Understanding hydrogen's role in Energy Transition to help find investment opportunities

There has been much press in recent times on how hydrogen could be a significant component in the energy transition of moving away from energy and fuel sources that produce greenhouse emissions. At RC Global Funds Management, we want to take a look at the potential for hydrogen and entry-points into the listed global equity markets for an investor that wants exposure to the hydrogen investment thesis. To do this, we will look at hydrogen basics, where it fits in with energy transition, challenges, growth drivers, global movements, takeaways and investment thoughts.

Hydrogen Basics

Overview

Hydrogen is the most abundant element in the universe, though it is not found naturally on Earth and must be extracted from other sources. In its purest form, hydrogen is a non-toxic colourless and odourless gas.

When used as a fuel source, hydrogen-like electricity is an energy carrier, not an energy provider. An energy source produces it, and then it is used in its final application or stored. Its role is very similar to that of electricity. Energy carriers allow the transport of energy in a usable form from one place to another.

Efficiency

Hydrogen’s efficiency is dependent on the number of steps that it incurs between production and application- each step from converting electricity to hydrogen, shipping it, storing it and converting it back to electricity in a fuel cell entails an energy loss. Energy loss is common to all energy carriers. In terms of its chemical properties, hydrogen requires faster-flowing or larger pipelines and bigger storage tanks vs fossil fuels to satisfy the same energy demand because of its low energy density per unit of volume . It is possible to overcome the problem by compressing, liquefying or transforming it into hydrogen-based fuels (e.g. methanol or ammonia), but this also leads to energy losses. However, hydrogen has the highest energy content of any standard fuel by weight (about three times more than gasoline) and thus is useful as an energy source/fuel which is why it is used as rocket fuel and in fuel cells to produce electricity on some spacecraft.

Production

Hydrogen is similar to electricity and can be produced from all energy resources available, including natural gas, petroleum products, coal, solar and wind electrolysis, biomass, and others. As with electricity, sustainable renewable energy resources, such as wind or solar power, can produce hydrogen.

Today, 95% of the hydrogen produced is made by industrial-scale natural gas reformation. This process is called steam methane reforming (SMR) and uses natural gas and steam to generate carbon dioxide and hydrogen. The other method is to make hydrogen by exposing coal to heat, oxygen, steam and pressure in a process called “coal gasification”. Both ways ended up with "Grey Hydrogen".

