Energy Efficiency is already a shining light as an immediate pathway to reaching net zero

Energy Efficiency is one of the critical pathways to reaching net zero carbon emissions by 2050. It is also vital to resolve challenges with energy security, energy prices, and the cost of living. As an investment segment in the global equity markets, it is rising to the top in providing exceptional wealth creation for shareholders investing in the international markets. By reviewing the energy efficiency market, we will gain a better understanding of this excellent investment opportunity. To do this, we will explore the market, growth drivers, the investment universe, and investment opportunities available in recent times.

What is energy efficiency?

Energy Efficiency involves optimising the amount of energy an endpoint uses. The endpoint could be a device, appliance, vehicle, building, facility, or any endpoint drawing on power. A perfect example of energy efficiency is turning off lights within a building when they're not required or using electrical devices built to use less energy when operating.

Another example would be the amount of energy a steel plant uses to produce per unit of steel. The more units of steel produced to less energy used, the more significant outcome for energy efficiency. Such an indicator is the energy intensity used to measure progress with energy efficiency worldwide. Energy intensity is the inverse of energy efficiency, so we want to see energy decrease as an indicator.

Energy Efficiency’s impact on decarbonisation

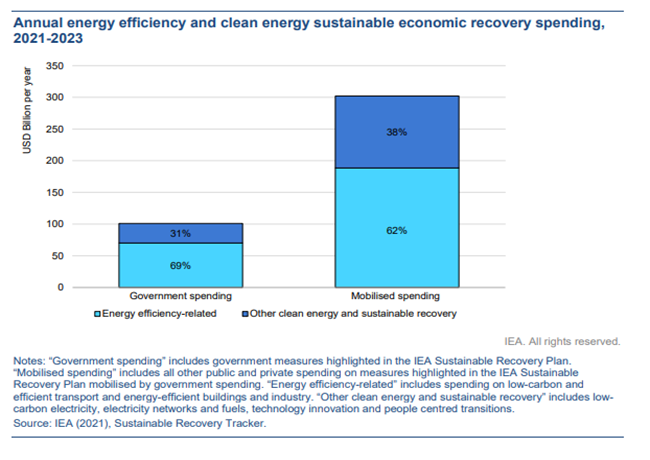

Energy efficiency as a pathway to decarbonisation is on the demand side of energy, whereas renewable power generation is on the supply side. The beauty of being on the demand side is its immediate impact on reducing energy usage generated from fossil-fuel sources. Also, energy efficiency provides the extra benefit of lowering consumers' day-to-day living costs. The direct effect on energy reduction has led to energy efficiency being a star performer as a pathway for decarbonisation, and there are high expectations to do the heavy lifting until 2030. To highlight the significance of energy efficiency in achieving net zero targets, we can look at the profile of the global governments' recovery plan spending after the health pandemic between 2021-23:

Another significant reason for a large proportion of government spending going to energy efficiency is the immediate flow-on benefits it provides to consumers’ cost of living by reducing energy bills and making appliances available that assist with the comforts of day-to-day living.

Moving forward in reaching the net-zero emissions target for 2050, IEA has stated that energy efficiency improvement must increase from 2% per annum to 4% per annum up until 2030. Such an improvement would make the world around 35% more energy efficient [1].

The critical factors driving energy efficiency as a vital pathway to net-zero

The two critical factors driving energy efficiency across global economies are behavioural change and the electrification of everything.

Behavioural Change

Behaviour change has always been one of the critical components of energy efficiency. It has been one of the early initiatives to address higher carbon emissions from energy usage and reduce energy costs when energy prices have risen. Early initiatives were logical steps such as turning off lights in the building when not needed or any other energy-generating appliance such as a PC or hot water. However, such actions have become scalable due to standards and automation.

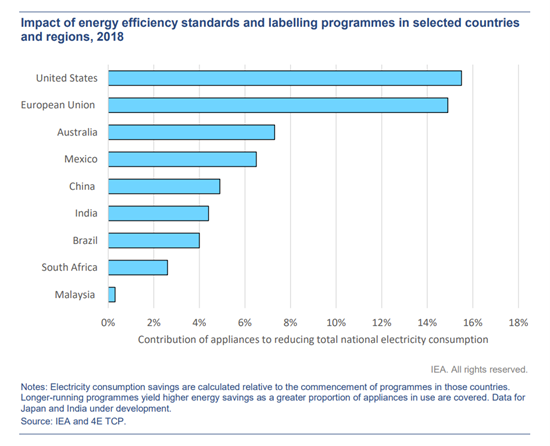

Setting energy efficiency standards for devices, appliances, vehicles, buildings, and industry has given clear expectations on what is required to deliver a service or product. It has made energy efficiency central in product design where apart from meeting the standards, it is a leading key feature that provides essential value to the consumer. The global rollout of standards accelerates the energy efficiency delivery of all products and services.

