Forgotten chemical sector provides opportunities too good to miss for investors

In December 2019, we had approximately 10% in the chemical sector. After Covid-19 hit hard in March 2020, we decreased our weightings to several segments including all types of energy and transport-related to travel, chemical was one we actually increased our weighting, since then it has been as high as 18%, having taken some profits and redirected some funds to non-chemical names within the Materials sector, at just over 14% now it is still our biggest weight among all segments.

The high weighting very much reflected our thinking about this sector. When Covid-19 hit almost every sector back in March 2020, this sector saw one of the steepest declines, as shown in the chart below. We asked ourselves a question “How would the end industries fare if things got worse and falling into a deep recession or if we get a recovery, be it V-share, L-shaped or K-shaped how would the industry end up? Before we answer this question, we want to look at the size of the investment universe in international equities. Follow by, an overview of the chemical industry – sub-sectors, industry players, end-users, growth drivers, and future headwinds.

Photo by Marco de Winter on Unsplash

How big is the investment universe for the chemical sector, a sub-sector of Materials?

With a total market value of US$ 2.4 trillion at the end of May 2021 (including only those with a market value of more than US$1 billion) it is not small and identical to the Transport sector covered in our previous article. The table below shows the Top 20 names which collectively with a market value of US$1.11 trillion or over 46% of the total universe.

Ranked by market cap in US$ billion as at 4 June 2021

| 1 | Linde* | Germany | 156.0 | Industrial Gases |

| 2 | Sabic | S Arabia | 100.8 | Diversified Chemical |

| 3 | Air Liquide | France | 81.2 | Industrial Gases |

| 4 | BASF* | Germany | 76.6 | Diversified Chemical |

| 5 | Shin-Etsu Chemical* | Japan | 74.0 | Diversified Chemical |

| 6 | Air Products & Chem | US | 67.5 | Industrial Gases |

| 7 | Ecolab | US | 61.6 | Specialty Chemical |

| 8 | Wanhua Chemical | China | 55.8 | Diversified Chemical |

| 9 | LG Chemical | South Korea | 53.7 | Diversified Chemical |

| 10 | Dow# | US | 52.6 | Petrochem/Diversified |

| 11 | Du Pont | US | 45.5 | Diversified Chemical |

| 12 | Givaudan | Swiss | 41.9 | Fragrance & Flavour |

| 13 | LyondellBasell* | US | 38.9 | Petrochem/Diversified |

| 14 | Nutrien | Canada | 36.8 | Fertiliser |

| 15 | Corteva | US | 33.9 | Specialty Chemical |

| 16 | DSM* | US | 32.4 | Netherland |

| 17 | Ganfeng Lithium | China | 26.7 | Lithium Producer |

| 18 | Nanya Plastics | Taiwan | 24.6 | Petrochemical |

| 19 | Formosa Plastics | Taiwan | 24.4 | Petrochemical |

| 20 | Industries Qatar | Qatar | 21.4 | Diversified Chemical |

NB * are companies in the portfolio # had been in the portfolio NB The above list only includes companies classified as chemical, however nearly all integrated energy companies have a chemical division, two of those with very substantial revenues are ExxonMobil US and Sinopec China and would easily be among the Top 20 if they separately listed.

