Reflecting on the oil and gas sector 15 months on from the fallout of historical oil price lows

Back in June last year, we published an article on “Oil prices at historical lows creating a significant risk-reward opportunity to invest” this was amid witnessing negative oil prices and evaporating cash flow for oil and gas producers. It is now 15 months later, and the pendulum for the oil and gas market has certainly swung back in the other direction due to the energy crunch, which has driven up gas prices. The energy crunch started in Europe due to several combining factors we outlined in the recently published article. However, the energy crunch was not confined to Europe and spread across the globe into Asia, adding further pressure to the global supply chain shortages. Furthermore, if the North American winter is colder than expected, additional pain could be in the US.

Given the nature of the radical swing in sentiment for oil and gas prices with the recent energy crunch, we wanted to look back at what we said last year and discuss our latest thoughts going forward. To do this, we will look at the critical factors that led to the energy crunch, review and discuss our investment strategy for each segment in the oil and gas sector.

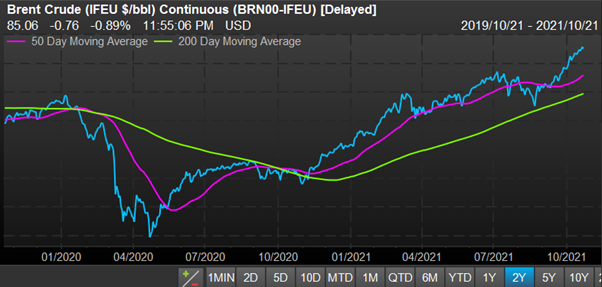

Two-year price chart of Brent Crude Oil -the international benchmark: Source Factset

The critical factors contributing to the Global Energy Crunch

The Global Energy Crunch has caused natural gas prices in Europe and Asia to accelerate rapidly. The accelerating price increases of natural gas have seen utilities go out of business, food production companies stop producing, and businesses are left with rising costs. The factors contributing to the Global Energy Crunch, especially in natural gas, include:

- Solid rebound in demand after the outbreak of COVID-19, as requirements from industry and consumers are returning to pre-pandemic levels.

- Investment in the energy sector has been underfunded for years. COVID-19 halted near-term investment for oil and gas companies while they repaired their balance sheet from historically low oil prices.

- Geopolitics within Europe restricting traditional natural gas supply routes.

- Energy transition shift towards more renewable energy types such as wind and solar added to the vacuum in the short-term energy supply. The variable nature of wind and solar does not make it easy to add back into the energy grid to make up for demand deficits if there is not enough.

The last three factors can be fixed over time through investment, diplomacy, and innovation. But in the immediate term, it influences the significant change in sentiment in the oil and gas sector, seeing rising prices. With this background in mind, let us look at the oil and gas sector and our changing investment strategies from the end of May 2020 to mid-October 2021.

Integrated Energy Segment- Remains in the best position

Our strong preference last year was the bigger "Integrated Energy Companies or Majors - Big and diversified is the best positioned for recovery" covers both the production (upstream) and refining/chemical units (downstream). Also, many have substantial LNG (Liquified Natural Gas) activities and operate gas liquefaction plants with export facilities.

The key factors influencing our preference for this group:

- These more prominent integrated companies with more substantial balance sheets are more likely to weather the industry downturn than smaller companies within this group or the specialists in the other groups within the sector.

- Their integrated model means quite often one part of the business may be doing better than the other part. For example, offering a partial hedge when the oil price is low – the downstream elements like refining and marketing as well as chemicals tend to do better with lower input costs.

- Those with sizeable LNG businesses could withstand the shorter-term lower oil price as LNG mostly rely on long-term contracts.

At the height of the downturn last year, several majors reduced their dividends but have since restored them and share buybacks. The previous quarterly results of this group were nothing short of spectacular, with an abundance of cash flows!

We can make the following observations about this group, in particular, the European names:

- In a matter of ten months, the group had put in place material resilience measures in a 10-year strategic cycle.

- Having gone through massive changes in 18 months of their operating environment, all should be well placed to generate and return an enormous amount of cash, FCF yield averaging 13.6% with a dividend yield north of 6% plus share buybacks.

- Return on invested capital is returning to double digits again.

- For ESG centric investors, the group has firmly committed to carbon emission targets by investing heavily into renewable sources of energy - peer renewable power capacity 4GW 2019 moves to 75GW 2026E (19x) and 142GW 2030E (35x), with biofuels increasing 15x by 2035E and hydrogen, CCUS-as-a-service, and multi-energy customer support all expanding massively over the coming decades.

All considered we see a lot of value headroom for opportune investors positioning in the already re-set, re-charged and ready-to-generate European majors with a lot of cash returns in the interim too.

