Strategy Update – Energy Sector

We last reviewed and published an article on the Energy sector back in November 2021, “Reflecting on the oil and gas sector 15 months on from the fallout of historical oil price lows “. As part of our ongoing research and in response to the rapidly changing dynamics since then, we would like to share with you our views and observations in this sector and how the portfolio is positioned as a result

What happened in 2022 and 1H 2023?

- The sector did very well in 2022 and in fact, was the best performing MSCI sector for 2022 +42.7% compared to Brent crude, which was up 10% and MSCI AC of -12.5%. There was no doubt it was a year of peak earnings for most companies in the sector.

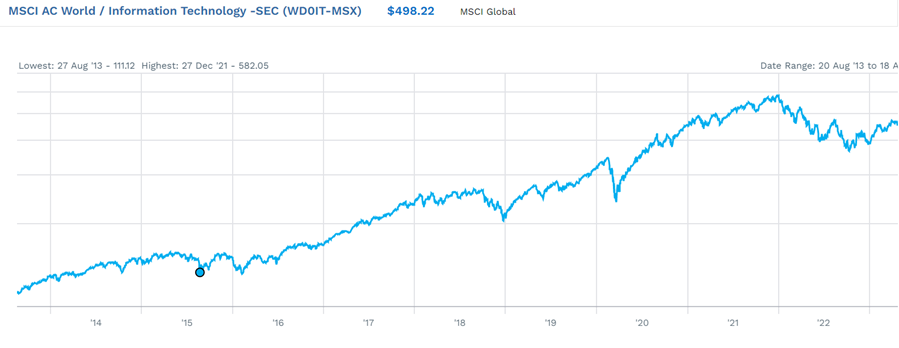

- In direct contrast, we finished 1H 2023 with Energy being the worst sector and the only one in the negative -0.5%. Brent crude fell 12.5% in the half year and MSCI AC rebounded +16.1% led by IT sector, which surged +39.5%.

- Investors will no doubt wonder whether or not it is worth staying with the energy sector when the tech-heavy sectors are the ones making the strong gains.

10 year chart of MSCI AC Energy Sector in USD

Source: Factset

10 year chart of MSCI AC IT Sector in USD

Source: Factset

Our Current View

- At RC Global, we are of the view that the Energy sector still offers compelling valuations, with some segments very much overlooked by most investors. We believe that the sector has the potential to generate very good performance outcomes, and as such, we are maintaining an overweight for Energy. For the entire period from Dec 2021 - June 2023, we have maintained exposure above 20% even though the mix of the different energy segments has varied over time.

- In 1959 the world’s first LNG tanker, a converted World War II Liberty freighter called The Methane Pioneer, successfully carried an LNG cargo from Lake Charles, Louisiana, to Canvey Island in the United Kingdom.

- We recognised that given lower prices for both oil and gas this year versus last year. It is to be expected that the majority of companies will continue to report lower earnings for Q2 on a YoY basis, which is what we saw in Q1 earlier this year.

- The recent underperformance of the sector has created a bearish short-term outlook for the oil price because of fears of a global recession and the slower than anticipated recovery of the Chinese economy. From our perspective, this has provided us with the perfect opportunity for buying and increasing exposure.

What has changed in our Strategy?

- Integrated Energy still forms the core of our energy sector exposure, but no significant outperformance can be expected until later in the year when Q3 and Q4 should deliver better earnings than 1H 2023.

- For the first time we are overweight in both Energy - Oil Services and Energy Producers (E&P) segments.

- We are now underweight Energy Infrastructure and Energy-Refiners, the latter now completely out of the portfolio for the first time.

Below is our high-level take on each of the energy segments.

Integrated Energy (9.9%) - still offers the most attractive valuation and key metrics.

- The entire group is attractive on PE, EV/EBITDA, FCF Yield and Dividend Yields with very strong balance sheets, but we do not expect any exceptional Q2 results given lower oil and gas prices as well as refining margins compared to last year.

- The average of the nine stocks we currently hold shows extremely attractive metrics (almost unmatched by any other sector in the MSCI universe):-

| PE FY1 6.6X | EV/EBITDA FY1 3.4X |

| Free cash flow Yield FY1 14.3% | Dividend Yield FY1 8.5% |

- We can expect these companies to pay handsome dividends backed by free cash flows even if the results fail to live up to expectations.

