Investing in water the source of all life

If one were to look at planet earth, water is present everywhere, but most of it is seawater in oceans and not drinkable. Only 3% of all water on Earth is freshwater, and only 1% of it is readily available for human consumption. Shortage of water is in every continent, more acute in some regions than others. We see water as one of the most attractive investment themes in the coming decade and beyond. This article aims to explore this opportunity.

The $100bn p.a. Water Opportunity

World Economic Forum (WEF) in 2019 identified water scarcity and its effects as the greatest threat of the coming decade. Both climate change and population growth are likely to exacerbate the situation of freshwater shortage. Since the 1980s, global water consumption has been climbing by around 1% per year. Global water demand is expected to continue growing at a similar rate until 2050, which represents an increase of 20% to 30% compared to the current water consumption.

The global water market is led by Asia Pacific, where growing demand for water and water systems is fuelled by the surge in manufacturing and construction activities across the region as well as a massive population that is consistently on the rise. Additionally, efforts on the part of governments in Japan, India, China, and other developing countries to support and encourage urbanization and dedicate sufficient resources toward wastewater treatment processes have benefitted the Asia Pacific water market. In the meantime, the scope for growth of the water market in the rest of the world is immense. Increasing demand for bottled water and rising use of water in the utilities sector is driving the water market in Europe, North and South America. In contrast, poor quality of water is a major issue in most countries in the Middle East and North Africa.

The World Bank estimates that delivering the UN’s Sustainable Development Goal 6 by 2030 will require over $100bn of additional Capex globally every year, which is 40% above the current spending. Developing countries need to close the projected demand/supply gap in both water and wastewater provision, whereas developed countries (notably the US) urgently need to upgrade existing infrastructure to address losses and improve quality.

The Chinese Water Market – using China as a prime example

The UN classifies China as one of the 13 countries in the world with a water shortage. The Chinese National Bureau of Statistics states that per capita freshwater resources is 2,355m3 (in 2016), approximately one-third of the global average. Increasing demand from rapid economic growth and urbanisation is only likely to make matters worse in the absence of policy action. The 2030 Water Resource Group projects that in a ‘business as usual scenario’, China’s deficit of water will be 199bn m3 by 2030.

The scarcity of water is one thing, but China also suffers from the regional disparity in water resources. Water is relatively more abundant in the south but a very severe shortage in the north. The north has 47% of the country’s population but only 16% of water supply. According to China Water Affairs, more than 400 of 660 Chinese cities suffer from water shortage.

Over the years, the Chinese government has deployed several policy initiatives and interventions to rectify availability and quality issues. South-to-North water diversion project is one to address the regional imbalance. The Water Pollution Prevention and Control Action Plan of 2015, known as the ‘Water 10 Plan’ is another one; its key objective is to reduce pollution in major rivers and target water usage. The PRC’s 13th Five-Year Plan (2016–2020) for the Construction of Urban Wastewater Treatment and Recycling Facilities represents a recent initiative, which envisaged an expenditure of RMB 560 bn (US$ 81bn) or 30% higher than the previous Plan. Much of the expenditure is focused on the installation of new sewage pipelines and plants as well as upgrade of existing facilities.

Hydropower

Hydropower is another area less discussed but is also vital -using water as a resource to generate electric power. Accounting for approximately 55-60% of the global renewable power capacity, which also includes solar, wind and geothermal, hydropower is the largest source of “green power”. Mountainous countries such as Canada, Brazil, Chile, Austria, Finland, and New Zealand have relied on hydropower for decades. The world famous “Three Gorges Dam” undertaken to meet the acute demand for power in China has been the world's largest power station in terms of installed capacity (22,500 MW) since 2012.

Water as an investment theme/global megatrend

From the above discussion, it is with no doubt that water consumption will continue to rise. Key drivers include population growth, urbanisation, a higher standard of living and changes to consumer habits, increased irrigation of agricultural land and various industrial processes. Water as a theme is attractive for many portfolios, especially those with income as an investment objective as well as a growing pool of capital looking at sustainable and impact strategies. There are also specialist water funds set up to target the sector.

The topic of water affects mainly companies from several subsectors and industries. We have identified over 50 companies with a combined market capitalisation of over US$500bn that generate a significant proportion of their revenues from water and associated businesses. These can be divided into the following three broad categories:

- Water utilities - providing services such as the supply of drinking water and the removal and treatment of wastewater.

