Investing in the transport sector for listed global equities - Part 2

In May 2021, we wrote Part 1 of our review of the transport sector in listed global equities, a year after COVID-19. Now that we are approaching the three-year anniversary of the beginning of the health pandemic, the investment team see it as an excellent time to review the investment strategy for the global transport sector. While at the same time draw some conclusions on the outlook for the coming year.

In the review, we will first summarise the significant changes over the last three years and look at the winners within the sector. Secondly, we will explain the diversified investment strategy we deployed over the three years and provide an update on the revised investment strategy going forward.

Summary of significant changes over the last three years

- The investment universe of the listed transport sector has grown little from approximately US$2.32 trillion in May 2021 to US$2.5 trillion by 16 Feb 2023 or 7.8% growth in market value. The two most significant additions to the Top 10 companies are Uber US and Meituan China. For the complete table of the current Top 10 in market value, refer to table 1 in the Appendix.

- In less than three years in the transport sector, we have gone a full circle. The segments hit hardest by COVID-19 are now coming back strong, while some of the early winners in 2021-2022 are now suffering different degrees of a downturn.

- Some segments have done well in the last couple of years and may continue to outperform for a prolonged period due to a congruence of factors favouring the companies in those segments.

Looking at the winners after CONVID-19

The two winning segments within the global equities transport sector were air freight operators and container shipping companies. The dramatic gains by these two segments were driven by the enforced lockdowns to combat COVID-19. The lockdowns forced consumers to shop online, generating a boom for e-commerce where large amounts of goods were required to be transported versus people who were in lockdown. At the same time, the lockdowns were causing supply chain bottlenecks driving extra demand in sourcing goods from locations that were not in lockdown and transporting them to other places. Furthermore, with the sector ill-prepared, there were further bottlenecks with port congestion and a shortage of containers. All these demand drivers and supply side issues were a tremendous benefit to air freight operators and container ship segments through significantly higher rates and led to their shares skyrocketing.

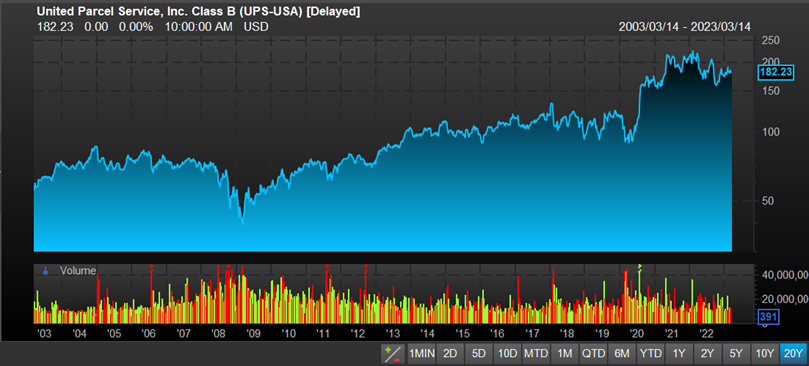

The air freight operators were the first group to experience the rush in demand. The demand was so high that commercial airlines were taking the overflow and using it as their main income source to keep themselves afloat through the lockdown periods. The big three that dominate the air freight segment are UPS and FedEx in the US and Deutsche Post DHL in Germany. UPS is the largest of the three, and when reviewing its twenty-year share price history, we see an excellent picture of what best represents what happened to the industry.

Source: FactSet

From the share price chart, we witnessed an accelerated share price peak in Feb 2022 and a peak to trough in September 2022, which corrected by 28%. It clearly replicated the US consumer's activity in locked that relied on the manufactured items in China and other parts of the world. When we take a look at the peak share prices from March 2020 and the peak to trough for the big three, as below, we see the same story.

