Indoor air conditioning providing an excellent investment opportunity

Part 2 : Three rising investment opportunities in air, making society more sustainable.

Continuing with our investment theme on air, in this Part 2 article, we look at the secondinvestment opportunity we believe will be very attractive in the coming decade and beyond. The second investment opportunity relates to the quality of air inside the building, which is as important as air quality outside the building and was our first investment opportunity we investigated in Part 1 in our three-part series of articles on air. Air quality or conditioning inside a building directly relates to the business segment that is producing air conditioningunits or HVAC systems. We believe the HVAC equipment segment is providing a long-term sustainable trend that is financially beneficial to a portfolio in particular one that focuses onessential industries, such as our Global Infra-Energy Fund.

The growing problem of air quality and pollution

Air pollution and deteriorating air quality is a global challenge facing all countries as The World Health Organisation (WHO) estimates that air pollution contributes to seven million deaths per year! That’s more than AIDS, tuberculosis, and malaria combined. Air pollution is not only harmful to humans but the health of our entire ecosystem. Its impacts on humans include the heart (caused by, e.g. carbon monoxide), lungs (due to nitrogen and sulphur oxides) or both (e.g. particulates). The impacts on the environment include reduction of photosynthesis (e.g. ozone); damage to foliage and growth (e.g. sulphur dioxide) and the depletion of water and soil quality (e.g.particulates).

What is an HVAC system?

HVAC stands for heating, ventilation, and air conditioning. This system can improve the quality of air inside a building by changing the temperature, improving airflow, and filtering the air. Even when there are different conditions outside the building, all these changes can be made to the indoor air quality.

HVAC is widely applied in various aspects of the industrial, commercial and residential environment to provide climate control for better comfort or indoor air quality.

Technological advancements play a large role in the HVAC industry's operations and products. The rapid rise in energy-saving and smart technology has become one of the significant HVAC Industry trends in the global market.

Size of the HVAC investment opportunity

According to the latest market research from MarketsandMarkets, the size of the global HVAC market is US$202 billion in 2020. It is expected to reach US$277 billion by 2025, representing a strong CAGR of 6.5% during the forecast period. The market growth is being fuelled by escalating global warming caused by greenhouse emissions. Other factors such as growing demand for energy-efficient solutions, rising government incentives, and an increasing trend of smart homes are also driving the growth of the global HVAC market.

Approximate size -Projected by Markets and Markets

| Residential Air Purifiers | US$13.6 billion (by 2025) |

| HVAC Filters | US$7.7 billion (by 2024) |

| HVAC controls | US$27 billion (by 2023) |

| Overall HVAC System Market | US$277 billion (by 2025) |

The case for investing in HVAC

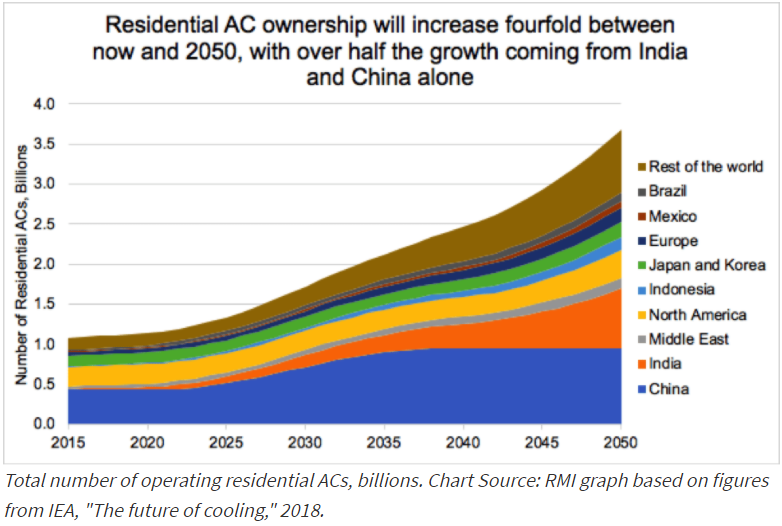

Investing in the megatrend of an emerging middle class in the developing world is a time-tested idea, and an excellent way to do it is through the heating, ventilation, and air conditioning (HVAC) sector. According to the International Energy Agency (IEA), future demand for air conditioning alone will be such that, all other things being equal, "energy demand from air conditioners will more than triple by 2050, similar to China's electricity demand of today. Among all the HVAC equipment segments, the air conditioning accounts for the largest share in the industry revenue. The increasing adoption of air conditioning systems around the world is driving revenue.

