Energy, water, and food; inseparable links central to investing in the global food security megatrend

One of the world’s most unprecedented challenges over the coming decades is food security and doing it in a sustainable way to avoid harm to the environment for future generations. Essentially, we need to feed 9.6 billion people by 2050 without damaging the water and environmental systems we depend on. To solve such an impending challenge, we must look at the recent statement from Ban KI-moon, the Former UN Secretary:

“As the world charts a more sustainable future, the crucial interplay among water, food, and energy is one of the most formidable challenges we face”.

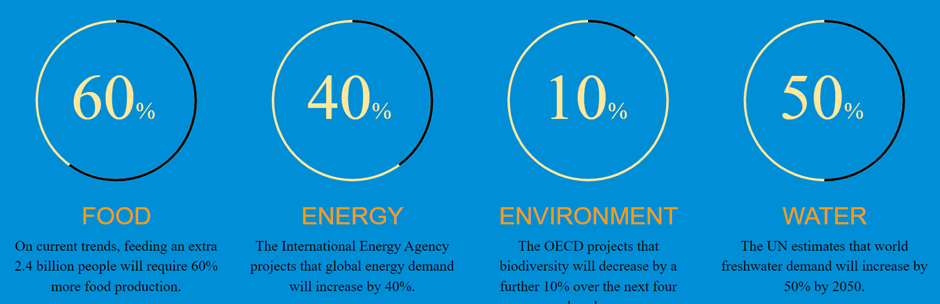

Recognising the inseparable linkage and interplay between energy, water, and food is vital for understanding how the world can solve the accelerating problem of sustainable food security with a growing and more prosperous population. To bring some numbers into the equation to understand the links between energy, water and food:

Sources: UN, IEA, OECD, and FE2W Network

The water-food-energy nexus is central to our investment approach in finding long-term investment opportunities in listed global equities. Our thought process is not because of recent events, such as the global energy crunch stopping production food in Europe or locally here in Australia with the pending Adblue (Urea) crisis, a shortage in diesel fuels used extensively for trucks transporting food produce around the county. Instead, our thinking relates to a core tenant of our investment thematic – identifying megatrends that drive long term earnings and cash flow for companies we invest in. Sustainable Food Security is a megatrend we identified because of the pending challenge, and the connection between energy, water, and food puts us in a solid position to gain excellent investment exposure to our investment universe of energy and infrastructure with the Global Infra-Energy Fund.

To explore this further and provide insights into our investment thinking, we will firstly look at the core components of the food value chain and linkages to energy and water. Secondly, look at our investment exposure into the food value chain through energy and infrastructure industry segments. Finally, outline our key takeaways for investing in the sustainable food security megatrend now and into the future.

The food value chain starts from the farm to the plate, wrapped in sustainability.

There are five components of the food value chain:

- Agri Inputs

- Producing and Processing

- Food and Beverage Processes

- Food Distribution/Retailers

- Transportation/Logistics to tie all these elements together

The above components are critical for individual nations to have food security for their population. The United Nations define food security as meaning that all people always have physical, social, and economic access to sufficient, safe, and nutritious food that meets their food preferences and dietary needs for an active and healthy life.

So, we start to see the inseparable linkages between energy, water, and food. But we want to show how deep these interconnections run in the food value chain by looking at components of the food value chain in detail.

1. Agri Inputs

Agri Inputs covers the essential inputs for growing food at scale, and there are three vital elements:

- Agri Equipment - covers a wide range of products from grain storage, irrigation, tractors, and harvesters with crucial drivers in mechanisation.

- Fertiliser - plant growth requires three essential nutrients - nitrogen, phosphorous and potassium

- Seed and Crop Protection - rising yields result from the evolving seed industry. Breakthroughs continue to be introduced in specialised varieties that target specific disease resistance, insect resistance and weather conditions.

Energy has the most important link with the Fertiliser segment, especially for Nitrogen-based type which account for more than 60% of the global fertiliser production. Natural gas is used primarily as a feedstock and as a source of energy for the manufacturing. Combined it could account between 70-90% of the cost of the fertiliser produced and hence a cheap source of natural gas is vital. This benefits natural gas producing countries like the US, Russia, Qatar, and Norway. In the case of China coal is used to produce the synthesis gas needed.

For Agri Equipment, energy in the form of diesel is the primary fuel required to operate the equipment. At the same time, water efficiency has a direct relationship with irrigation systems deploying water at the right time.

2. Production and Processing

Production and Processing involves the growing of crops, plantations, and livestock and processing the harvest or livestock for transport to the subsequent end-user. There are four vital elements, which include:

- Farmland/Timber/Agribusiness - companies in this sector include farmland, forest/timber, palm plantations and sugar/ethanol production.

- Agri Commodities/Crops - cereal crops consisting of wheat, rice, and coarse grains such as corn are the largest categories of crops.

- Agri Processors - includes sugar processors, corn/ethanol processors, oilseed processors, and diversified agribusiness companies.

- Protein Production /Processing - protein production and processing includes companies in the following industry sectors: pork, poultry, beef, fish and dairy. The emergence of the middle class in developing nations such as China is the biggest driver here.

Water access is a significant factor in producing crops, plantations, and livestock. The land needs to receive enough rainfall and absorb the water to produce crops and plantations. In addition, high-quality water needs to be available to grow and maintain livestock in the production process. Energy is an essential requirement for processing various crops such as sugar, corn, and oilseed. With cane sugar and palm oil plantations, energy can be created in the form of biofuels such as ethanol for petrol blending and palm oil as feedstock for renewable fuels refinery.

