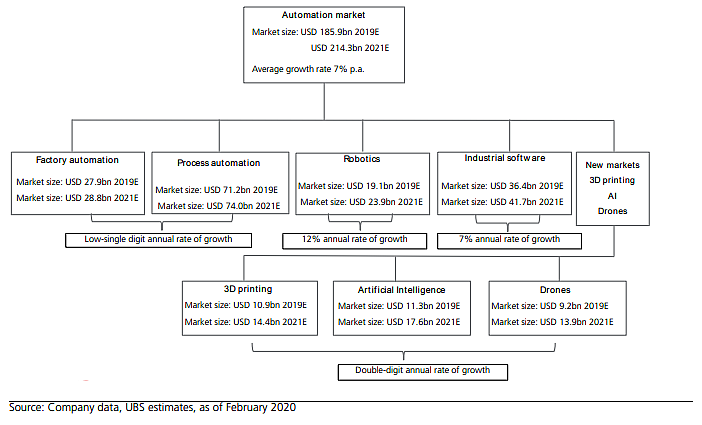

Smart automation will continue to power the fourth industrial revolution. Combined with innovation in industrial and IT processes, it will drive global manufacturing productivity gains. In return, the increasing penetration of information technology in manufacturing and the advances of industrial internet will propel the growth of automation companies. In a report dated March 2019, UBS estimated the automation market was worth USD 179bn, as shown below.

Within this group of companies, we will concentrate more on the industrial software and robotics segments that offer high growth opportunities.

Key drivers that will propel the automation sector

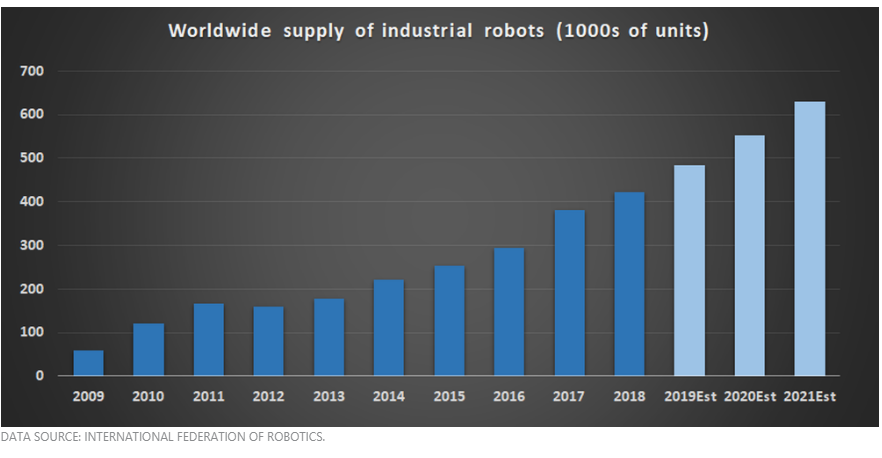

The International Federation of Robotics (IFR) sees the supply of robots quadrupling over the 10 years that followed the last yearly drop in worldwide supply back in 2012. Drivers include:

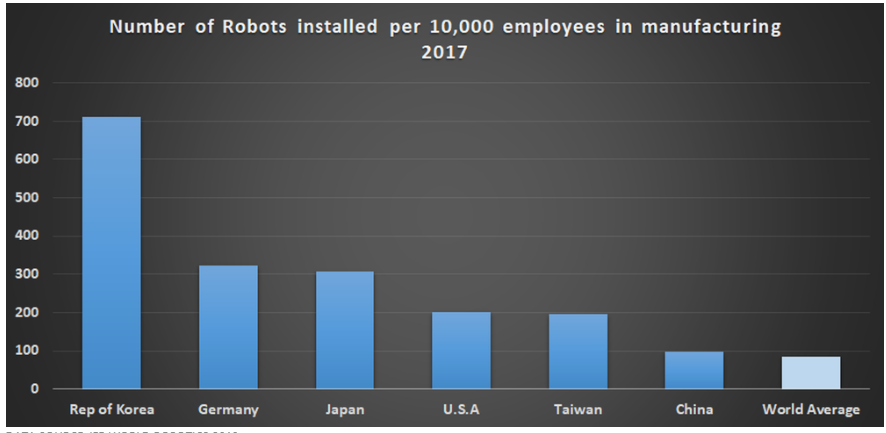

- Emerging markets (EMs) are key to this promising growth theme. In EMs, robotics use is still far behind developed countries, but it is equally attractive given the aging population, the need to drive productivity gains, rising wages and the size of the manufacturing sector. This is true particularly in China, where the mass reallocation of cheap labour from the agricultural sector to manufacturing is slowing down and the use of robots still lagged most developed countries – the two charts below show these trends.