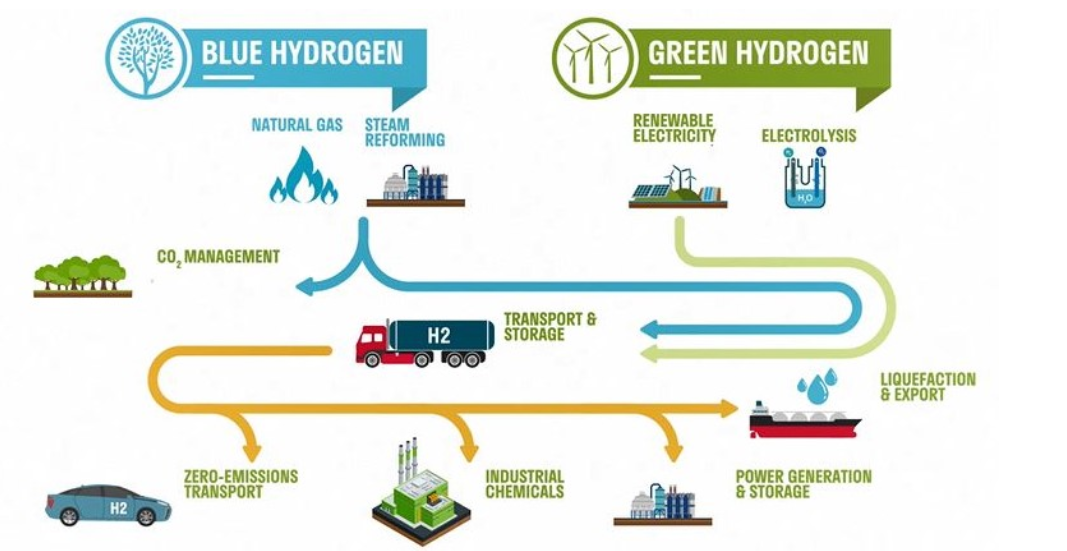

"Blue Hydrogen" and "Green Hydrogen" are two other methods that are more environmentally friendly with no carbon dioxide released to the atmosphere."Blue Hydrogen" is made in the same way as "Grey Hydrogen", but using carbon capture technologies prevent CO2 releasing, enabling the captured carbon to be safely stored deep underground or utilised in industrial processes.

"Green Hydrogen" is produced from water using renewable power. It is made by passing an electric current through the water in a process called "electrolysis" and requires much electricity which can come from a renewable source like wind and solar.

The diagram below compares the different process between "Blue Hydrogen" and "Green Hydrogen":

Source: Woodside Petroleum

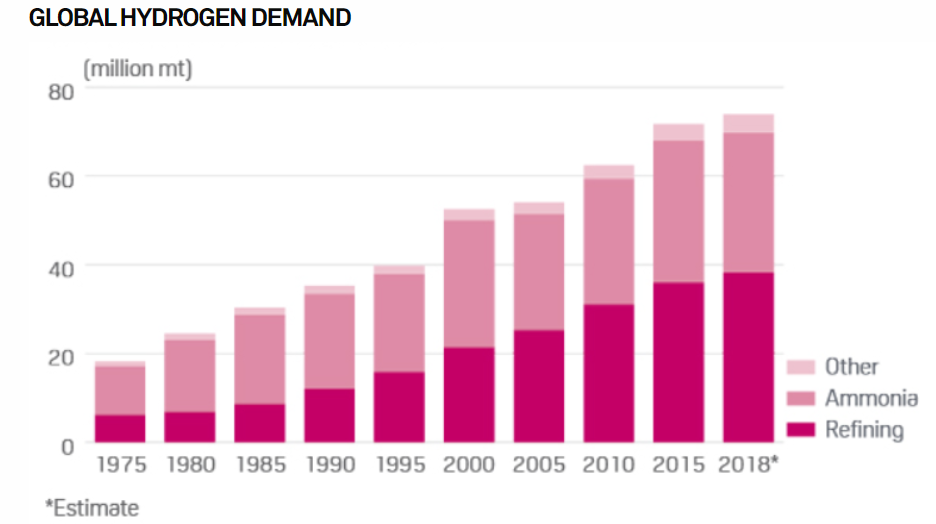

Current Demand

The current primary uses for hydrogen are for the petroleum, ammonia for fertiliser, chemical, and food industries. The demand for hydrogen has grown significantly from 1975 and continues to rise. We can see the growth from 1975 with the graph below:

Source: S&P Global Platts Analytics

Role hydrogen can play with Energy Transition.

Hydrogen is considered one of the most promising alternatives to fossil fuels in many fields spanning from the chemical industry to transport. When hydrogen is used, it does not produce any greenhouse gas or particulate, and if used in a fuel cell, it simply emits water. Hence, hydrogen's carbon footprint is determined by the way it is produced (electricity/biomass/fossil fuels).

Hydrogen becomes the perfect fuel for reducing greenhouse emissions when it is produced by a productions process that does not emit carbon dioxide into the atmosphere. To become the ideal fuel, hydrogen needs to be created as Blue Hydrogen or Green Hydrogen.

One of the significant advantages of hydrogen is the technology and infrastructure required for conversion, storage, and transportation is proven and available it only needs to become scalable.

