Energy Transition a megatrend that investors can no longer ignore

Part of our investment approach is to identify megatrends. Energy Transition is one that we have identified and represents a key part of our thinking with our Global Infra-Energy Fund. We believe in the last quarter hidden in the haze of the heath pandemic and the US election, the velocity of this long-term trend is starting to pick up. Some say it’s the beginning of a very long-term trend, others say its accelerating, while some even say it’s about time you get on board. All are correct, but you can no longer keep your head stuck in the sand, as there will be missed investment opportunities. At RC Global Funds Management, we want to explore and show you why we believe energy transitions is a megatrend and is going to generate significant shareholder returns from now on and into future if you choose wisely.

What is Energy Transition?

The energy transition is a pathway toward the transformation of the global energy sector from fossil-based to zero-carbon by the second half of this century. At its heart is the need to reduce energy-related CO2 emissions to limit climate change. Decarbonisation of the energy sector requires urgent action on a global scale. While a global energy transition is underway, further action is needed to reduce carbon emissions and mitigate the effects of climate change. Renewable energy and energy efficiency measures can potentially achieve 90% of the required carbon reductions.

What is driving Energy Transition?

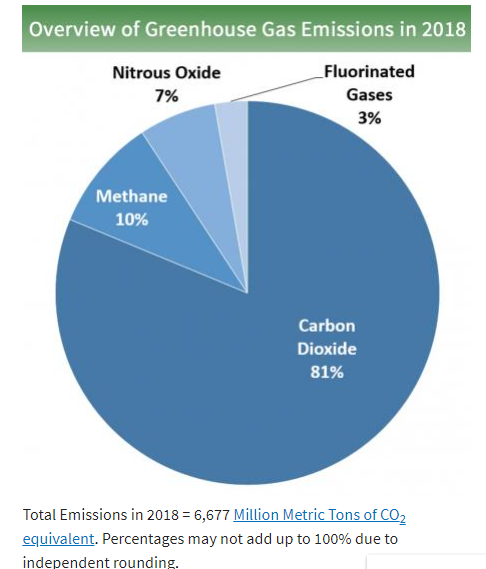

The global problem of society emitting too much greenhouse gases into the atmosphere is the critical growth driver. These greenhouse gases trap heat in the atmosphere. Society needs to solve this problem over the coming decades to avoid the damaging consequences of climate change. The primary greenhouse gases that need to be reduced by us are carbon dioxide and methane. Greenhouse gases caused by carbon dioxide and methane make up 91 % of greenhouse gases:

Source: United States Enviromental Protection Policy

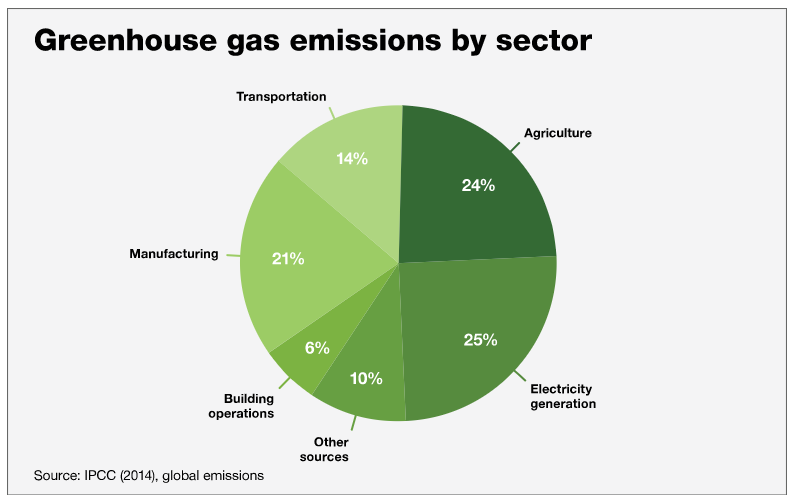

The energy sector’s use of fossils fuels for supplying and producing electricity, manufacturing, transportation, and buildings is a significant source of greenhouses gases , which Bill Gates explains well and with IPCC diagram below:

Contributing to 75% of the greenhouse gases either directly or indirectly the energy sector has a significant role in solving the problem by moving away from fossil-fuel energy sources to energy sources that do not emit carbon dioxide and methane gases.

