Digital infrastructure as essential as power, water, and roads

Just as power, water and road infrastructure enable us to go about our everyday lives, digital equipment and systems are core to our daily lives. They help us communicate and connect over a short and long-distance, make sense of the vast amount of data we are faced with, and automate more and more manual tasks performed every day. The future world is more digital and connected. The importance of digital infrastructure has been validated with the pandemic allowing people to socialise, work, and go to school on-line. In response, investors globally have been increasing exposure to digital infrastructure in their portfolios. At RC Global Funds Management, we were no different and recognised that we need to increase our exposure to digital infrastructure. To do this, we had to expand our thinking about the essential layers and core components, the depth and width of the value chain, size of the market, and megatrends that drive future growth. This article takes a look at how we increased our understanding of Digital Infrastructure and our approach to identifying investment opportunities for our Global Infra-Energy Fund .

What is Digital Infrastructure?

Digital Infrastructure is the foundation layer that is necessary for information technology capabilities for a nation, region, city, organisation. It consists of servers, computers, switches, data centres, telecom exchanges, fibre networks, submarine cables, mobile towers, radio access networks, satellites, databases, data stores, software, cloud applications, cybersecurity systems, and device endpoints. All these elements come together to allow information and data to travel around the world to support our everyday lives and the economy

The importance of Digital Infrastructure

Our society has been increasingly faced with some long-standing issues like growing/ageing/urbanising population, climate change, increasing number of global challenges (including pandemics), and our expectation of an ever-improving quality of life. These are challenging factors to reconcile and must be met with ever greater productivity and technological enhancements. At the same time, more and more economies have been transforming towards a service dominated economy and these services economies are increasingly digital, online and driven by data. Our need for building future-proof infrastructures to transfer, store, analyse, and manage data is stronger than ever.

Size and growth of the market

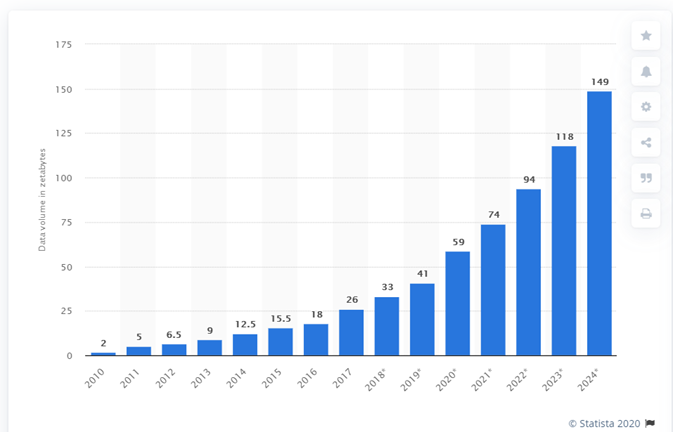

Digitisation has been one of the most important trends shaping the global economy over the last ten years. The total amount of data created, captured, copied, and consumed in the world has grown 20 folds in the previous nine years, from 2 zettabytes in 2010 to 41 zettabytes in 2019. This number is estimated to reach 59 zettabytes in 2020 and 149 zettabytes in 2024, another growth of 29% five-year CAGR.