Going back in history, the hard-partying Roman emperor Elagabalus used imported snow from mountains to cool down indoor buildings. The 1902 invention of air conditioning changed everything; it brought chilled indoor air to the mass population.

The Three-Year Action Plan contains specific targets for reducing emissions of sulphur dioxide and nitrogen oxides by 2020, with both to decrease by at least 15% compared with 2015. For cities that have not met the existing PM2.5 (Particulate Matter) standards, their urban concentration of PM2.5 targets needs to decrease by at least 18% compared with 2015. China is targeting the annual numbers of days with fairly good air quality to increase to at least 80%, and highly polluted days to decrease by at least 25% compared with 2015.

China is by no means the only country tackling the issue, many governments around the world are making commitments such as enacting several legislations and setting targets to combat air pollution.

The long-term growth trend since the inception of air conditioning will continue to increase as incomes rise in emerging economies. Recent market research shows that China is the largest air conditioning market in the world, with over 55 million units of air conditioning units sold every year. The US is the second-largest market for aircon sales, with about 25 million units sold every year. As of 2019, over 60% of US households have central air conditioning systems.

According to the International Energy Agency (IEA), ten air conditioning units will be sold every second for the next 30 years. Geographically, Asia Pacific dominates the global HVAC market. The residential sector contributes significantly to the region’s HVAC equipment demand due to the rising product use in emerging economies. China, India, and Japan are the major contributors to the growth of this market. Much future demand will come from Asia and Africa, responsible for 90% of the projected 2.5 billion increase in global urban increase in global urban population by 2050

Growth drivers for HVAC

In summary, the key drivers are:

- Increasing urbanisation , particularly in emerging economies, will create more demand for cooling, as cities tend to be hotter than suburban and rural areas.

- Improving living standards in developing countries are likely to lead to an increase in demand for creating comfort like air conditioner.

- Global economic growth is shifting toward countries that tend to be hotter. The markets expect India, China, and Indonesia alone to account for half the increase in energy use from cooling by 2050. Then there are other countries with a sizeable population like the Philippines and Thailand in SE Asia, Pakistan and Bangladesh on the sub-continent, Nigeria and Ethiopia in Africa and Brazil in South America.

- Replacement of legacy systems for units that create energy savings, and put less demand on the electricity grid.

- Immediate effects of global warming with extreme weather are fuelling the demand for indoor cooling.

Like other industries, the COVID-19 health crisis has impacted the growth of some segments of the HVAC market, but the long-term trend is positive and intact. Also, HVAC systems are emerging as a critical component in combating the spread of viruses within indoor environments.

IEA report forecasts that global residential AC capacity will grow from 6,200 gigawatts (GW) in 2016 to 23,000 GW in 2050, representing a compound annual growth rate of 4%.

The beneficial aspects of HVAC to society

The big beneficiary of HVAC systems is that the productivity of the workforce has significantly improved when indoor workplaces have become more comfortable for workers. Conducted studies have linked a 2% productivity loss in tasks like mental arithmetic to each degree over 25 C. Also, such improvements in schools and university have improved education outcomes and increased the skillset of our future workforce.

The indoor comfort levels of households through HVAC systems have improved workers downtime by improving indoor temperatures when the home is too hot or cold to allow individuals to sleep easily. In times of extreme weather events, such heatwaves they can be lifesavers. You only have to look at the devastating heatwave we had in Europe in August 2003 that killed 35 000 people.

HVAC systems are playing a critical role in combating the current COVID-19 virus by reducing the spread of the virus within indoor buildings. HVAC systems that can improve airflow, lower humidity levels, and apply filtration to air in the room can reduce the viruses from spreading.

HVAC high-energy demand risk

Air conditioning systems do cause stress on the electricity grid. In the US, a total of 16% of electricity demandcomes from space cooling and increases to nearly 30% during peak load. The high-energy appliance creates a negative impact on our climate with global warming because carbon emission is increased when using power generation from fossil fuels. The adverse effects on climate change present a risk of discouraging the use of the HVAC system, which halt the long-term growth of the segment.

At RC Global, we believe the risk relating to a negative impact on climate change through high-demand power usage is being negated at a micro and macro level. At the micro-level, we see HVAC system address this problem by developing smarter systems that can change their usage levels in real-time by recognising time-ofday, outside temperatures, and occupants within the room. HVAC companies are promoting the energy-savings heavily and supported by government initiatives for building operators to upgrade to a new system with these features.