| March 2020-Peak 2022 | Peak-trough | |

|---|---|---|

| UPS | +130% | -28% |

| FedEx | +190% | -53% |

| Deutche Post | +176% | -50% |

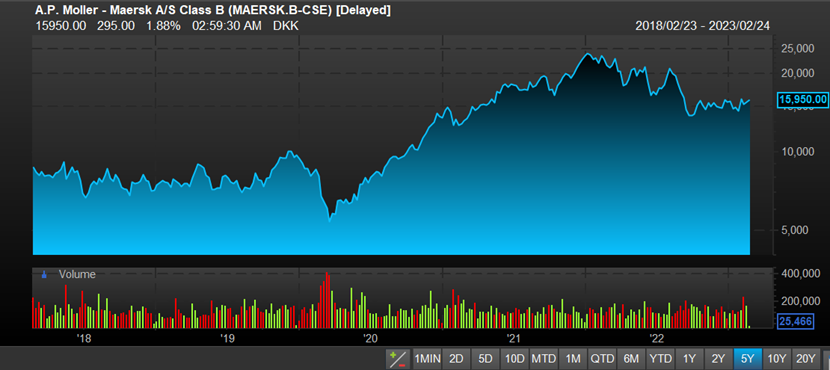

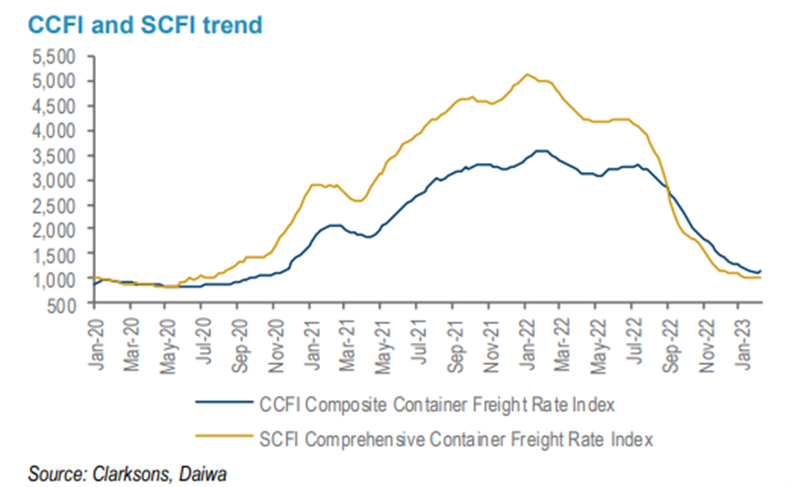

Container shipping companies were the second group to be a significant winner from the online shopping rush. Three global alliances dominate the container shipping market. AP Moeller (Denmark) and Hapag-Lloyd (Germany) are the largest listed European companies. In Asia, we have Cosco(China), Evergreen (Taiwan), HMM (Korea), and in Japan, there are three diversified shipping companies Nippon Yusen, Mitsui OSK and Kawasaki Kisen. Similar to the air freight companies, the container shipping companies benefited from the accelerated demand and supply chain bottlenecks, which are clearly seen by two charts AP Moeller share price chart and container rates over this period.

Source: FactSet

Source: Clarksons, Daiwa

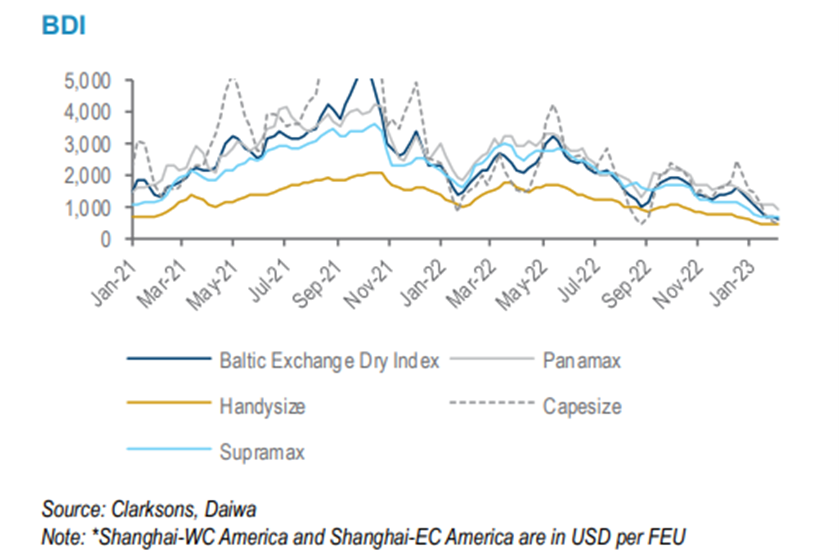

Another transport segment that benefited in the three years was the Dry Bulk Carriers. These seaborne carriers transport bulk materials such as coal, iron ore, cement and grains—the spot rates for transporting bulky materials are represented by the Baltic Dry Index (BDI). The BDI chart below shows the higher rates they received over the period.