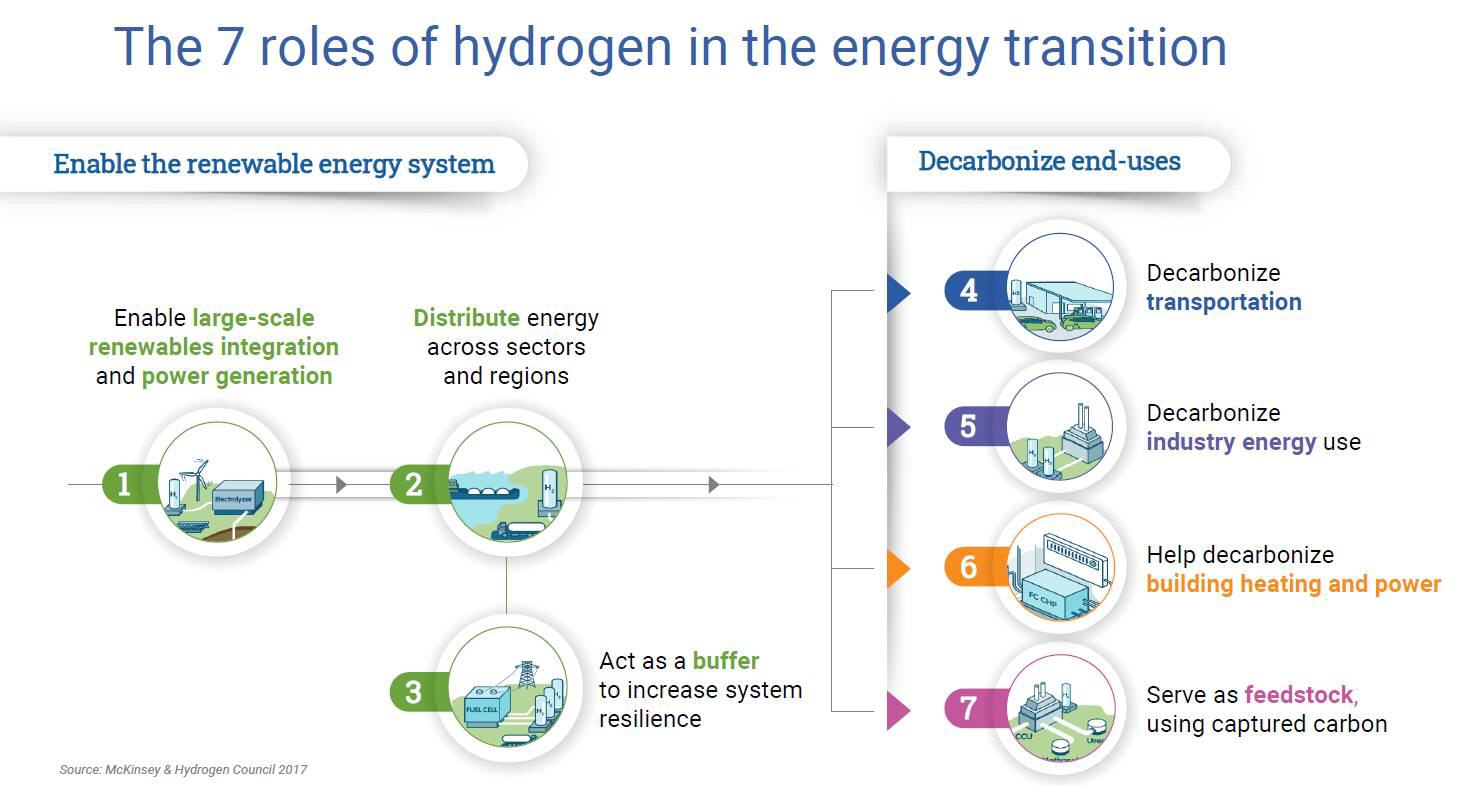

The diagram below provides a breakdown of the various roles that hydrogen can play in energy transition.