Source: Statista

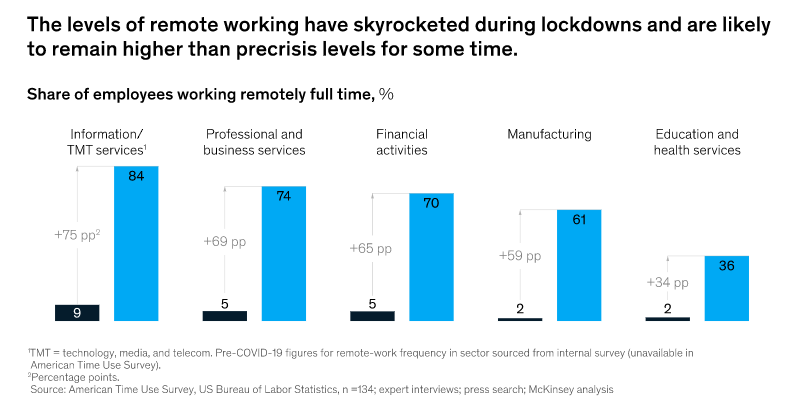

Now, during the COVID-19 pandemic, the pace of growth is accelerating. With recent changes to how people live and work due to the COVID-19 pandemic, the move away from physical assets and towards cloud-based infrastructure is more significant than ever. COVID-19 is becoming a substantial boost to the steady progress of change towards the connected, online, digital future world. Social and economic trends that were already gathering steam before the pandemic, such as the increased take-up of tech and focus on sustainability, are impacting all asset classes and, together with the market reaction to the crisis, create selective opportunities.

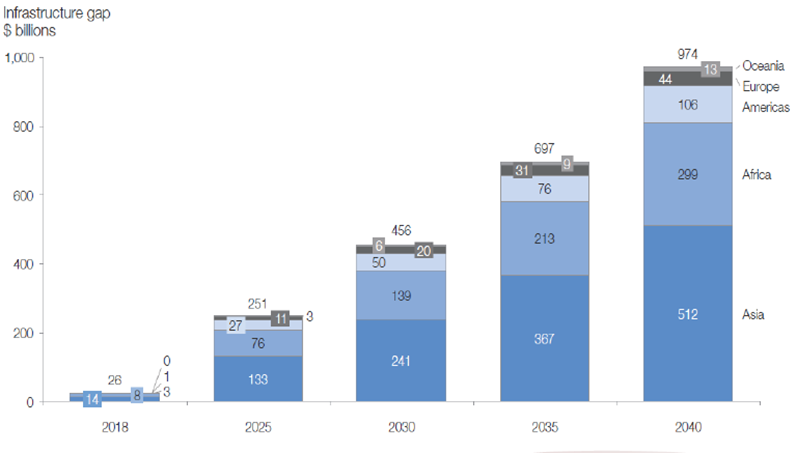

The digital economy is emerging to become one of the most significant growth drivers and indispensable part of the modern economy. The global digital economy in 2016 was worth $11.5 trillion, or 15.5% of global GDP. This is expected to reach 25% in less than a decade. Emerging markets see the highest growth of the digital economy, due in part to the young population with the longest time using the internet. Digital infrastructure development is the foundation of the digital economy. With the latter growing in size and relative economic significance, the financing gap is growing between the critical needs of the digital economy and actual digital infrastructure investment. Financing gaps are especially prevalent in middle and low-income countries, with Asia accounting for half of the total and reaching $512bn by 2024. McKinsey estimated digital infrastructure investment will rise between 6-11% p.a. between 2018 and 2030.

Source: World Economic Forum, EIU, Ovum, OECD, HooteSuite

Megatrends Driving Digital Infrastructure

The market for Digital Infrastructure is large and growing, and there are significant megatrends that will maintain growth. The megatrends are:

Prosperity

People want a better life economically to increase their living standards. Access to digital infrastructure improves productivity through more significant resources available to enhance their work.:

Every 10% increase in broadband (3G & above) penetration increases GDP pa in developing countries by 1.38%