- We expect the rising digitalization of the manufacturing sector (industrial software) to lead to a new wave of automation investment in developed countries.

- The so-called Industrial Internet of Things (IIoT) enables communication along the entire value chain, improving productivity through the use of big data.

Factory and process automation

Factory and process automation are the two most prominent areas within industrial automation, and industrial software is becoming an increasingly important business driver in both segments. Factory automation generally describes the assembling process, such as automating robots in the automotive industry. It also includes other automation processes in say packaging and semiconductors, among others.

Process automation refers to continuous production processes that transform raw materials into final products. Typical end-markets for process automation are the oil and gas industry, refining, chemicals or power generation. Between these two segments, there are several hybrid markets that use both factory and process automation equipment.

Investing in automation and robotics stocks

There are four distinct groups of stocks to consider, which are:

- Companies that develop core automation and robotics technology.

- Companies that make technologies and components that work with or in robotics

- Industrial software companies, which are an integral part of the automation revolution.

- Companies that use robotics/automation to enhance product offerings to existing customers.

Besides factory(discrete)automation and process automation as well as the growing industrial software, there are several new applications to the automation market like 3D printing, artificial intelligence and drones- these are outside the scope of the current article.

Given our emphasis on good dividend-paying companies , we focus on the core automation and robotics stocks with bigger market caps. Looking at the three areas of automation (Robotics, Factory and Process automation), we find these companies that have key core strengths in some or all of the three areas:

- Fanuc and Yaskawa, both Japanese corporations, and Kuka of Germany are major players in robotics with intensive involvement in Factory Automation

- Others like Mitsubishi Electric -mainly in Factory Automation and Honeywell International US which specialises in Process Automation

- Industrial software companies, which are an integral part of the automation revolution.

- Those that are strong in both Factory Automation and Process Automation – two of our current holdings Emerson Electric US and Schneider Electric France as well as a previous holding Siemens are in this group

ABB Switzerland*is unique in that it is in all three areas. Its portfolio is consists of five broad business segments: electrification, industrial automation, motion, robotics and discrete automation, as well as power grids. These segments together cover the wide spectrum of industrial automation and robotics. The company is divesting its low-margin power grids business (to Hitachi of Japan) to focus on the other four higher-margin segments. Right now, ABB is feeling the COVID-19 heat like any other industrial stock, but its diversity and financial fortitude are strengths that are hard to be ignored. For instance, ABB serves more than 30 end markets with at least 30% exposure in each of the Americas, Europe, and Asia-Pacific/Middle East/Africa regions. Despite a challenging business environment that lead to a 7% YoY drop in 1Q revenue, ABB's new orders rose by 1% with backlog value (as of March) hitting $13.7 billion, up 8% from Q1 2019. Industrial automation and motion led the pack with some big orders coming in. Robotics also has incredible potential, and ABB enjoys a solid foothold in the area. With a generous dividend yield of 4.5%, ABB is our latest purchase in this space with sound long-term potential for value creation.

Schneider Electric France* has been a core holding of the portfolio. Since our Oct 2018 initial purchase, the stock has returned 61% including dividends. Schneider has organised its businesses under two key divisions: Energy Management which consists of Medium-voltage, Low-voltage, as well as Secured Power and Industrial Automation. The company services many industries and is ideally placed to capture the upside in the following ones:

- Utilities & Power - Decentralization of grid, Renewable and green power, Better energy management

- Datacentres and Networks - growth across all regions and segments – large clouds and service providers, colocation and micro datacentres

- Residential/Non-residential Buildings and Industry and Infrastructure -Hybrid and discrete industries as well as Process industry – focus on productivity and efficiency

Best of all, it has a very high free cash flow yield and high cash conversion.