Source: Hydrogen Council

The challenges that "Green Hydrogen" and "Blue Hydrogen" face

There is a view that the order of transitioning away from Grey Hydrogen will be Blue Hydrogen first and then to Green Hydrogen. The reason for this thinking is that Blue Hydrogen will face fewer challenges compared to Green Hydrogen with becoming an affordable replacement in the near-term of Grey Hydrogen. We believe both will be part of the mix for hydrogen to become a significant component in energy transition away from fossil fuels. What we believe to be more important is identifying each of the challenges they face to become a cost-effect alternative for producing hydrogen.

Green Hydrogen challenges

- Hydrogen produced from electrolysers not yet cost-competitive. Despite the growing interest towards electrolysers, the technology is in general still not competitive in terms of price per unit of hydrogen vs fossil fuels.

- Availability of renewable energy sources needs to be at competitive prices. On average, hydrogen from renewables costs today around $6/KgH, which makes green hydrogen too expensive for most of the applications in which it is not the only existing low-carbon alternative.

- All the infrastructure needed for production, transport over long distance and storage of hydrogen need to be fully developed - in many ways resemble that of how LNG has grown and evolved globally in the last few decades.

Blue Hydrogen challenges

- Oil and gas resources available to provide an energy source, a core component of generating hydrogen.

- Management of Carbon Capture and Storage. For storage of carbon, there needs to be affordable access to salt caverns, which stop the carbon releasing into the atmosphere.

Key growth driver for Blue and Green Hydrogen

The key growth driver for advancing the production hydrogen as blue or green is to reduce the risk of climate change. Climate change risk has become a high priority problem to solve by society. The production of clean hydrogen provides an efficient solution to reducing carbon emissions emitting from power generation, transport, chemical production and the making of steel.

The beginnings of a new hydrogen value chain are grounded in proven technology. The scale-up of these technologies is critical, as is the development of new end-use technology that will further expand and drive hydrogen use.

Movements around the globe

Both government support and comprehensive industry commitments are needed to develop “Blue and Green Hydrogen" as a viable and critical fuel in the coming decade. Growth in hydrogen adoption is reliant on government support measures in favour of the energy carrier, thus enabling the sourcing of hydrogen to be cheap enough.

To gauge this commitment from industry and government, we have listed some recent movements form industry and leading countries for growing the hydrogen market.

The Hydrogen Council

A global initiative of leading energy, transport and industry companies with a united vision and long-term ambition for hydrogen to foster the energy transition. Launched during the 2017 World Economic Forum in Davos, the growing coalition of CEOs have the ambition to:

- Accelerate their significant investment in the development and commercialisation of the hydrogen and fuel cell sectors.

- Encourage key stakeholders to increase their backing of hydrogen as part of the future energy mix with appropriate policies and supporting schemes.

The Hydrogen Council believes hydrogen can address 18% of global energy demand and abate one-fifth of carbon emissions. But it won't come cheap. Scaling up the hydrogen economy will make investments of $20 billion-$25 billion each year through 2030, the council says.

Euro Zone

In the aftermath of coronavirus, the EU has launched its hydrogen strategy targeting 6GW in new capacity from electrolysers by 2024, and it wants to increase to 30GW of additional capacity by 2030. 100MWe projects are now under discussion. Over the last few years, Europe commissioned an increasing number of electrolyser projects with the average size shifting from 0.1MWe in 2000-2009 to 1MWw in 2010-2019 and some 10MWe already commissioned.

Germany

Germany has set out to become a global leader in the associated hydrogen technologies, and the government has penned a National Hydrogen Strategy to fulfil these ambitions. It calls for the Development of a "home market" for hydrogen technologies in Germany and paves the way for imports.