Source: Asian Infrastructure Investment Bank

Digital Transformation

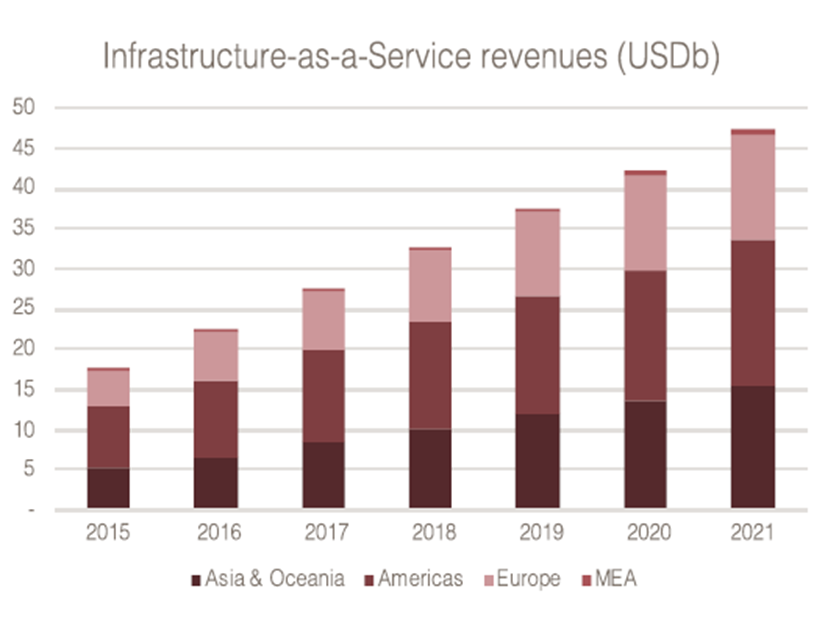

Business, Governments, and Schools are moving their process online to increase productivity, provide a better customer experience, and expand the market place for their product and services. The growth of cloud providers or Infrastructure-as-as-Service (IaaS), which provide scalable, reliable, and on-demand platforms to host processes online, highlights significant growth of digital transformation.

Source:

Real-time Connectivity

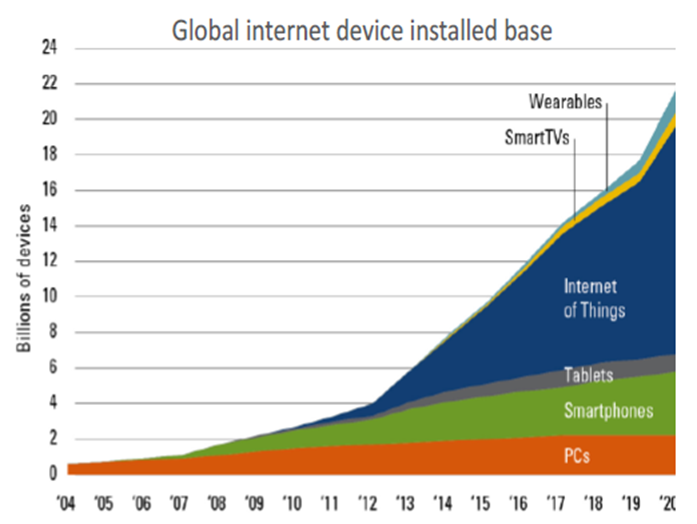

People want more immediate social reaction, on-demand delivery and viewing, and faster responses. This megatrend is best illustrated by the growth of the number of devices connected to the internet since early 2000’s. A major contribution to the development has been the connection of machine operated devices, which are part of the Internet of Things (IoT) network. These connected devices are sensors, remote switches, and trackers that help maintain and manage physical assets.

Source: Gartner, IDC, Strategy Analytics, Machina research, company filings, BI estimates

Mobility

The need for people to work, travel, and move anywhere has driven a more significant footprint of communication networks. People's increasing desire to move quickly within cities and across borders has caused the uptake of digital platforms that allow for shared-economy associated with transport and travel, such as Uber and Airbnb.

Source: Source: McKinsey

Data Analysis and Transparency

Greater access to information combined with increasing number of applications that help people use data with every day decision making has accelerated the need for capturing data on daily events. The accelerated uptake in data-driven decision making has allowed people, organisations, and governments to provide greater transparency in their actions, and give a sense of validation.

Automation

Businesses continue to drive productivity by automating more and more tasks within their administration, production, and supply chain, as evidenced by the growth of smart buildings, smart factories, and smart offices.

Research and Markets has stated that the global process automation market was valued at USD 76.83 billion in 2019 and is expected to reach USD 114.17 billion by 2025, at a CAGR of 7.23% over the forecast period 2020-2025.

More rapid acceleration compared to traditional infrastructure.

Digital Infrastructure has had rapid acceleration compared to traditional infrastructure. Even though similar megatrends drive both, the steep acceleration of digital infrastructure can be attributed to several key factors that improve economies of scale and produce more generous multipliers from the use of digital infrastructure.