At the macro level, we see a significant push for energy-efficient power generations or renewable energy. Renewable energy includes power sources from solar, wind, biofuels, and hydro. These sources of energy reduce the carbon emission significantly by replacing fossil-fuels power sources, which are heavy emitters. Renewable power capacity is set to expand by 50% between 2019 and 2024, led by solar PV. This increase of 1 200 GW is equivalent to the total installed power capacity of the United States today. China accounts for 40% of global renewable capacity expansion over the forecast period, which is one of the countries we expect to see substantial growth in HVAC systems.

Other positive impacts we could see from HVAC systems in combating global warming is through carbon capture. Air conditioning systems could help pull the carbon dioxide out of the atmosphere. Such a solution is very theoretical, as there are still many engineering hurdles to overcome to provide a viable and commercial solution.

Who are the major players in HVAC?

Many of the world's largest HVAC companies are investing heavily in developing more efficient products that also use less energy to provide comfort. Smarter technology-enabled HVAC equipment allows customers to control HVAC systems such as ventilation and air conditioning through smartphone apps. At the same time, other mobile technologies will enable preventative maintenance and service programs. Making up the list of the top players are :

- Prominent Specialist in HVAC - Daikin Japan, Ingersoll Rand, Johnson Control International, Carrier Global US, Trane Technologies US, Lennox US

- Diversified players in the Industrial sector - Honeywell, Raytheon Technologies Emerson Electric, 3M (all US-based), Schneider Electric France, Mitsubishi Electric Japan

- Diversified players in the Electrical/Electronic segment - Samsung Electronics Korea LG Electronics Korea, Sharp Japan, Panasonic Japan

- Household Appliance - Electrolux Sweden, Whirlpool US

- Others - Royal Philip Netherland, AOON US

In total, we estimate that the investable universe of listed HVAC companies is well above US$1.1 trillion. - RC Global

An industry set for more consolidation

We believe the HVAC industry is ripe for more consolidation. Johnson Controls sold its power solutions business for net cash proceeds of $11.6 billion, partly to make strategic initiatives in HVAC. United Technologies choose to spin out it's HVAC business as Carrier Global, which allowed it to merge with Raytheon Technologies. Furthermore, Ingersoll-Rand has spun off its industrial businesses and then combined them with Gardner Denver (now delisted) to create a highly focused HVAC company. At the same time, its climate change business now becomes Trane Technologies. In this context, it is no wonder the kind of valuation at which smaller companieslike Lennox International and AAON trade at.

At RC Global, we consistently apply our strict financial discipline, which includes balance sheet strength, the ability of companies to generate free cash flow, and a commitment to rewarding shareholders via growing dividends. Even within attractive industries, we do not overpay or go with the flow when something is hot, as downside protection and capital preservation are of utmost importance to us.

Average metrics of our 6-stock "HVAC " portfolio within the Global Infra-Energy Fund .

| Market Cap | $68.6 | US billion |

|---|---|---|

| FY1 | PE | 22.8X |

| FY1 | EV/EBITDA | 13.5X |

| FY1 | Free Cash Flow Yield | 5.0% * |

| FY1 | Dividend Yield | 2.6% |

| FY1 | ROE | 14.0% |

| FY1 | Net debt/EBITDA | 1.2X |

Key Takeaway

The HVAC segment is presenting another excellent long-term investment opportunity in global equities markets.The critical factors in making this the second opportunity in our air investment theme attractive are:

- The quality of air in indoor buildings is an essential component for our lives at work, home, and schools with the HVAC system a critical element in maintaining air quality and comfort levels.

- Risingliving standards, urbanisation, and higher economic growth in countries with hotter average temperaturesare driving long-term growth of the HVAC industry.

- The headwind of high-energy demand for HVAC appliances is being negated by new features focused on energy savings and the increased usage of renewable energymaking growth more sustainable.

- The investable universe of listed HVAC companies is well above US$1.1 trillion in global equities markets providing leverage into the business segment.

- TThe large capitalised players within the industry are at reasonable prices with strong balance sheets, freecash flow yield around 5%, and producing a return on equity of 14 %.

Like what you're reading? Subscribe to our top stories.

Follow us on Medium, Twitter, YouTube, and Linkedin.

Roy Chen

Chief Invesment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.