- Based on relative valuation.In Developed Markets, we much prefer the European names to the largest US peers, which trade at sizeable premiums. Hence, we continue to hold Shell, TotalEnergies and BP but have recently taken profits on Chevron and ExxonMobil. We believe the best value plays are in Emerging Markets though the Asian names are closing the gap with the European majors. While we continue to hold Sinopec China, PTT Thailand and Ecopetrol Colombia, in recent months, we also added Petrobras Brazil and PetroChina

Energy-Oil Service (12.5%) – the biggest winners in the upcycle on renewed offshore capex spend.

- In 2022, global offshore E&P (Exploration and Production) spending rose by 20% to US$165 billion. We believe the oil majors, both international (Shell and ExxonMobil) and national (Saudi Aramco-the largest listed globally) will commit similar or perhaps even higher levels of spending for 2023 and 2024 and at current oil prices as well.

- This group is highly sensitive to capex by oil & gas producers-both integrated and E&P.

- For the offshore driller sub-segment, two other important indicators are also very positive. Rig utilisation rates are now around 90% and day rates for rigs are north of US$450,000 a day for both the deep-sea semi-submersibles and drill-ships segments which contrasts sharply with lows of $125,000 a day during the pandemic

Current high conviction names and other positions.

- Our No.1 pick is Schlumberger - the leader of this group, along with its peers Halliburton and Baker Hughes, for the offshore oilfield services.

- For the offshore driller sub-segment, our No.1 pick is Noble, along with Valaris and Transocean as the top 3.

- China Oilfield Services Ltd is the largest Chinese oil service company currently being totally ignored by the market.

Based on our in-house research, we own a combination of "bigger market caps" of our "most preferred names" plus other companies in this segment, including smaller mid-caps. We believe that this "basket approach" gives us maximum exposure while minimising the risk.

Energy Producers (9.5%) - big winners leveraged to higher oil price and production growth.

Our core holding here has been Woodside Energy Australia . Due to high volatility and sensitivity to the oil price, we have actively traded a number of our favoured names since the Covid-19 period. We continued to hold ConocoPhillips US - it is highly disciplined in capital allocation with increased shareholder returns - both dividends (including specials) and share buyback.

Lately, we have been taking advantage of price weakness in this sector and have increased exposure via companies well positioned in the right basin that are likely to make a significant impact in the coming years.

- Hess US – Part of its portfolio is the exposure to Guyana operated by ExxonMobil – a region that boasts 35 discoveries in the last few years.

- CNOOC China - Addtional exposure to some of the best basins globally and the dominant player in China's still under-explored offshore basins.

- AkerBP Norway – best leveraged to offshore Norway, another prolific basin for oil and gas

- Vista Energy Argentina -the most promising play in Vaca Muerta, the largest shale oil and gas play under development outside North America.

Energy -Refiners (0%)likely to underperform.

Last year, it was our preferred way to play the post-Covid19 re-opening with demand for air travel and hence jet fuels. We believe this has been priced in. There has been a deluge of new refineries coming onstream in both the Middle East and Asia at a time when fear of global recession and slower than expected recovery of the Chinese economy will both weigh on refining margins.

Energy Infrastructure (1.8%) – likely to perform in line with the sector.

Capital spending growth for US pipelines and terminal infrastructure will not be at the same level as for offshore spending. Selective new LNG and FLNG projects will push ahead with some challenges for FIDs, and hence, we are slightly cautious here. Our two holdings are Cheniere Energy – the top US LNG infrastructure play owning LNG export terminals/liquefaction plants and New Fortress Energy – which is becoming an FLNG (Floating LNG) pure play.

In total,l we have effectively 33.8% of the portfolio in the MSCI Energy Sector, the highest level since Dec 2019 when it was 35.9%. Between March 2020 till most recently, we had maintained exposure at 20-22% except for a brief period in May 2022 when it was up to 30.6%

In conclusion

In conclusion, the energy landscape has undergone significant shifts since our last report in November 2021. While 2022 saw the sector surge to impressive heights, the first half of 2023 witnessed a tempering of these gains. Nonetheless, at RC Global, we remain optimistic about the potential within the energy sector. Our research points to compelling valuations, particularly within overlooked segments, and we continue to believe that the sector has the capacity to yield strong performance outcomes in the long run. We're strategically positioned to maximise opportunities, leveraging a diversified portfolio that includes Integrated Energy, Energy-Oil Service, and Energy Producers segments. Our consistent portfolio exposure to this sector underscores our belief in its intrinsic value and future potential. As we navigate the evolving energy landscape and impending periods of volatility, we are quietly confident that we will be able to identify and capitalise on the most promising opportunities for our investors.

All material in this article is general information only and does not consider any individual’s investment objectives.Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.