- Industrials and Chemicals – a diverse group of companies supplying hardware systems (pumps, valves, etc.), engineering and consulting services or infrastructure to service providers and the efficient use of water, treatment and purification of water (including the use of chemicals)

- Hydropower - utilities that generate power using water as a source via dams and pump stations

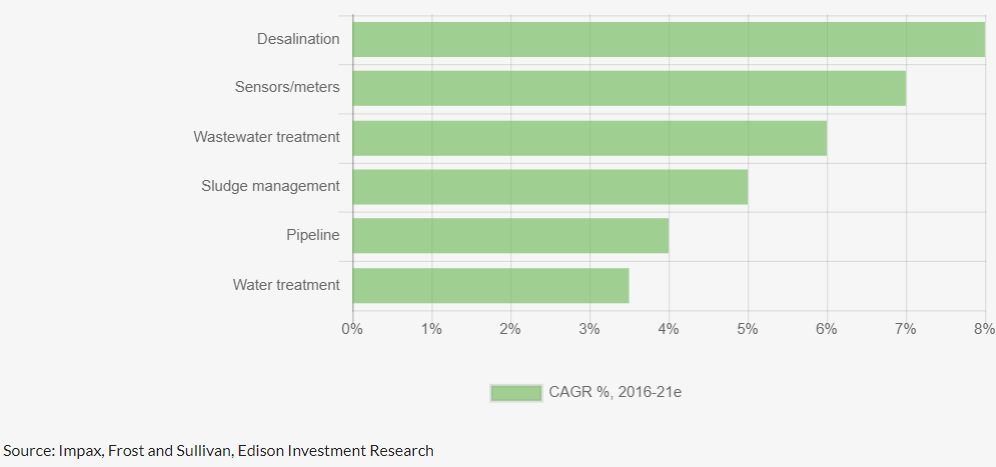

Growth rate by product categories (relevant to the second group of companies):

The RC Global Infra-Energy Fund currently holds the following stocks across all the three areas:

| Waters Utilities | Industrials & Chemicals | Hydro-utilities |

|---|---|---|

| Guangdong Investment (HK/China) | Xylem (US) | EVN (Austria) |

| China Everbright International (HK/China) | Kurita Water (Japan) | First Generation Corp (Philippines) |

| Thai Tap Water (Thailand) | Alfa-Laval (Sweden) |

Brief description of activities for 4 of our water-related companies in the portfolio follows below.

Guangdong Investment derives the majority of its revenue from supplying unprocessed natural water to water distributors in HK, Shenzhen and Dongguan regions under Dongjiang concession agreement. Dongjiang water accounts for 75% of water supply in HK, 50% and 80% of water supply to Shenzhen and nearby cities. Apart from this, Guangdong Investment also has several subsidiaries and associates that are engaged in water distribution, sewage treatment and waterworks construction in China.

China Everbright International is a leading player in the environmental resource management industry in China. It operates in a broad range of environmental protection areas, including waste-to-energy, hazardous and solid waste treatment, biomass, as well as environmental water. As of 31 December 2019, China Everbright International, via its listed subsidiary China Everbright Water, had secured 129 water projects in total, including 96 municipal wastewater treatment projects and 12 industrial wastewater treatment projects, with a total investment of approximately RMB23.485 billion (US$3.4bn).