"As a first step towards the market take-off of hydrogen technologies, strong and sustainable domestic hydrogen production and use - a 'home market' - is essential. A robust domestic market also creates an important signalling effect for the use of hydrogen technologies abroad." … "The Federal Government sees a hydrogen demand of about 90 to 110 TWh until 2030. To cover part of this demand, generation plants with a total capacity of up to 5 GW, including the necessary offshore and onshore energy generation, are to be built in Germany by 2030. This corresponds to a green hydrogen production of up to 14 TWh and a required renewable electricity quantity of up to 20 TWh. It must be ensured that the demand for electricity induced by electrolysis plants does not increase CO2 emissions. For the period up to 2035, a further 5 GW will be added if possible, by 2040 at the latest."

In addition to the €7 billion earmarked for green hydrogen in Germany, the government stimulus includes a further €2 billion to build up partnerships with other countries.

France

The French government has presented a national hydrogen strategy. It provides for an investment of 7.2 billion euros by 2030 and a hydrogen production capacity of 6.5 GW by 2030.

The French Ministry of the Environment and the Ministry of Economy have published a joint strategy paper focussing on the decarbonisation of hydrogen production and the design of a hydrogen industry. The aim is to create 50,000 to 150,000 direct and indirect jobs in France over the next ten years.

The development of hydrogen-powered vehicles such as trucks, garbage trucks, trains and – in the long term – aeroplanes is to be promoted. “Hydrogen is a strategic opportunity to intensify and accelerate the decarbonisation of the most difficult to decarbonise sectors, especially in industry and transport”, said Environment Minister Barbara Pompili when presenting the plans.

As far as the distribution of investments is concerned, for example, 1.5 billion euros France will spend on the construction of electrolysis plants, which will later be powered by renewable energy.

Korea

In January 2019, Korea announced its Hydrogen Economy Roadmap. The Roadmap outlines the goal of producing 6.2 million fuel cell electric vehicles and rolling out at least 1200 refilling stations by 2040. Additionally, the plan aims to roll out at least 35 hydrogen buses in 2019 ramping this number up to 2000 by 2022 and 41000 by 2040. In terms of the energy sector, the Roadmap outlines an objective to supply 15 GW of fuel cell for power generation by 2040.

The government's vision has the backing of critical private sector industrial firms, most notably the Hyundai Motors Group which plans on investing 7.6 trillion won ($6.7 billion) under its "FCEV Vision 2030". Hyundai Motors Group is also part of the HyNet consortium to build 100 new hydrogen refuelling stations in South Korea by 2022.

Hyundai is not alone in investing in hydrogen fuel cell technology. Doosan recently spun out its fuel cell division into a separate company to advance the division’s growth and is set to complete construction on South Korea’s first liquid hydrogen plant in 2021. Doosan’s Mobility Division has also developed a hydrogen fuel cell drone to service deliveries in areas with poor infrastructure.

Hanwha Energy has completed the world's first by-product hydrogen power plant, which opened in July 2020 in the Daesan Industrial Complex. The plant utilises fuel cells produced by Doosan.

South Korea’s dominant steel producer, Posco, also produces both fuel cells and components for fuel cells. Korean steelmakers have begun to make hydrogen and hydrogen vehicle parts in line with Hyundai Motor Group's expansion of its hydrogen vehicle production capacity.

Hyundai Steel has joined hands with Hyundai Motor Co., KOGAS, Hyundai Glovis and SPG to expand its hydrogen production capacity from 3,500 tons to 37,200 tons per year. With its current hydrogen production capacity, the company can charge about 17,000 hydrogen cars a year. If the production capacity is expanded as planned, the company can charge up to 180,000 hydrogen cars a year.

Japan

Under the Japanese government Hydrogen Plan, the country will develop commercial-scale supply chains by around 2030 to procure 300,000 tons of hydrogen annually and ensure the cost will be competitive. It will attempt to commercialise power-to-gas systems by 2032 and reduce the cost of hydrogen from a renewable source to as low as that of imported hydrogen in the later future.

Japan's initiative to ship hydrogen over substantial distance offers a taste of how the market could potentially evolve and could stimulate efforts by global oil and gas companies to open their seaborne trade routes to hydrogen.