The transition towards sustainable energy sources will require nearly every sector to decarbonise in the coming decades, including the obvious sectors and the not so obvious ones, the latter being more difficult. The transition presents challenges for both operating companies and fund investors but also creates tremendous growth opportunities for renewables, networks, storage and many other sub-sectors.

Size of the opportunity to validate the megatrend

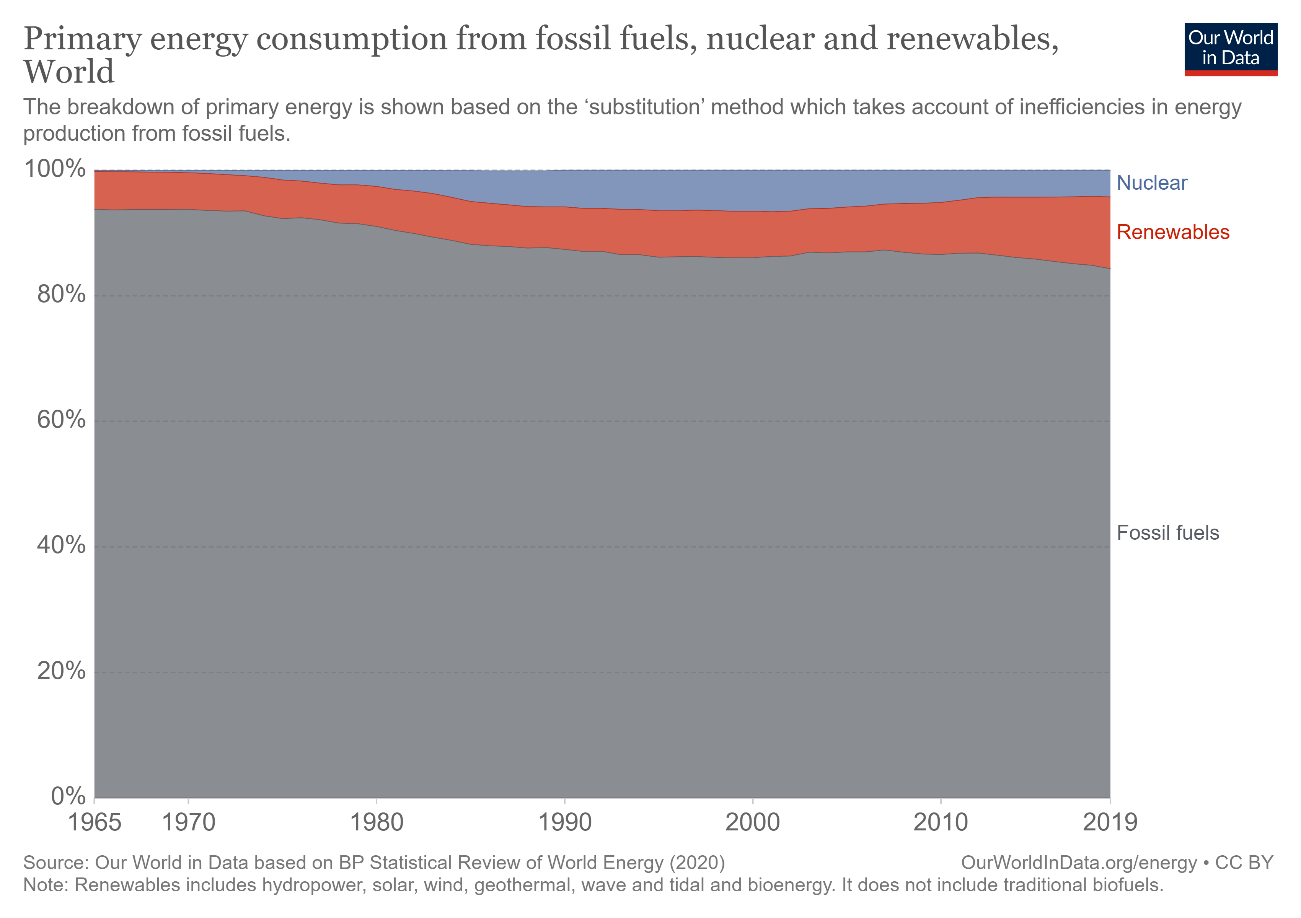

Comparing energy consumption from fossil fuels against renewable sources and recognising the gap between the two is a good starting point for the size of the market.

Primary fossil fuel represented 84.32% in 2019, while renewable energy was merely 11.41%.