Source: Clarksons, Daiwa

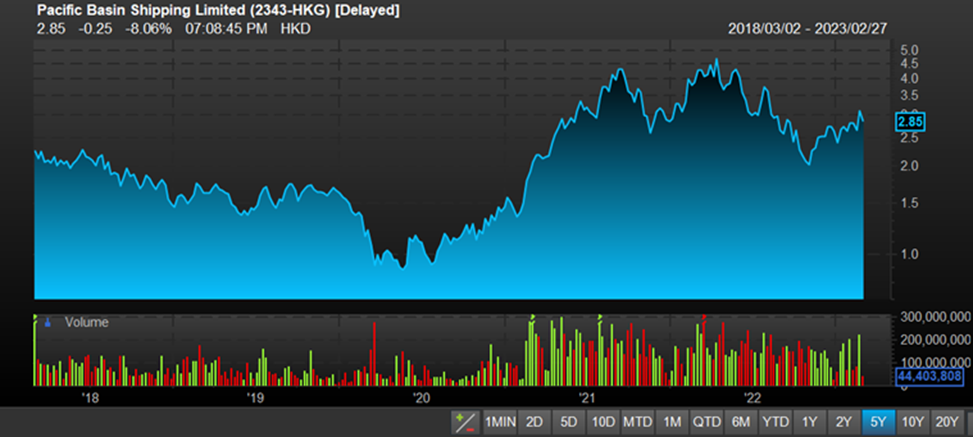

Regarding investment exposure, there are no mega-cap pure plays as in the air freight carriers and container shipping companies. The largest listed bulk carrier pure play is Star Bulk Carrier US, with a market value of US$2.3 billion. The best known in Asis is Pacific Basin Shipping based in Hong Kong with market value US$ 1.8 billion. When we review the price chart of Pacific Basin Shipping, we not only see the gains, we have seen the increased volatility of the segment.

Source: FactSet

The volatility of the bulk carrier segment is linked to the demand for the materials they are transporting. The key materials are iron-ore and coal, primarily driven by China's economic activity to produce electricity and steel. Another essential material to watch is the movement of grains, which can depend on the amount harvested in a season.

Disruptive impact on the transport sector leads to diversified investment strategy

At RC Global Funds Management, we had to make some changes to the investment approach to respond to the unknown impact that COVID-19 would have on the global transport sectors. The changes were centred around preserving capital while we were dealing with the unknown, but nimble enough to tap into accelerating trends and quickly recover from any mistakes we made with investment allocations.

The steps we took included the following:

- Foremost was to preserve capital. On the realisation of pending economic issues that COVID-19 could have on the transport sector, we made quick exits from people moving transport such as Airports, Airlines, and Passenger Rail. Exiting this group reduced our exposure in transport from 18% to 7% and allowed us to preserve capital for the redeployment to other transport sectors that would outperform in this disruptive environment.

- Allocate to segments that would benefit in the disruptive conditions. The initial segments we chose were the Air Freight Operators, Container Shipping, Port Operators, and Rail Freight. As previously mentioned, all these segments benefited from the increased demand for moving goods with the e-commerce boom. As we recognised peak demand for these segments, we reallocated to diversified shipping companies to maintain exposure but with less volatility. Also, we focused on other segments that benefited from events driving demand, such as the Ukraine conflict and supply-side constraints. These segments included energy shipping companies and vehicle carriers.