Our number one pick last year was Total, which has changed its name to TotalEnergies to reflect it is no longer just an oil and gas company but also embracing all types of renewable energy. It has returned 44% in 16 months with 11.8% in income alone as it was one of the few that did not cut the dividend, a result of being very cautious on leverage which worked well in a crisis environment. As a result, it is a top-three player in the LNG market with an ambitious net-zero target by 2050.

Overall, the European of five companies (Total Energies, BP, Shell, ENI and Equinor) returned on average 56.8% with exceptional outlier Equinor Norway +89.7% and group average income yield of 7.3%.

The European Five have outperformed their US peers of two (Exxon and Chevron) by +36% and Asian peers of three (Sinopec and PetroChina of China and PTT Thailand) by +31%. Currently, we also own Sinopec China and PTT Thailand among this group.

Recently, we took profit on Lukoil Russia and switched to Chevron US, as they finally committed to a net-zero carbon target by 2030, a true laggard among the western peers. Chevron's 3Q result report was their best FCF for 3Q of US$8 billion.

Integrated Energy Segment remains in the best position for recovery and represents the core holding for the oil and gas sector. We still prefer the European majors as they address climate change risks and leverage into the energy transition megatrend away from fossil fuels.

Oil Refining & Marketing Segment – Travel re-opening is its friend

In the past 15 months, we had reduced the weighting of this group to as low as less than 2% by 4Q 2020, but last month we made a significant upgrade because of the impending re-opening of many economies globally, which would greatly benefit this group.

These companies focus on refining specific products from crude oil and then market these products through their distribution channels. As a result, these companies generally have extensive marketing and sales channels, points-of-delivery networks, and other associated businesses. As recently as 3Q 2020, the top 3 US refiners posted an average return of -7.5%.

Our number one favourite here remains Phillips 66 US until recently was our only holding. Phillips 66 is one of the top three refiners in the US, but it is the most diversified and defensive one given its other midstream pipeline assets and a 50-50 JV chemical business with Chevron. It returned 10.5% in 16 months, of which dividends accounted for 5.8%.

What is driving our upgrade of the oil refining and marketing segment?

The upgrade is driven by the re-opening of various economies around the globe, with the US being the most attractive market. In Europe, most refining operations are held within the Integrated Energy companies. Refiners’ revenues have been constrained primarily due to a downturn in the commercial aviation sector (impacting demand for jet fuel) because of Covid-19. Secondly, less traffic on the road has been reducing the need for gasoline and diesel. On the other hand, demand for petrochemicals and bunker fuel for shipping remained buoyant. All refiners in our list have strong balance sheets, are profitable, and continue paying dividends.

Now with the transportation sector moving back to normality, we believe the lift in earnings would be substantially meaningful. So to take advantage of the higher earnings, we have increased our weighting in Phillip 66 and bought back other companies we owned. The other names we have added each have unique features that we like:

- Neste Finland, a unique refiner with its renewable fuels ranking number one globally, is an up-and-coming part of the business where others are well behind. It has built a state of the art renewable fuel refinery in Singapore.

- Sunoco US - this company does not refine oil anymore but runs one of the US's largest service stations/convenience stores network.

- ENEOS Japan - the largest oil refiner and marketing company in the country, making a big push to renewable energy with a $1.7 billion acquisition, plans for hydrogen and further downstream to chemical segment.

Oil and Gas Producers Segment – From Deconstruction to Consolidation

Last year, we were cautious given the depressed oil price and emphasised the need to be highly selective because their business models were turned on their heads. Rapidly declining cash flows and the revaluation of oil and gas reserves on their balance sheets meant they could no longer fund future projects through earnings growth and debt levels becoming unacceptably too high. Consequently, forcing them to reconstruct their business to weather the storm of lower long term oil prices.

As one would expect, this segment saw increased mergers and acquisitions (M&A) activity, especially in the US, as consolidation of the industry was very much overdue in the shale space. The most important deals announced and completed:

- ConocoPhillips** (COP-US) acquired Concho Resources for US$13.3 billion

- Chevron *(CVX-US) acquired Nobel Energy for US$13 billion

- Pioneer Resources (PXD-US) acquired Parsley Resources for US$7.6 billion

- Cenovus acquired Husky (both in Canada) for US$7.8 billion

- Devon (DVN-US) combined with WPX Energy for US$5.6 billion

The Australian equities market has not been immune to consolidation with:

- Santos is in the process of merging with Oil Search

- BHP is combining its oil and gas assets with Woodside Petroleum

Our preferred investment was Woodside Petroleum Australia through this period. The rationale was the company being essentially an LNG play where most of the revenue generated is tied up in very long-term contracts. Hence it is "safer". Lately, it has also benefited from LNG's extraordinary high spot prices, which probably account for 15% of its LNG sales.

Woodside returned 15.2% for the last 15 months while another holding in the Fund Occidental Petroleum did +108%. However, as both stocks were purchased before Covid-19, they are still below water in the Fund – indicating how far this segment had fallen and still well below they used to trade at.

