Oil refiners one of the first cabs off the rank in the travel re-opening play

Before Covid-19, we had held positions in airports, airlines, and passenger rail operators. We exited all of them because they no longer met our investment criteria. Over the last many months, we saw investors become bullish, believing various economies were to open but to see the rally all fizzled out again.

Photo by Marco de Winter on Unsplash

We were unmoved until now as we looked at all these stocks and tested them against our two critical investment criteria- balance sheets and free cash flow (FCF) generation. Most of them still fail the tests. Many of these operators still have mountains of debt and negligible FCF, making the prospects of paying us dividends while we wait for travel to normalise fairly grim! It did not mean we moved out transport sector entirely. Instead, we switched from the transport of people to the transportation of goods and, most recently, energy transport.

The problem facing most of them is that they generate negligible revenue during the lockdowns but still must service their debts, some had to do capital raisings, and it may take years rather than months to get back to normal.

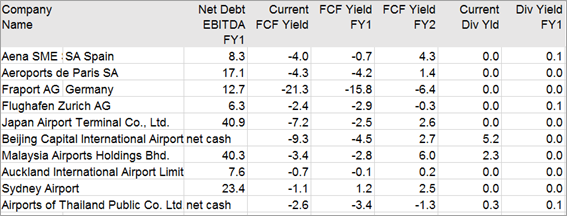

The following table of our universe of listed airports illustrates the point:

Source: Factset and RC Global Funds Management

From the above table, it becomes apparent the Airports of Thailand followed by Beijing Airports are two we could consider out of this group.

The limited selection with airports and airlines left us looking for a more near-term re-opening travel play within the transport infrastructure and energy value chains. The investment opportunity that we found was Oil Refiners and Marketing companies within the energy sector, a segment that we are very familiar with within the Global Infra-Energy Fund. The Oil Refining companies make a range of refined products from oil and gas, while the marketing companies have the distribution networks and channels for the refined products. One of the main products is jet fuel for airplanes, which directly relates to air travel demand. An excellent play when international flights start to ramp up. In addition, there will be more cars on the road with domestic travel boosting demand for gasoline and diesel and increasing the activity of stores attached to the petrol stations.

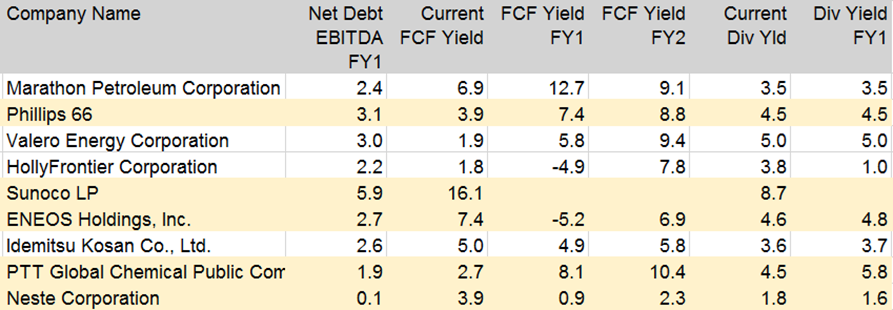

When we worked through our screening process, we could immediately see the contrast with the first group (airports) and clearly put the Oil Refining and Marketing segment in a strong position for the re-opening across all three continents- North America, Europe, and Asia.

Source: Factset and RC Global Funds Management

The other significant attractions we found with the Oil Refining and Marketing segment included:

- Even with COVID-19 and lockdowns, they are still generating decent revenue, free cash flow, profitable and paying dividends.

- The negative impact of reduced revenue was directly related to their refinery product stream's jet fuel component because commercial air traffic was heavily impacted by COVID-19, which was being slightly offset in the growth in cargo plane traffic.

- Valuations are discounted due to negative sentiments toward all things related.

Hence at worst, an investor could wait for economic recovery while still receiving the dividends if entering the travel re-opening play too early

Now that we were comfortable with the segment as a travel re-opening play, we still had to make final stock selections. As with most industries, we still need to be highly selective in picking the best even if the financial metrics meet the investment criteria and be convinced about the business model/business mix, past track record, and strategy to grow the business.

One existing holdings, Phillips 66 (PSX), had a very differentiated business mix from others, making it very compelling. The business mix included oil refining, marketing, and two other essential businesses – midstream (pipelines) assets and a Chemical JV (50-50 with Chevron).

In mid-September, we started to make a move back into this segment as a near term re-opening play, as we felt life ways beginning to come back to normal with vaccinations rates increasing around the globe. We started by topping up our PSX position, then buying back some of our previous holdings that met our criteria with our business model, track record, and ability to grow the business. Also, with our selection, we wanted to make sure we had broad exposure to global recovery. Each holding had a unique characteristic in their business mix, and there was geographical spread with the selections. Our selections included:

In Europe

- Neste Finland– the number one renewable fuel refiner globally with an impressive latest state of the art refinery in Singapore servicing the fast-growing Asian market.

In the US

- Sunoco LP US – this company no longer refines oil but is one of the largest fuel distributors in the country, with an extensive network of petrol stations and convenience stores.

In the US

- ENEOS Japan- the largest oil refiner and marketing company in the country, making a big push to renewable energy with a $1.7 billion acquisition, plans for hydrogen and further downstream to chemical segment.

- PTT Global Chemicals – the chemical division of Thailand’s leading national energy company PTT. The unique characteristic of the company is the full integration of the oil refinery with the chemicals – this diversity means it can recover faster as well.

Our moves have now been made with the comfort level of knowing our investments in the Oil Refiner and Marketing segment have a safety margin with their balance sheets, free cash flow, and business model quality where they can maintain dividends if we have another disruption with the travel re-opening play.

All material in this article is general information only and does not consider any individual’s investment objectives.Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.