- Further diversification at the stock selection level. Apart from allocating across different segments, we further diversified with a basket approach to stock selection. Instead of a single stock selection in each segment, we selected several companies, as there remain many unknowns about how the health pandemic would play out. We remain resolute in our stock selection process of only selecting companies that have a strong competitive advantage, significant market share, solid balance sheet, quality management, and ability to pay a dividend, but we have a preference of basket of stocks instead of single one to minimise risk

- The timing and the exiting into each sector were equally crucial in the investment strategy. Apart from the volatility caused by the disruptive impact of COVID-19, various transport segments have been historically volatile due to the nature of the industry and the cargo they are carrying. Therefore, another critical element of the timing and exiting strategy was not to exclude taking losses when we recognised mistakes had been made.

In terms of returns, how did the investment strategy play out for us over the three years? We had some excellent realised gains in the following stocks: -

| Company | Segment | Realised Gain |

|---|---|---|

| UPS | Air Freight Operator | 88% |

| Hapag-Llyod | Container Shipping | 96% |

| D/S Norden | Dry Bulk Carrier/Product Tanker | 90% (Combined trades) |

| Nippon Yusen | Diversified Shipping Companies | 84% |

| Mitsui OSK | Diversified Shipping Companies | 79% |

Rail Freight and Port Operators were segments where we made a very modest gain. The Segment that has gone from bullish to bearish over the three-year period was container shipping, in which weaker demand will be compounded by an increasing supply of new vessels going forward. Air Freight and Dry Bulk Shipping also face challenges due to more fragile global economies.

Overall the investment strategy had played out well for us over the disruptive period and was a significant contributor to our solid performance of the fund over the last two-year period.

Looking at the winners after CONVID-19

We continue to have a high conviction call on Shipping within the transport sector but becoming selective in these segments. The three segments within Shipping where we have maintained exposure are :-

- Energy Shipping

- Diversified Shipping

- Vehicle Shipping

Energy Shipping. These are specialist shipping companies focused on the transport of different types of energy. There are three specialist areas we are bullish on because demand is strong, but most importantly, supply is limited with very low-order books while older vessels (>15 years old) are being scrapped as they have become costly for maintenance and for environmental reasons. The first specialist area is Oil Tankers transporting both Crude oil (dirty tankers) and refined products such as diesel and jet fuels (clean tankers). These smaller latter groups are benefiting the most from the US/EU sanctions on Russian export of refined products -now having to import all the way from Asia (India and China). The startups of many refineries in the Middle East also increase demand for more product tankers. The second specialist area is LNG Carriers, which for years have been shipping LNG to the key markets in East Asia -namely Japan, Korea, and China. These carriers have benefited the most from the huge European imports, mainly from the US, due to the Russian gas pipeline being cut off. The third specific area that goes unnoticed and is one of the smaller shipping segments is LPG Tankers. The tankers ship LPG, a by-product of oil refineries and liquids-rich LNG plants. LPG is both a cheaper (than LNG) and cleaner fuel (than coal) as well as a petrochemical feedstock.

Our Energy Shipping exposure includes the following stocks:

| Segment | Company | Country |

|---|---|---|

| Oil Tankers-Refined Products | Scorpio Tanker | United States |

| Oil Tankers -Crude Oil | Euronav | Belgium |

| LNG Carrier | Flex LNG | Norway |

| LPG Carrier | BW LPG | Norway |

Vehicle Shipping. The transportation of vehicles includes cars, trucks, buses, rails, agriculture equipment, and other heavy equipment. The demand driver for vehicle shipping will be the post-COVID-19 recovery of industries, increasing the demand for all types of vehicles. We have invested in WALLENIUS WILHELMSEN ASA Norway (WAWI), the number one player in the RoRo (Roll on Roll off) segment known as Car Carrier for vehicle shipping exposure

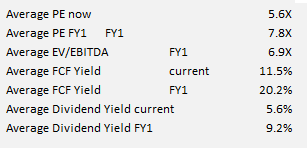

Diversified Shipping. The allocation to Diversified Shipping increases the exposure in our preferred segments of Energy Shipping, Vehicle Shipping and Dry Bulk. Diversified shipping activities should limit the downside when certain activities are underperforming. The valuation for diversified shipping companies was another attractive factor, with valuation multiples at historic lows (PE x 2) and very high dividend yields (>10%). We are most positive on Mitsui OSK Lines (MOL) Japan.