On the other hand, we have traded top US names ConocoPhillips and Devon Energy on multiple occasions and realised 10-20% returns each time in the last 16 months. We rate both these companies highly, consider them the best operators in the upstream segment, and we will be looking to purchase them on any further weakness.

Given that oil and gas prices are now much higher and likely to stay high for longer, we are now more constructive for the group, but our experience taught us this segment will always be volatile. Hence we adopt a two-tiered strategy where we combine a more trading-oriented strategy and have core holdings such as Woodside for the longer term.

Oil and Gas Producers Segment – From Deconstruction to Consolidation

In the midstream segments, companies typically own and operate pipelines, terminals and associated facilities with various contracts signed up with customers.

Last year, we were attracted to this group's more utility-like business models, except those with very high debt. The one we highlighted last year, Magellan Midstream Partners, together with its larger peer in the US-Enterprise Energy Partners and Kunlun Energy of China, became our three core holdings in the Fund. However, given the higher energy price environment, we believe this group would underperform for a while. Hence, we have taken profits in all three instead of buying a Chinese Sinopec Kanton, which operates pipelines and terminals across the country. Given the volumes of imports of both oil and gas by China, we see further upside here.

This group is one to reconsider once the more energy price-sensitive segments have their runs and the time to go defensive again.

Oil Service Segment – The tide is turning with Energy Digitization by its side

Last year we were not keen on the oil service segment, as it is the most sensitive to energy prices. The price of oil has a significant impact on how much national oil companies (NOC- the likes of Saudi Aramco and Petronas Malaysia) and international oil companies (IOC-all the majors like Shell and ExxonMobil) would commit on their capital expenditure (Capex) plans. Due to two downturns in less than ten years, Capex spending has been severely curtailed. The low investment by the industry is a significant factor to blame for the high energy prices we are seeing now when supply is an issue with growing demand. Therefore, it would be logical to assume Capex plans for most of these companies will increase in the coming years. Last year we said the leader of this group, Schlumberger would one day be a great buy again. It has indeed performed well, but our pick in this group is Baker Hughes which, together with Halliburton, are the top three names in this group.

Today, Baker Hughes is a combination of the old oil service company of Baker Hughes and GE's oil and gas division. We view it as an "Energy Technology “company, more diversified and our preferred business model of the top three, and we classify it as an “Equipment & Services “holding. Baker Hughes’s focus on technology puts in a strong position the benefit from the digitisation of the energy grid, which will be important in making the sector more efficient.

Where to from here for the Oil and Gas Sector?

YTD 2021 Energy has been the best sector for both MSCI AC (+49% in AUD) and US S&P 500 indices (+57% in AUD and +51% in USD) vs Brent crude +64% in USD.

The big rise must be seen in the context of the Energy sector underperforming for several years relative to big techs with IT, Communications and Consumer Discretionary sector. As a result, both US mutual funds and hedge funds have been underweight or even nil positions for the sector. The limited exposure to the energy sector is not surprising given energy companies represent only 3% of the S&P 500 index versus the last time when Brent crude traded above $60/bbl, it was 6% of the same index.

Today energy sector earnings make up nearly 5% of the S&P500 earnings. One can argue there are other pressures because of energy transition and hence terminal growth that it would be unlikely to go back to the 6% level.

We believe oil (and gas) prices staying higher for longer will drive:

- Significant earnings growth

- Cash flow growth

- Dividend growth

These improved fundamentals will drive share prices higher. To put things into perspective of where the sector is in terms of a cycle, we can look at the chart below produced by Bloomberg in Feb 2020 is the most revealing.

In addition, the sector is a beneficiary of higher inflation pressure and is one of the best hedges against a "stagflation scenario". September performance with energy, the only sector with a positive return, primarily reflects this view.

Key Takeaway

- Given our strong preference for the integrated group for all the reasons highlighted earlier, we have not changed our view only with even higher conviction - we have maintained weighting over 10% for the entire 15-month and currently at 13.5%, the highest in two years as shown in the table below.

- We next rank both Oil Refining and Marketing and Energy Producers almost equal second for different reasons given earlier. Even though Oil Services and Energy Producers are equally sensitive to higher energy prices, we still prefer the latter with better financial metrics among the top players, including FCF and dividend yields.

- Tactically we now rank the Midstream segment last as we can play the defensive via the Utilities sector.

The updated exposures in the Global Infra-Energy Fund:

| End May 2020 | Mid Oct 2021 | |

|---|---|---|

| Integrated Energy | 8.7% | 3.7% |

| Midstream | 4% | 4.8% |

| Oil Refiners & Marketing | 2% | 2.1% |

| Oil and Gas Producers | 2.5% | 5.9% |

| Total | 22.9% | 26.4% |

All returns numbers quoted below are for the period 31 May to 15 October, including dividends, unless otherwise stated.

All material in this article is general information only and does not consider any individual’s investment objectives.

Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.