Chemical Industry – the Big Picture

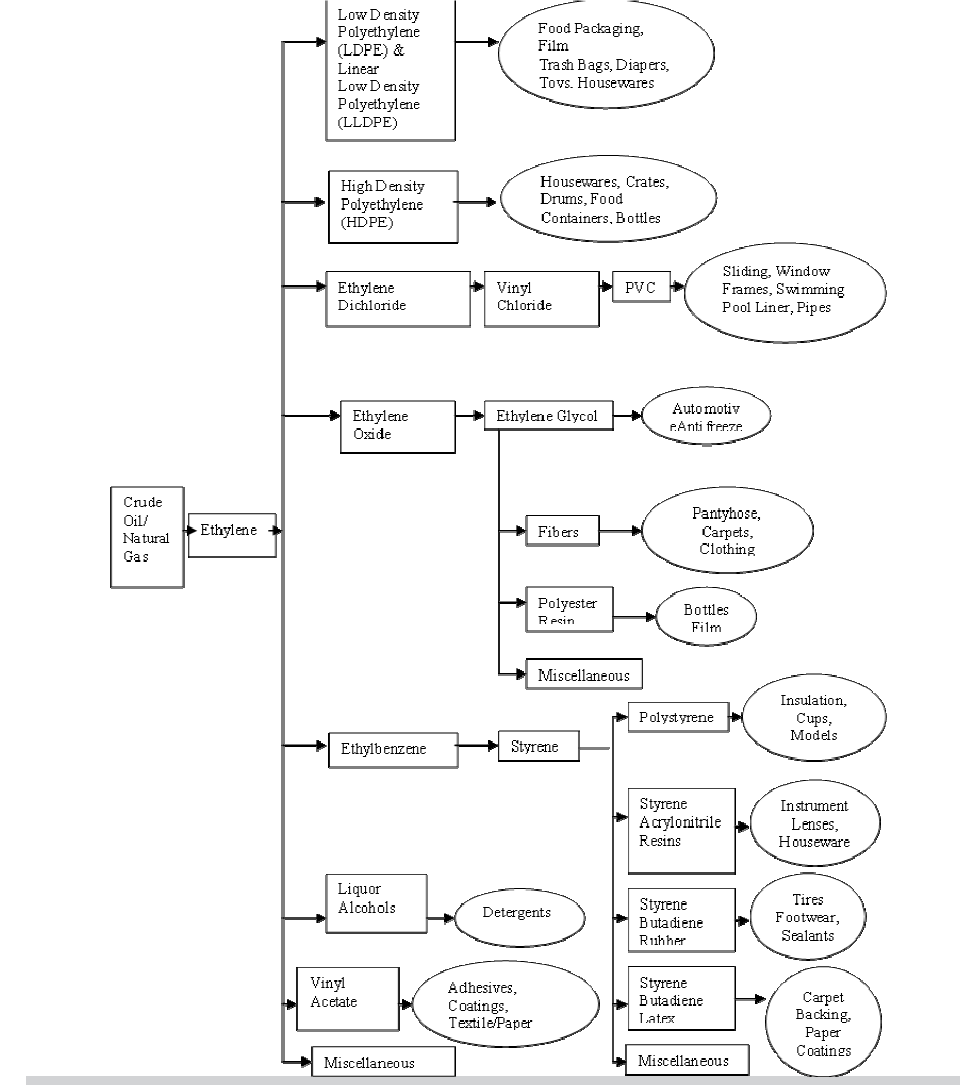

In the Chemical industry, the best starting point is to look at the chemical value chain. The value chain typically starts with commodities/bulk chemicals (petrochemicals, inorganic chemicals) using either naphtha (crude oil fraction) or ethane (within natural gas) for hydrocarbons or minerals as the raw material. The chain ends with fine chemicals and speciality chemicals, products which are delivered into every industry in modern society, so the entire value chain starts from an oil or gas well all the way through to the plastic in the home and car or synthetic fibre in clothing.

The plastics segment is the fastest-growing group of bulk materials globally, compared with others such as steel, aluminium and cement. Meanwhile, synthetic nitrogen fertilisers underpin nearly half the world’s food production.

The US, Europe and other advanced economics use 20 times a much plastics and up to 10 times as much fertiliser as developing countries on a per head basis, indicating the sector’s growth potential.

Source: IEA

Countries with dominant chemical industries are the US, Germany and Japan and now increasing Middle-East (Saudi Arabia, Qatar), China and then India. A combination of history (Germany, Japan), cheap feedstocks (US, Middle-East) and large end markets – China, India, US.

The profitability of the industry is all about volume and prices -both intermediate or end products as well as raw material or input cost.

The chemical industry is broadly divided into three main sectors:

- Commodity or Bulk Chemicals

- Diversified Chemicals

- Specialty Chemicals

Most Diversified Chemicals are the combination of bulk and specialty. Specialty Chemical includes two of the following distinct categories Industrial Gases and Fertilisers.

1. Commodity Chemicals

Commodity or bulk chemicals are typically used as starting materials for some other chemicals, ending up finally in the myriad of chemicals produced in much lower volumes, such as fine chemicals, agrichemicals, and active pharmaceutical ingredients. Along the production route, where a simple chemical has been modified step by step, the amount declines, but the price per ton increases rapidly. However, as a chemical becomes more complex (as chemically modified by various chemical reactions), production capacity declines and the cost per kg increases.