The shipping segment we no longer have exposure to is Container Shipping pure plays. We have become bearish on the sector because there will be no capacity constraints this year and beyond, with many new ships being added to their fleets, creating a surge in capacity supply at a time of falling demand and plunging freight rates.

Dry Bulk Carriers -we expect to recover gradually with the opening of the Chinese economy out of lockdown. We capture partial exposure here via Norden, which is now benefiting more from its product tanker segment, but it has a dry bulk fleet with ships all on contracts.

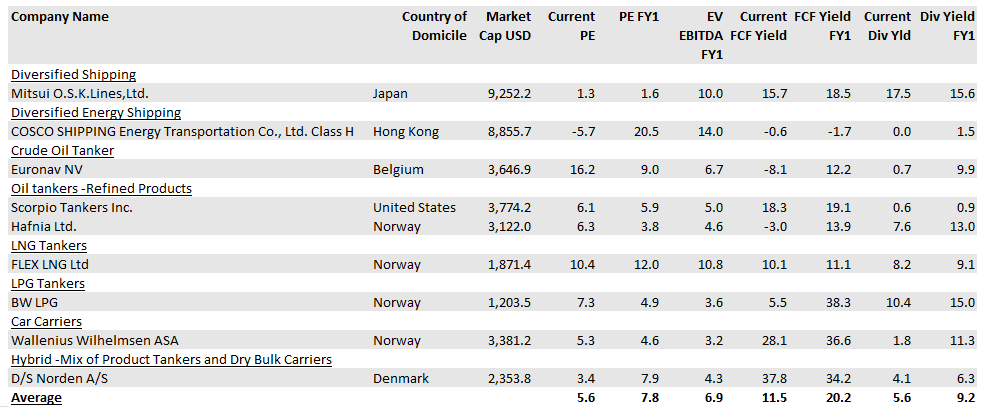

All the companies we selected in these segments generate bumper dividends that no other sector can match in 2023

RC Global Infra-Energy Fund -Basket of Shipping Stocks within the Transport Segment

Source: RC Global and FactSet

Summary of the 9 Stock Basket

Source: RC Global

The other segment outside of shipping we have been slowly reallocating is transporting people, which is the exposure we had before COVID-19. Apart from this view, the sector is now seeing immediate benefits with the removal of lockdowns and a surge in travel demand. As lockdown travellers need their sugar hit, travel will be a long-term driver for people's transport.

There are two segments we are allocating to air-related travel and passenger rail. For air-related travel, we have the following exposure:

| Segment | Company | Country |

|---|---|---|

| Airports | Airport of Thailand | Thailand |

| Auckland Airport | New Zealand | |

| Airlines | Singapore Airlines | Singapore |

| Japan Airlines | Japan |

The investment exposure for passenger rail we have:

| Segment | Company | Country |

|---|---|---|

| Rail Operators | West Japan Rail | Japan |

| East Japan Rail | Japan | |

| Rail Equipment-makers | Alstom | France |

| CRRC | China |

Within the air and rail travel segment, we have taken an overweight position in Asia Pacific because we strictly adhere to companies with solid balance sheets and can pay dividends. Asia Pacific has met this profile against US and European peers. For example, Singapore and Japan Airlines have both resumed paying dividends ahead of other airlines.

Overall the transport sector is in good shape, with recovery from global lockdowns starting to gather steam, with bottlenecks in supply chains easing and people returning to travel. As a result, we believe the exposure transport sector remains a sector that can provide outperformance to our Global Infra-Energy Fund portfolio going forward in the immediate term and longer time horizon.

Key Takeaways

- The size of the investment universe for the global transport sector has modestly grown in the last three years when the health pandemic hit the industry.

- In terms of winning segments, the sector has come full circle where sectors transporting goods were the winners early on the pandemic, but now, we are seeing the outperformance of transport segments moving people.

- Using the whole value chain in the transport sector can assist us in identifying investment opportunities to outperform with changing economic conditions.

- At present, certain shipping segments within transport segments offer very attractive valuation and high dividend yield. Also, there is a recovery play with the transportation of people.

Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.