The other significant factor is automation and, to be more specific, digital automation with real-time connectivity. For example, we can now deploy Energy Management Systems (EMS) that automatically turn on and off appliances and make energy adjustments with changes in the operating environment, such as an office building. Such systems are removing physical tasks involved with reducing energy usage, and the ability to connect more sensors to energy usage endpoints means these systems can perform a lot more jobs. Looking into the future, this improves even more with increased computing power and the implementation of AI to recognise energy efficiency patterns we were unaware of before.

Electrifications of everything

Using more appliances, transport, and buildings that use electricity allows society to switch from fossil fuel generation. A perfect example is installing heat pumps to replace gas heating or gas stoves with electrical stovetops. In addition, being more electrified allows more things to run on renewable energy and increases the optimisation of energy efficiency.

The significant areas of growth in electrification that will have a material impact on decarbonisation will be the electrification of heating and transport. Heating will be at the consumer and industry level. The industry level will require further innovation, but the consumer side is in motion now with hot water and cooking. For transport, we see rapid growth with electric vehicles and scooters daily, but rail networks are another area of large-scale transport that is becoming more electrified. India, one of the largest populated countries, has made massive inroads in electrifying its rail network with 71% or 48 000 kilometres of the network electrified and expects to have the whole network completed by the end of 2023 [2].

Available investment universe in global equity markets

The global equity markets are an excellent investment universe for best-in-class companies that are part of the value chain for the energy efficiency market. The type of companies we are focused on in the energy efficiency marketplace are:

- Businesses designing and manufacturing equipment optimising energy usage or enabling electrification.

- Businesses that are developing systems that automate the optimisation of energy usage.

- Businesses providing alternate solutions reduce heat in the production process for industry.

In this focus group, apart from the market leaders, we are seeing emerging leaders in new markets that are positioning themselves well for long-term growth in energy efficiency. We also anticipate the investment universe will increase over time with more private companies going public, as there has been tremendous growth in venture capital and private equity investment space other the last three to four years.

Buying opportunities are presenting themselves with the current market conditions.

In the current market, we are seeing a lot of industrial companies entering oversold territory due to high-level concerns around reduced margins. The problems relate to the global supply chain issues and higher energy prices from the Ukraine conflict. All these concerns are justified, but it is creating an excellent opportunity to buy high-quality equipment and systems companies to optimise energy efficiency and enable electrification. Our existing exposure with our Global Infra-Energy Fund and Sustainable Energy Model Portfolio includes:

| Company | Market Cap US$* | Country |

|---|---|---|

| ABB Ltd | $52.3 billion | Switzerland |

| Emerson Electric Co | $48.3 billion | United States |

| Hubbell | $11.0 billion | United States |

| Honeywell International | $127.5 billion | United States |

| Schneider Electrical | $66.2 billion | France |

| Siemens | $80.3 billion | Germany |

* Market Capitalisation calculated on the 31/08/2022

The other catalyst creating buying opportunities is the sell-down of high-valued technology stocks due to the discount of growth stocks in a higher interest environment. Such movement has brought down valuations in companies providing technology and automation solutions around energy usage optimisation, which are very much related to the accelerating trends of digitisation and real-time connectivity. We are eagerly reviewing this segment to gain high-quality exposure to the sector.

Takeaways

- The Energy Efficiency industry has robust structural growth, as it will do a lot of the heavy lifting over the next ten years to remove carbon mission and remain on target for net-zero 2050.

- Government initiatives will support energy efficiency because it immediately impacts improving the environment and reducing consumers' cost of living.

- Standards and electrification have driven the success of energy efficiency and will be drivers into the future.

- A long-term buying opportunity presents itself in the current market conditions with supply chain pressures and the re-valuation of growth stocks.

References

- IEA (International Energy Agency), Net Zero by 2050, May 2021.

- IEA (International Energy Agency), Energy Efficiency Report 2021, November 2021

Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Nick Harriss

Chief Investment Officer for the Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.