Cost of digital infrastructure over the years has benefitted from Moore's law and Metcalf's Law. At the same time, the vast number of applications built on the digital infrastructure has benefited from the Network Effect. The outcome is a wider multiplier of benefits from digital infrastructure versus a railway line, road, or airport that can be one or two dimensional.

The connection with traditional infrastructure and energy

Digital Infrastructure is the new "bridges and roads" that support the digital economy. In a similar way that dams, pipes and pumps help the water needs of citizens, digital infrastructure allows information and data to travel around the world. As our economy digitises, many sub-sectors within digital infrastructure have become essential to the functioning of everyday life. The traditional infrastructure and digital infrastructure share some differences and similarities. Different from conventional infrastructure, digital infrastructure is made up of more than just physical assets. Data, digital services and reusable components include fewer tangible elements, but are no less important.

On the other hand, in a similar way that the infrastructure industry is very capital intensive in the beginning, digital infrastructure often requires a large up-front investment, such as fibre optics, satellites, and high-powered computing facilities. Although future cash flows are not as guaranteed like traditional infrastructure assets, many digital infrastructure companies do offer utility-like characteristics, providing desirable investment opportunities from a risk/return perspective. We regard this sector as resilient, as we believe data consumption will not drop dramatically, if not rise, in a recession. To capture these opportunities, we have expanded our radar over the last few months to include digital infrastructure in our investment universe.

Another area of connection relates to our investment focus on the energy segment. As we do with traditional infrastructure investments, we apply our understanding of the energy sources to digital infrastructure, which have enormous power requirements for computer process and storage. It becomes imperative in evaluating a portfolio of existing and future data centres.

Essential layers for Investment Opportunities

In expanding our investment exposure into Digital Infrastructure, we devised a process that helps the investment team navigate the complexity of different technologies, old and new business models, and deal with the disruptive nature associated with the technology industry. At the same time, we analysed the value chain and its associated essential components in digital infrastructure, which together with other fundamental analysis under our investment process, ultimately lead us to find the best companies delivering these products and service for higher investment returns.

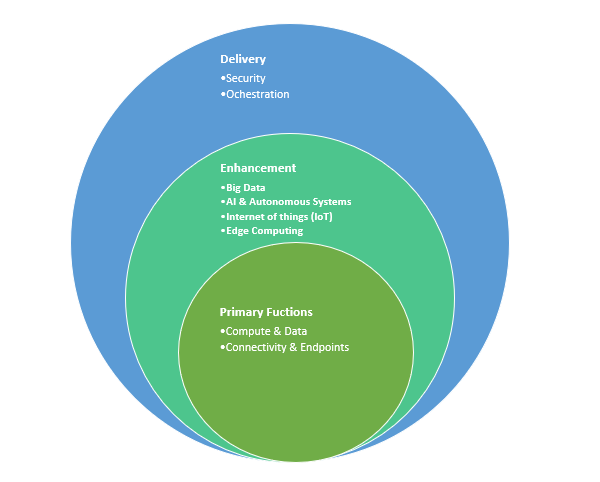

The process we devised was very broad with our categorisation of the different essential components, enabling us to list many items under these categories. This approach allows us to keep clarity through a simplistic view and removes the noise that comes with technology protocols, labels and acronyms when screening companies for investment. There are three main areas we identified as the essential layer in Digital Infrastructure. These three areas, combined together, deliver the primary purpose of Digital Infrastructure. The three main areas are

- Primary functions performed

- Enhancement of utilisation

- Delivery

The first area is primary functions performed by Digital Infrastructure which is broken up into two categories. Each category represents a primary function performed by Digital Infrastructure. Even though the classes can be interconnected, we focus on the core function for categorisation. The two categories are:

- Compute and Data - All the elements that allow systems to process information and store data for applications.

- Connectivity and Endpoints - All the elements that enable networks and endpoints to connect, capture, and transfer information.

The second area involves functions that are enhancements to the primary functions being performed by Digital Infrastructure. These enhancements increase the utility of digital infrastructure by driving greater value for the end-users. The segments we have identified include:

- Big Data– Involves many datasets that are more complex and arrive from more sources at speed. Also includes data analysis and putting the data to good use for better outcomes in decision making.