Just last month October Saudi Aramco announced that there first "blue" ammonia shipment sent to Japan. This shipment of 40 tons of ammonia is a Saudi-Japan blue ammonia supply network demonstration covers the complete value chain. The process includes the conversion of hydrocarbons to hydrogen and then to ammonia, as well as the capture of associated CO₂ emissions.

Japanese utilities J-Power in partnership with Kawasaki Heavy Industries has built the first specialised tanker as shown below. The ship will have a storage capacity of about 1250 cubic metres, less than 1 per cent of the size of liquefied natural gas carriers. The vacuum-insulated, double-shell tank will be able to hold hydrogen chilled to -253 degrees Celsius, which shrinks the volume of the gas to 1/800th of its standard size. The ship will run on diesel fuel.

Source:Nikkei Asia and Recharge News

Australia

The Australian governments, both Federal and State, are all aiming for cheap hydrogen as a key export for the country. The CSIRO National Hydrogen Roadmap from 2018 estimated demand for imported hydrogen in China, Japan, Korea and Singapore could reach 3.8 million tonnes in 2020, at a value of about $9.5 billion.

Both Woodside Petroleum and BHP are among seven companies short-listed to receive support from federal government funding to fast-track the development of large-scale renewable-based hydrogen projects- all of which involve renewables-powered electrolysers of 10 MW or more. Woodside Petroleum is also involved in a consortium led by Korea Gas and Hyundai Motor to roll out hydrogen fuelling stations in Korea.

A $50 billion Asian Renewable Energy Hub (AREH) in the Pilbara region, the world’s largest new energy generator, destined to establish Australia as a major global producer and exporter of green energy in the form of hydrogen, was granted Major Project Status by the Commonwealth Government. The 6500-square kilometre hub aims to take advantage of the abundant sunshine and wind in the Pilbara to generate 26MW of electricity to power the fledgeling green hydrogen industry.

Of late there are proposals to develop hydrogen plants in Tasmania. Both Origin Energy and Fortescue Metals Group are going head-to-head with rival ambitions to export "green hydrogen" and ammonia from plants built in Tasmania's Bell Bay.

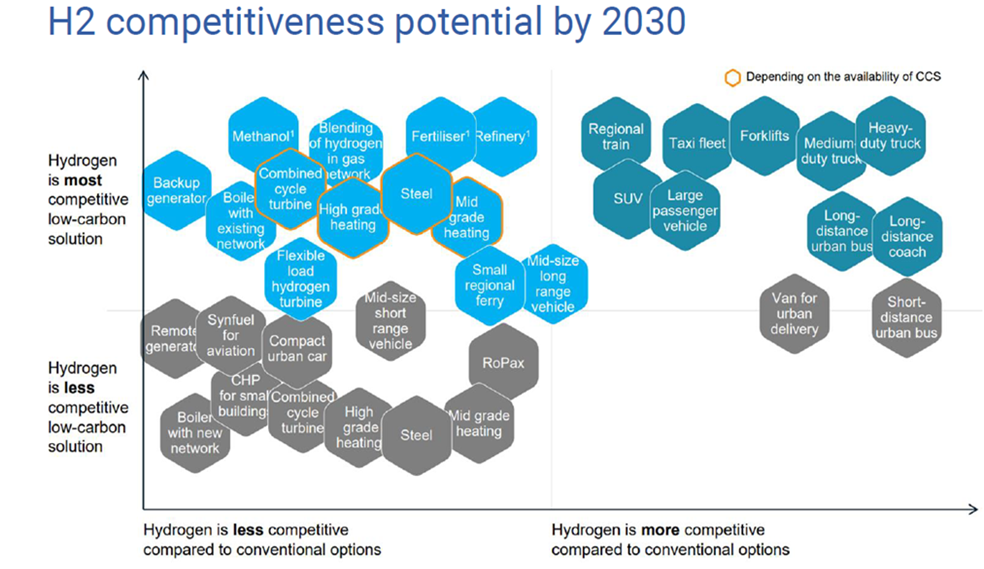

New addressable markets

The production of blue or green hydrogen is going to open up new addressable markets. The diagram below shows hydrogen's various applications by 2030 in terms of competitiveness potential.