You can see there is a significant addressable market for energy transitions. Apart from replacing fossil fuel energy sources, there is further market expansion opportunities through growing energy consumption driven by urbanisation, rising living standards, increasing utilisation of technology, and greater mobility around the world.

Why is it accelerating now?

We believe the trend for energy transition is at an inflexion point where the upward trend is gaining velocity, and presenting a long-term investment opportunity for global equity investors. There is a combination of factors for the pickup in momentum:

- Combined government actions that have stated the intent to be net-zero carbon by 2050. There are over 70 countries around the world joining the campaign while the European nations have taken the lead with the Green Deal 2019. However, the most significant movement has come out in the last couple of months from one of the largest emitters in the world. China has now officially stated its intention to achieve carbon neutral by 2060, which represents the most considerable reduction by any nation around the world. China’s action provided the catalyst for Japan and South Korea to set a net-zero target by 2050. They are leading the way for Asian companies to follow suit. To add to this movement, the United States could be the next country to be added to the list with the election of the Biden government.

- Economics of renewable energy sources rapidly improving. Thanks to technology advancement in recent years, wind and solar energy sources have significantly reduced the premium to fossil fuels sources. In some cases, they are equal or even below the cost of fossil-fuels. For the first time in-history, the International Energy Agency (IEA) has stated that coal is no longer the cheapest energy source, with cases of solar more affordable.

- Some of the best business minds with capital mobilising to solve the problem. Jeff Bezos has set up a fund dedicated to fight climate change. Such efforts are following on the actions of Elon Musk building a company that is decarbonising transport and improving the reliability of renewable energy through battery storage.

- Investors require a higher benchmark for environmental impact for their investments. The capital market is also giving this energy transition a big push. There are growing demands for ESG investing. The world’s largest fund manager BlackRock announced in January 2020 that it would toughen its stance on climate change andreduce exposure to thermal coal .

The players we look for

We seek high-quality companies with economic moats that enable consistently high returns on capital, as this drives value creation and superior growth. We do this by exploring the energy transition value chain, including energy, utility and renewable equipment companies, to search for energy transition winners while avoiding companies with future stranded assets. Also, the energy transition will be enabled by those with information technology, smart technology from the Industrial and IT sectors, so there are winners from these sectors as well.

Although reaching carbon reduction goals presents challenges for companies throughout the energy value chain, it also creates investment opportunities. Companies that invest today in the transition to renewables will be best placed to succeed in a more sustainable world, while investors who identify the future winners will reap the dividends.

How to play it with global listed equities?

There are several strategic areas we believe that provide us excellent leverage into energy transition megatrend with a safety margin on the downside. The strategic areas include:

- Renewable energy producers and suppliers, such as hydro, solar, wind, geothermal, and biomass. Our focus is on utilities that have a proven track record of delivering renewable energy source at affordable prices and have made a significant investment over the last ten years to increase their supply.

- Integrated Energy companies (Big Oil) that have committed future capital spending to clean energy. These out of favour companies have the resources of free cash flow, engineering talent, and convertible infrastructure to pivot and grow market share in the renewable energy space.

- Midstream oil and gas companies have convertible infrastructure that can improve the delivery of renewable energy to the end-users.

- Energy efficiency companies that are digitalising the energy value chain and for the end-users.

- Enablers of “green hydrogen” as this energy source can solve carbon emissions in manufacturing and heavy-vehicle transport. Industrial gas companies are our current point of leverage, as they have the know-how and infrastructure with producing hydrogen.

- Equipment, IT, Materials, Engineering and Services within the value chain of renewable energy that make it a reliable and affordable energy source.

Another area that we have not included is new players entering the game because of the size of the market and huge growth potential. We are watching this space, and taking the view that they must have a proven track record in solving and executing complex engineering problems backed up with abundant capital with the former being the most important criteria.

Key Takeaway

The energy transition trend is at an inflexion point where the megatrend is starting to accelerate. Governments, investors, economists, and private sector positioning have validated the acceleration process. The investment opportunity is enormous, and a key reason it is one of our favoured investment themes in our Global Infra-Energy Fund. An investor can play this investment opportunity across the whole value chain of any business removing greenhouse gases. We have chosen global listed equities with track records of operating in renewable energy, energy efficiency, integrated energy, midstream oil and gas, and enablers of green hydrogen as our starting point due to their positioning and leverage into this market of energy transformation.Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.