Profitability from early-step products is highly dependent on the crude oil/gas/ethane price (input cost) and energy costs used in the various processes.

Capacity utilisation is important. World-scale production sites have to be run at a certain utilisation rate to be efficient and profitable, and they all involve continuous process day in day out, downtime is costly, but scheduled maintenance is essential.

Over the years, there had been a trend towards more significant sites and a shut-down of smaller, less competitive ones. Large and new capacities have been added in the Middle East, India and China.

Petrochemicals companies must be innovative to reduce costs directly related to production or tackle the end-of-the-chain problem.

Most have moved downstream and incorporated some specialty element, thus effectively become Diversified Chemicals.

The chemical industry will continue to optimise capacities, processes, sustainability and enlarge the value chain. Companies will do this either organically or by small acquisitions.

The chemical industry is still highly dependent on oil and gas and this will not change in the foreseeable future. According to IEA, the world’s demand for crude oil in 2019 stood at 100m bbl/day, the petrochemicals sector demand was 18.5m bbl/day.

“While road transport accounted for 60% of oil demand growth in the last decade, petrochemicals will account for 60% in the next decade, largely as a result of rising demand for plastics, notably for packaging materials,” said the IEA

Back in 2018, the IEA forecast that Petrochemicals to account for nearly half of oil demand growth by 2050, while the demand for transportation fuels such as gasoline and diesel gradually replaced by EV. The world will continue to need more chemicals for the different end uses from housing/construction, automotive/Transport, Semi-conductor/5G, and pharmaceutical/healthcare.

Over 300 basic chemicals are produced with ethylene, propylene, 1,3-butadien, benzene, toluol and the two main forms of xylene making up the largest volumes and the starting points of respective value chains.

Ethylene is the most crucial building block in the petrochemical value chain and is one of the largest volume chemicals produced globally. Worldwide the ethylene capacity stands at 201.32 million tonnes per annum (mtpa) in 2020 and likely to grow to 310.68 mtpa in 2030

These basic chemicals represent not only the starting point of the value chain, but they can also dictate the location of a whole complex:

- In the US, key petrochemical complex concentrates on the Gulf Coast

- In Germany, around the riverbank in Mannheim

- In China, around Nanjing and increasing in the western region of Xinjiang

As shown in the following flow-chart diagram, the industry moves along the value chain and extends it through from petrochemicals to fine chemicals via customised products (specialty chemicals) to functionalised materials and solutions (specialty chemicals with additional features)

Due to the large capital expenditures in the last decade in China, and the Middle East, companies have moved down the value chain and over capacities have been built up in some areas.

Chemical companies see advantages in closer relationships with their customers’ industries and higher profitability as they can sell a value-added package.

As many end-customer industries have moved or are shifting production capacities to Asia, the chemical industry has established footholds there as well have started with basic chemicals and now followed by more sophisticated ones

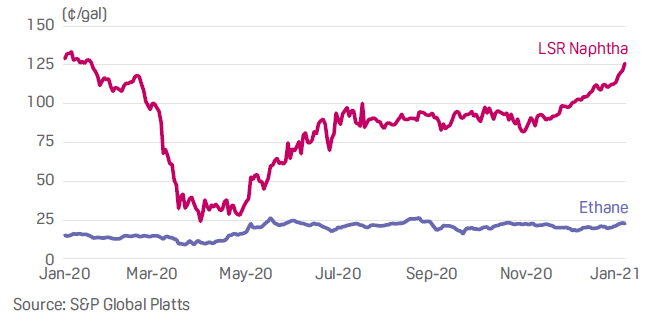

Outside the US, ethylene is typically produced from crude oil refining. Most petrochemical plants, including those in China, India, Singapore and Thailand, are integrated with oil refining. Due to the abundance of shale gas, most US petrochemical plants' starting point is based on ethane, which is separated from natural gas. Ethane price relative to oil-linked naphtha has been much cheaper, giving US chemical companies an enormous cost advantage i.e., lower input cost as well as a source of energy used in the manufacturing process.

The following price chart shows the cost advantage of ethane versus naphtha

Source: S&P Global Platts

2. Diversified Chemicals

Diversified chemicals companies do not have a single driver as their product portfolio can range from commodities via fine chemicals to agrochemicals and specialty chemicals and a company would be active in at least two of these areas.