Source: Hydrogen Council

Hydrogen as fuels for transportation

Hydrogen can be used both in its pure form, as an energy carrier or an industrial raw material, or combined with other inputs to produce fuels and feedstocks (in particular methane, methanol and ammonia). The hydrogen conversion into synthetic liquid fuels and ammonia, which are easier to handle and transport using existing infrastructure, might be useful in improving hydrogen transportation. The types of transport where it will have a comparative advantage is heavy vehicles, shipping, and industrial vehicles. Japan is actively pursuing the ammonia route.

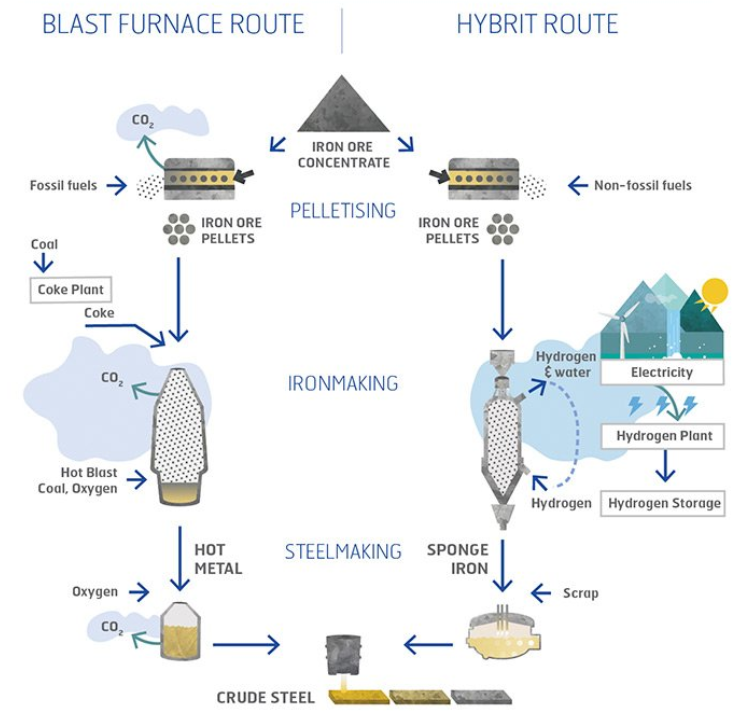

Use of hydrogen in steel-making

The global production of zero-emissions steel has taken a massive step forward, with a world-leading Swedish project completing the construction of a world-first fossil-free steel pilot plant in Luleå, Sweden in September this year. Three Swedish firms came together to form an innovative partnership around the HYBRIT project, which has integrated the supply of raw material, steel processing and energy supplies into a single project, that could be the gateway to the decarbonisation of the current coal-dependent steel industry. The partnership, which includes LKAB, SSAB and Vattenfall established the HYBRIT project, intending to produce emissions-free steel and cutting Sweden's greenhouse gas emission by as much as 10 per cent in the process. (SSAB is one of the world’s largest steel manufacturers, LKAB, an iron ore producer and Vattenfall electricity company l, to undertake the HYBRIT project as a validation of the green steel manufacturing process:

Source: HYBRIT

Takeaways

- Green, blue, grey - all forms of hydrogen will play a role as the industry scales up to meet the growing demand. While green is a goal, there is a dynamic mix of technological approaches and processes involving all colours of hydrogen in play while the industry takes shape. Such methods include Carbon Capture Technology (CCU), among others.

- Commercial production of green hydrogen is the main target because it has less environmental impact or risk through the production process.