Emerson Electric* has increased its dividend for the last 63 years. Despite some very difficult end markets, Emerson's 3.7% dividend yield looks secure. Emerson does have significant exposure to energy prices with around 20% of its total revenue currently coming from upstream oil and gas as well as pipelines and terminals. The other segment, commercial and residential solutions, is a collection of industrial businesses comprising heating and air conditioning solutions, industrial tools, and refrigeration solutions. Its CEO David Farr just gave a very reassuring earnings guidance (unlike many companies that have abandoned guidance because of Covid-19). He also outlined the company’s efforts in teaming up with its process automation rival Honeywell International to facilitate the production of N95 face masks. The dividend remains well covered by earnings and free cash flow. Its CFO Frank Dellaquila reiterated the strength of Emerson's financial position when he forecasted the company would end 2020 with a debt to EBITDA multiple of just 1.9.

Honeywell International US* is a well-known leader in process automation that services industries as diverse as gas processing, aviation, packaging and health care, new growth areas include warehouse automation, sensors and climate control in large buildings. New initiatives since the Covid-19 crisis include ramping up production of N95 masks in the U.S being among the few world-renowned N95 mask makers, along with larger manufacturers like 3M*<. The announcement that it has made a quantum computing breakthrough and a new JV with SAP to give building operators key data in real-time

NB * denotes holdings of RC Global Infra-Energy Fund

These companies are not immune to Covid-19 as capital spending of many industries they supply to have short-term constraints and challenges. However, all the above three companies have very strong balance sheets, as shown below:

Key Metrics for the above four stocks

| Free CF Yield | Dividend Yield | Net debt/EBITDA | |

|---|---|---|---|

| ABB Switzerland | 4.2% | 4.5% | 0.6X |

| Schneider Electric France | 8.4% | 2.9% | 1.1X |

| Emerson Electric US | 8.0% | 2.7% | 1.2X | Honeywell International US | 4.7% | 2.4% | 0.7X |

Such companies are in a better position to survive the Covid-19 crisis

Robotics technology companies

The major automation & robotics companies are all large corporations, but there are smaller ones that specialise in just one segment and focus on improving certain aspects of robotics or developing specific products like vision system, digital sensors and motion-control sensors etc. One example here is Cognex’s machine vision systems. The growing adoption of smart sensors and actuators to improve the manufacturing process means more data has to be captured and analysed. The virtuous cycle of productivity requirements and advancement will boost the growth in this sector. Some other names include Teledyne Technologies in Digital imaging & sensor, Flir Systems in Imaging & detection systems, and IPG Photonics in industrial lasers.

Industrial Software companies

This is where the Industrial Internet of Things (IIoT) comes into relevance. IIoT is the process whereby web-enabled sensors can be deployed to capture data and information that help companies better manage their physical assets. They enhance the value of investments in robots and automation. Most of the companies in our first group (Emerson, Schneider and ABB) have their own industrial software solutions, or they form partnerships with other leading players. For example, in the area of programmable logic controllers, which both Siemens and Rockwell dominate, ABB chose to partner with Dassault Systems France and Rockwell also partners with PTC. Software companies like Dassault and PTC offer solutions that help manage automation assets better.

Last but not least - Companies that use robotics/automation to enhance product offerings

One good example is KION*of Germany. It ranks No. 1 in Europe in industrial trucks (only Toyota is bigger on the global stage) and is the No. 1 global provider of supply chain solutions (material handling solutions for warehouses). The company has a heavy focus on the U.S. which accounts for two-thirds of its supply chain solutions revenue. As such, KION is a company heavily exposed to industrial spending rates, particularly the trend toward warehouse automation spending. The growth of e-fulfilment may boost warehouse automation spending

What are the risks?

In the short-term, like many other industries, Covid-19 will be the driving force in growth slow-down. Weakness in the automotive industry even before the current crisis has hurt factory automation spending. Renewed weakness in oil prices of late similarly hinders petrochemical investments in process automation. However, we believe investors should look at the longer-term picture to capture the upside potential.

Conclusion

Robots have been replacing humans in certain jobs for some time, but the COVID-19 crisis is accelerating the process. Market research company Fact.MR now believes the robotic process automation market is poised to grow at a compound annual growth rate of 33% through 2029 due to the adverse impact of COVID-19. International Data Corporation's (IDC's) Jordan Speer wrote for IndustryWeek that more than 70% of the companies participating in IDC's 2020 Supply Chain Survey said robotics will be important, or very important, to their organization within the next three years.

Like what you're reading? Subscribe to our top stories.

Follow us on Medium, Twitter, YouTube, and Linkedin.

Roy Chen

Chief Invesment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.