Many fine chemicals are not traded, but specialty chemicals are sold and can be a combination of fine chemicals that add properties to an end-product according to customers’ specifications.

Typical specialty chemicals are additives and catalysts, biocides, pigments, flavours and fragrances or specialty polymers. Industrial Gases over time has become the largest segment and is now dominated by just three global players (Linde, Air Liquide and Air Products).

Diversified chemical companies are broadly intermediate producers of a wide range of chemicals and industrial gases. Therefore, they typically cover more than one step of the value chain and produce many products covering more than just the value chain. There are different business models for a diversified chemicals company that vary in the coverage of the chemical value chain. Some companies, such as:

- BASF, start with oil (naphtha) to produce commodities for captive use, of which a share could also be sold on the market, with various synthesis routes for the production of specialties used in different areas (e.g. agrichemicals, specialty polymers).

- Lanxess uses transportable commodities as a starting point for producing chemicals.

- To take advantage of cheap shale gas, Shin-Etsu Japan has expanded its PVC base to the US.

New markets and applications need innovation, founded on a solid academic and company R&D background. In the past, many chemicals started following the open innovation approach to help propel their R&D efforts, the cost of which ranges from 5-10% of sales.

Chemical companies are continuously optimising their portfolio and divesting areas that are less dynamic or with fading profitability. BASF is an excellent example of this, having divested roughly €26bn of sales and acquired approximately €9bn of sales since 2010. This portfolio optimisation has been supported by the generation of solid partnerships with such companies as Gazprom. It works closely with Sinopec via JV in China.

3.Specialty Chemical

Speciality chemicals are very heterogeneous as they are produced based on customers’ specifications to give a special performance product. Typical speciality chemicals are additives and catalysts, biocides, pigments, flavours and fragrances or speciality polymers as we exclude pharmaceutical ingredients.

In 2018, the largest speciality segments (excluding Industrial Gas) were agrichemicals, electronic chemicals, industrial and institutional cleaners, speciality polymers, surfactants and construction chemicals, accounting for 35% of chemicals’ global sales

Approximately 55% of world consumption went into only four end-use industries:

- soap, cleaning and cosmetics

- food and beverages

- electrical and electronics

- construction

The business model of speciality chemicals is to stay at the higher value region of the chain, buy some fine chemicals, chemically modify them add some other chemicals and sell them. In contrast to commodity chemicals, production sites of speciality chemicals can be much smaller and the number of multipurpose plants is much higher.

Due to the higher number of speciality chemicals and lower volumes, production has to be flexible to reduce Capex. Chemical companies can offer chemicals that add new performance to a client’s production process or the end-product.

Speciality chemicals must have a close relationship with the customer to fulfil the requirements and/or introduce innovations to give the client a competitive advantage.

R&D costs are higher, typically 8-15% of sales. When clients move production to other countries speciality chemicals company has to move also – at a minimum by opening an office with some tech specialists. Many European companies have moved part of the production and technical offices to China, Singapore to service the Asian market – the fastest growing.

The Asia-Pacific region remains the largest market for speciality chemicals, with China (39% of the total market) as the centre of gravity, followed by India (23%). The Asia-Pacific market is projected to register good growth because of the growing end-user industries such as construction, automotive, plastic, and electronics.

According to AlphaValue, the global speciality chemicals market grew from USD476bn (2010) to USD610bn in 2016, at a CAGR 2011-16 of 4.1%. Having reached USD711m (2019), the market is projected to reach c.USD954bn by 2027, growing at a CAGR of +5.0% from 2020 to 2027.

The speciality chemicals market has emerged as one of the most crucial chemicals segments across the globe. Many of the companies active in this field had been founded as spin-outs of a big chemical (e.g. Lanxess, Symrise) or a pharma (e.g. Clariant) or oil company (e.g. Arkema).

The market is dominated by large players who have diversified portfolios and employ sophisticated and modern management approaches, such as Dow-DuPont, BASF (despite being a diversified chemical), Akzo and Evonik, and many listed chemical companies in Japan are in this group.

Industrial Gases and Agriculture Chemical

Industrial and Agriculture Chemicals are part of speciality chemicals, but are two distinct categories that should be highlighted because of their size and importance in society. Industrial gases cover such things as nitrogen, oxygen and argon. To gain further insight please refer to industrial gases and hydrogen articles.