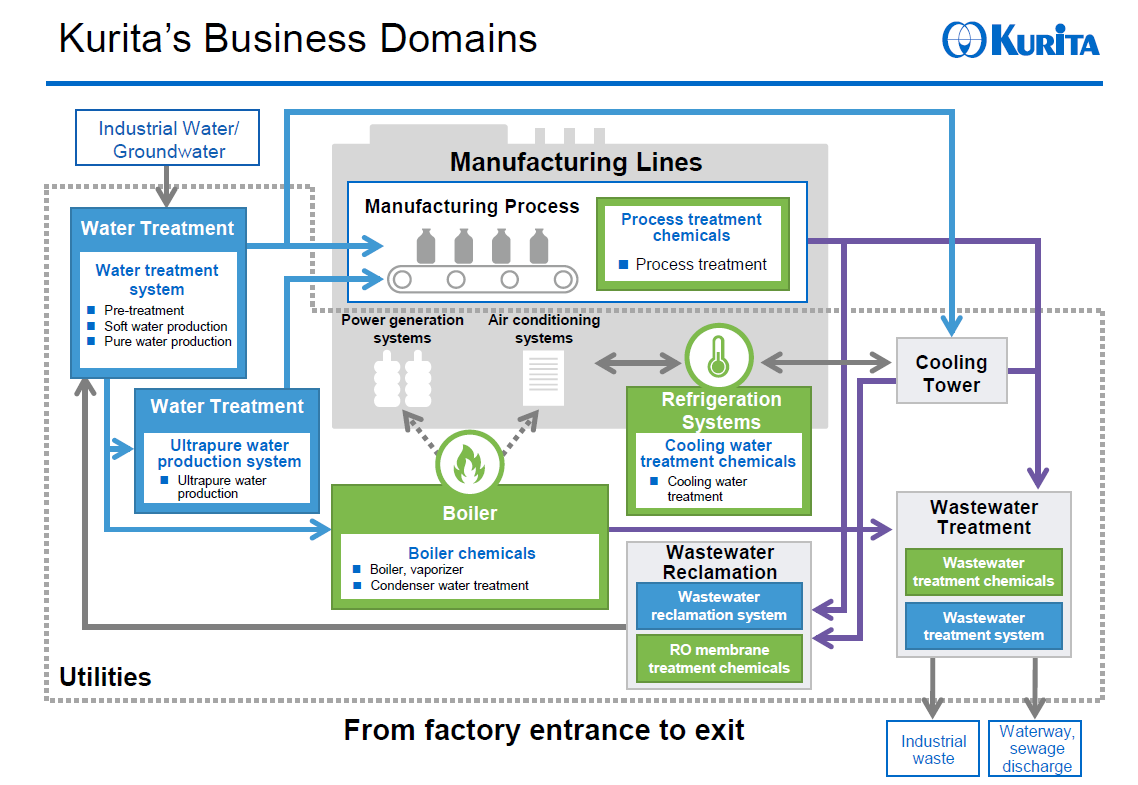

Kurita Water Industries Japan engages in the provision of water treatment solution products, technology, and maintenance services. It operates through the following business segments: Water Treatment Chemicals and Water Treatment Facilities. The Water Treatment Chemicals segment provides chemicals for the following: boiler water treatment, cooling water treatment, wastewater treatment, and process treatment. The water treatment facilities segment provides ultrapure water production system, water treatment systems for general industrial use, wastewater treatment and reclamation systems.

Source: Kurita's investor presentation 2020

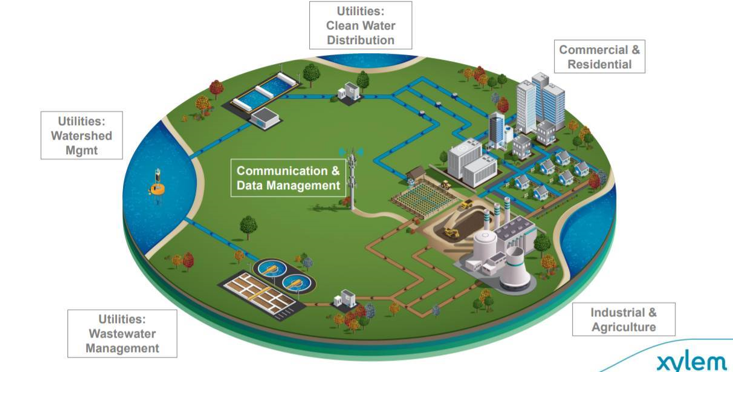

Xylem Inc US engages in the design, manufacture and application of highly engineered technologies for the water industry. It provides water and wastewater applications with a broad portfolio of products and services addressing the full cycle of water, from collection, distribution and water return to the environment. It operates through the following business segments: Water Infrastructure, Applied Water and Measurement & Control Solutions. The Water Infrastructure segment focuses on the transportation, treatment and testing of water, offering a range of products including water & wastewater pumps, treatment & testing equipment, and controls & systems. The Applied Water segment encompasses the uses of water and focuses on the residential, commercial, industrial and agricultural markets. Its products include pumps, valves, heat exchangers, controls and dispensing equipment. The Measurement & Control segment focuses on developing advanced technology solutions

Source: Xylem's investor presentation 2020

Concluding Remarks

We believe the inclusion of water-related companies in the portfolio will enhance the long-term total returns as well as lowering the risk and providing diversification benefits.As with the rest of the portfolio, we only select stocks based on strict financial metrics other than being in attractive and sustainable industries

Our 8-stock “water portfolio” within the Global Infra-Energy Fund has the following average key metrics.

| FY1 | PE | 17.4X |

|---|---|---|

| FY1 | EV/EBITDA | 9.7X |

| FY1 | Free Cash Flow Yield | 7.5% * |

| FY1 | Dividend Yield | 3.4% |

| FY1 | ROE | 12.2% |

| FY1 | Net debt/EBITDA | 1.3X ** |

NB * excl one stock with negative FCF ** two stocks out of 8 have net cash

Key Takeaway

The 3% of fresh water on earth is unevenly distributed and its availability is neither predictable nor constant over time. Quality is an issue as much as quantity: pollution, either by nitrates, biological material or heavy metals, can further restrict availability. One can live without food for three weeks, but only three days without water. Water, our most valuable resource, the one thing humans cannot survive without is becoming harder and harder to find, which means it’s becoming more and more valuable to investors.

Like what you're reading? Subscribe to our top stories.

Follow us on Medium, Twitter, YouTube, and Linkedin.

Roy Chen

Chief Invesment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.