3. Food and Beverage Processes

The food and beverage processing includes both packaged foods and beverages. The sectors include diversified foods, baking/confectionery, condiments/snacks, cereal, speciality/organic, canned vegetables, beverages, and brewers and distillers.

Feedstock derived from the energy value chain is a vital input component for manufacturing packaged foods and beverages. The pricing of these ingredients needs to be at a reasonable point to make food affordable and available for the population. At the same time, water is a natural ingredient in most packaged beverages.

4. Food Distribution/Retailers

This retail segment comprises of grocers, speciality/organic grocers, hypermarkets, restaurants, and foodservice suppliers. Companies in this part of the food chain are the ultimate customers for the entire food chain. Therefore, as these companies evolve to meet consumer preferences, they can have substantial impacts on the previous parts of the food chain.

The consumer preferences relating to price, quality, and sustainability are directly related to the inputs in the food value chain that are related to energy and water. Energy prices increase the cost of food. This could make the product out of reach for a consumer that is price sensitive with purchasing food.

5. Transportation and Logistics

Transportation and logistics are vital elements through all parts of the food value chain and provide the connection between producers and their commodities and food products with their respective customers around the globe. Relevant segments are railroads, trucking and shipping companies.

Affordable energy supply to power the railroads, trucking, and shipping is a significant factor in the efficiency of delivering the food to the end-users.

Three components of the value food chain where we enjoy investment exposure

Through the RC Global Infra-Energy Fund, we have three meaningful exposures out of the five components of the food value chain. Agri Inputs and Producers and Processers are the two areas due to their interconnection to the energy and infrastructure value chains, which is the investment focus of the Fund. Lastly all modes of transport needed for the entire food chain are big users of energy as well.

Within the Agri Inputs, our investment exposure with Agri Equipment starts with energy sector, from the producers to the refiners, that ultimately supply diesel fuel to run most agriculture equipment. From an infrastructure perspective, we hold Deer & Co US, the number one manufacturer of Agriculture Equipment globally with a market capitalisation of $108.7 billion. More importantly, Deer & Co are leading the mechanisation of farm equipment to make farming or food production more sustainable. The automation of food production is an area of focus that will have incredible value creation in solving the challenge of sustainable food security.

Fertilisers are our largest investment exposure in the food value chain because of energy’s direct relationship in fertiliser production. The price of natural gas as a feedstock in the production process is vital to the profitability of these products. This relationship provides the confidence for us to invest in the sector to give exposure to secular trends in the growing population and food. Our investment approach in the fertiliser industry is to take a broad approach by investing in four pure plays that produce different types of fertilisers. The diversified allocation allows us to reduce the risk inherent in just one type of fertiliser and volatility in a cyclical sector caused by many variables The companies we have invested in include:

| Company | Country | Fertiliser Type | Market Capitalisation |

|---|---|---|---|

| Yara | Norway | Nitrogen Based | $13 Billion |

| CF Industries | US | Nitrogen Based | $13 Billion |

| Nutrient | Canada | Potash (Potassium) Based | $10 Billion |

| PhosAgro | Russia | Phosphate (Phosphorus) | $10 Billion |

Our investment universe of listed global equities adds further diversification to invest in the best fertiliser companies worldwide; such companies are limited within the Australian market and under pressure with the supply of natural gas in the domestic market.

The other significant investment weighting we have directly tied to the food value chain and represents the second component is Production and Process. The area we have invested in that interconnect with energy is the processing of sugar and palm oil, which provides inputs for biofuels. Biofuels are an energy source gaining traction with sustainable fuels that reduce carbon emissions and air pollution. Such fuels will be valuable to making the food chain more sustainable and for other parts of the transport where electrification cannot be applied economically. We have three core holdings in Wilmar Singapore, KL Kepong Malaysia, and Cosan Brazil.

Other investment exposures in the food value chain relate to chemical and industrial gases companies. We have BASF Germany, a diversified chemical company that is a leader in the area crop protection chemicals for the in the agricultural industry, and Evonik Germany and DSM Netherlands, which provide value-added nutritional care for food processing. Linde and Air Liquide, our industrial gas companies, supply various gases for the food production process, such as oxygen, nitrogen, and carbon dioxide.

Finally, we have investment exposure in critical transport infrastructure companies transporting grain, ammonia, and farm machinery. There are two shipping companies and one railroad company. We have Nippon Yusen Kaisa, the largest of the three listed Japanese diversified shipping companies, and Pacific Basin HK, one of the top listed bulk shipping specialist companies. For railroads, we have Union Pacific US, the largest rail freight company in North America (and globally as well).

Our investment exposure into the sustainable food security megatrend through the food value chain is approximately 18% of the Global Infra-Energy Fund.

Key Takeaways

- The global challenge of feeding a world population that is growing and more prosperous is creating a megatrend around sustainable food security.

- The inseparable linkage between energy, food, and water will hold the key to our ability to resolve the sustainable food security challenge.

- To invest in the food value chain, you need an excellent understanding of the interplay between energy, food, and water.

- Sustainability is another added layer to solving the impending challenge of food security.

- Energy, water, and infrastructure business segments provide excellent investment exposure into the sustainable food security megatrend due to their interconnections into the food value chain.

- There are several entry points, but listed global equities provide an excellent investment universe to build a resilient portfolio to gain exposure into the food value chain.

- Other megatrends, such as energy transition and automation, will significantly impact the sustainable component of food security.

Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.