- AI & Autonomous Systems- Tasks performed by machines that would have previously required human intelligence.

- Internet of things (IoT)- The network of devices around the world that are connected to the internet.

- Edge Computing– Brings computation and data storage closer to the location needed to improve response times and save bandwidth.

The final area relates to Digital Infrastructure's delivery to make it available and safe to as many users as possible. There are two categories we identified that both interconnect and act as an overlay for the first two areas. The two categories are:

- Orchestration or Integration - All the elements that enhance uptime, reliability and scalability of the infrastructure

- Security and Surveillance - All the elements that make networks and endpoints secure and accessible.

A further benefit of this simplistic view with broad categories is that it gives us the ability to widen the scope of the type of companies we can invest in, in comparison to the typical well-known digital infrastructure universe that other global investment funds may invest in. The broader range sets us apart from other global infrastructure funds that focus on the infrastructure's owner and operators.

The types of businesses we are reviewing from our expanded view include semiconductor equipment makers that are increasing computing power and enabling big data, telecom carrier networks that are providing connectivity for a diverse range of human and machine endpoints through mobile, fibre, and IoT networks, cloud Service Providers that are providing Infrastructure-as-a-Service (IaaS) that encompasses all functions listed above for a company to build digital applications and connect from different locations. There are many more, but these are basic examples to help understand how we are using our process to identify the right types of businesses we are reviewing for investment opportunities.

Investments we have made

At RC Global Funds Management, we started to increase our investment exposure in Digital Infrastructure when the pandemic disrupted global economies. The pandemic accelerated the significance of digital infrastructure for the future and created an opportunity to find value in this space under uncertain financial market conditions.

Since then, we have added three digital infrastructure stocks that fit our investment criteria for the Global Infra-Energy Fund; all offer strong balance sheets, robust free cash flows, high ROEs and ROICs, as well as growing dividends. The invested stocks are:

Taiwan Semiconductor Manufacturing (TSMC) Tawain is by far the largest player in the semiconductor industry and ranks top 5 globally in the IT sector by market cap. The semiconductor industry performed very well in 2020. TSMC continues to dominate the space, fuelled by the transition to 5G, data centre expansion and high-performance computing (HPC), as well as some near-term drivers including Intel's 7nm setback and new orders from Apple. The company meets all our strict investment metrics at the time we bought the stock -net cash balance sheet, a 3.5% dividend yield backed by strong free cash generation, high ROE (>20%) as well as a proven management team and business model.

Citrix (CSCO) US is a leading provider of virtualisation (server, application and desktop), networking, software as a service, and cloud computing solutions. It offers secure and cloud-based digital workspace technologies that are seeing strong demand driven by coronavirus crisis-induced demand for secure work-from-home trend. Its increasing cash flow trend reflects that the company is making investments in the right direction and will help it sustain the current dividend pay-out level with the potential to resume shareholder-friendly initiatives of share repurchase in the future.

Cisco (CTRX) US is the largest player in the traditional networking space with a strong presence in the router and switch market as well as a leadership position in WLAN and Ethernet switching. The company is also growing into some growth areas like security and video conferencing, which will benefit from COVID-19 induced working-from-home demand. With a strong balance sheet and cash flow generation capability, Cisco retains a unique distinction of being one of the large capitalisation technology companies that we can still find some value.

Takeaways

- Digital Infrastructure has become an essential backbone of critical infrastructure required by countries around the world to prosper. The need for Digital Infrastructure will continue to grow. Its ability to improve daily life and tackle many of the challenges that have presented themselves in 2020 has reinforced the upward trend.

- Companies operating in the Digital Infrastructure space should be part of investors’ investment portfolios. When investing in Digital Infrastructure, there can be a lot of complexity with the value-chain wider and deeper than one can imagine.

- Breaking into necessary components and essential layers is a good starting point. At RC Global Funds Management, it has become vital for us to remove the noise when looking to increase our investments exposure in Digital Infrastructure.

Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Like to organise a meeting

To discuss investing in our global managed equity funds.