- The technology and infrastructure required for Blue and Green Hydrogen is proven and available it only needs to become scalable.

- Hydrogen can be used both in its pure form, as an energy carrier or an industrial raw material, or combined with other inputs to produce fuels and feedstocks st in particular methane, methanol and ammonia.

- Converting hydrogen into synthetic liquid fuels and ammonia might be useful in improving hydrogen transportation because it is easier to handle and transport with existing infrastructure. The types of transport where it will have a comparative advantage is heavy vehicles, shipping, and industrial vehicles.

- The industrial application of making steel could be the other promising area where hydrogen replaces coal-based furnaces for producing steel.

- We expect all participants involved in the hydrogen value chain to make a positive contribution in the energy transition to a less carbon-intensive future

Investment thinking

To quote the German Hydrogen Strategy which said,

"For hydrogen to become a central component of our decarbonisation strategy, the entire value chain - technologies, production, storage, infrastructure and use, including logistics and important aspects of quality infrastructure - must be considered."

The above quote does suggest an immense investment opportunity in listed global equities with the ability to play it from various angles across the value chain. At RC Global Funds Management, we have taken a low-risk approach because it is early days with hydrogen becoming the perfect fuel source. We have taken a broad-based approach to value chain to find opportunity, and we have looked to companies with proven track records.

We can see this with our core holding in our RC Global Infra-Energy Fund:

- Group 1 - The top two industrial gases companies globally – Linde Germany and Air Liquide France and a smaller company Air Water Japan. Both Linde and Air Liquide have been involved in the production and handling of hydrogen for over 50 years and remain partners of choice for customers in many of the hydrogen projects around the globe. Air Water has a local advantage when it comes to Japan.

- Group 2 - The top industrial conglomerates' Siemens Germany and its recently spun-off subsidiary Siemens Energy as well as ABB of Switzerland. These companies are leaders when it comes to the engineering and equipment side in handling hydrogen as with other forms of energy.

- Group 3 - Integrated energy companies such as Shell, Sinopec China, BP, Total France, ENI Italy and Equinor Norway. These companies are already producing hydrogen in their Steam-reforming units, as they commit more to have energy from renewable sources, they will become significant players in the hydrogen space.

- Group 4 - Large Utilities with leading positions in renewable energy such as wind and solar – they are ideally placed to produce “green hydrogen”, our holdings in this group are Orsted Denmark, Enel Italy, Iberdrola Spain and RWE Germany

- Group 5 - Others who are likely to be involved in some parts of the hydrogen value chain such as Toyota Motor (hydrogen fuel cells for vehicles), Weichai Power (hydrogen for truck and forklifts), Woodside Petroleum and Fortescue Metals (Partnering or creating a new business in hydrogen applications and production). All of these companies are members of the industry body called "Hydrogen Council".

In total, we have approximately 29% of the Global Infra-Energy Fund with some degree of involvement or exposure in the hydrogen value chain. A low-risk approach has been taken shown by the key metrics of the invested companies listed in the table below. The metrics conform with our strict criteria of a strong balance sheet and sustainable dividend yields. We have deliberately excluded several early-stage or not profitable “hydrogen pure plays”. Some of these stocks have sky-rocketed this year as hydrogen is attracting almost daily press coverage around the world.

| * | Weighting % |

net debt/EBITDA X |

EV/EBITDA X |

DY % |

FCF Yield % |

|---|---|---|---|---|---|

| Group 1 | 4.7 | 2.2 | 12 | 2 | 4 |

| Group 2 | 3.4 | 0.1 | 20 | 3.2 | 3.5 |

| Group 3 | 8.7 | 1.7 | 5.7 | 5.4 | 5 |

| Group 4 | 7.6 | 2.3 | 13.2 | 3 | 1.5 |

| Group 5 | 4.5 | 1.4 | 7.3 | 5.6 | 11.6 |

Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.