Agricultural Chemicals are predominantly additives that are added into fertilisers. The sector’s growth is essentially the demand for more fertilisers is primarily driven by long-term and structural trend of:

- an increasing population drives demand for agronomic-solutions;

- economic growth results in major changes in diet, primarily in emerging countries: higher food consumption, more meat, greater demand for grain, cereals and dairy products; and

- urbanisation leads to less arable land per capita, while, by 2050, 3bn additional people will live in cities

Challenges facing the industry

The chemical industry has significant challenges in the near future. To avoid erosion in in market share and declining margins industry participants will have to address such hurdles. There are three critical challenges that are opening the market up for transformation and these are:

- Carbon emissions effecting climate change

- esource scarcity with feedstock – energy, water, and minerals

- Plastic waste

Resource scarcity and carbon emissions

Resource scarcity and carbon emissions present both challenges and opportunities for the sector.

Chemical companies can offer a wide range of solutions to key environmental issues:

- gaseous pollution control: autocatalysis

- recycling

- carbon capture and storage

- water treatments

- bio-based chemicals

Through improved energy efficiency and recycling, companies could kill two birds with one stone! 70% of oil and gas is used as raw material and in addition also as a source of energy in the manufacturing process, recycling is both a good way to reduce cost and tackle carbon emissions.

In this respect, BASF Germany has skilfully used its “Verbund” concept, an integrated production system. The production system is a network of mass flow, energy and cooling at various sites (e.g. Ludwigshafen) and making annual savings of c.€500m due to, e.g. lower energy and transport costs.

Specialty chemical companies with low environmental impact benefit such as those with a large proportion of natural and agri-feedstocks hence fragrance & favour (Givaudan, Symrise and IFF are key players) oleochemicals (Croda), product reformation for environmental impact mitigation.

Plastic waste

One negative that attracts a lot of press attention is mounting environmental concern over plastic pollution in the ocean. Many countries have banned the single-use of cutlery, plates and straws made of plastics. Drastic improvements in waste management emphasise the urgency to curb the quantity of plastic waste entering the ocean. More recycling of single-use plastics is part of the solution. In the meantime, the pandemic has complicated the issue as demand for PPE surged, more ends up polluting the environment, many counties such as UK and Portugal have delayed single-use plastic bans. Finding a solution to the plastic boom during and after the pandemic will require a joint effort between manufacturers and policymakers to rethink and regulate products' lifecycles.

SABIC, the Saudi chemical group, is leading the way in an innovative solution to help and address the challenge of dealing with used plastic. It collaborates with customers and value chain partners to develop a circular economy for plastics, one in which products and raw materials are not wasted but used to create new, valuable products. In 2019 it unveiled its TRUCCIRCLE ™ portfolio. It is the world’s first petrochemical company to scale up advanced recycling using feedstock to create new plastics from used and mixed plastic waste and return the material to its original form from commercial applications.

To combat future headwinds

The chemical companies must do three things to turn future headwinds into opportunities:

- Innovate - New markets and applications need innovation, founded on a strong academic and company R&D background.

- Continuously optimise the product portfolio through investment and divest in areas which have been earmarked as less dynamic or fading profitability.

- Increasing production efficiency further to increase margins and better delivery to clients

If chemical companies embrace these three elements, we are likely to see even more focus on specialties within the industry to main a comparative advantage.

The larger chemical companies that cannot deliver on these three elements will have to consider acquisitions or merging with another company to avoid decline in valuation. Acquisitions and Mergers (M&A) has shaped the industry and will into the future because of the pending headwinds.

To gauge the level M&A in the sector can we look at activity pre-COVID-19. In 2019 M&A transactions had total value of USD178bn and 585 deals. The main deals that accounted over 50 % of the value and following deals included:

- The acquisition of 70% of SABIC by Saudi Aramco (for USD69.1bn) and

- the USD26.2bn acquisition of Dupont Nutrition and Biosciences by International Flavors and Fragrances (IFF

For 2020 M&A transactions were slow because of the pandemic, but we should expect the pace to pick up again with the global recovery from the health pandemic.

Investing in the global listed Chemical Sector

According to research done at Alembic Global Advisors, when the pandemic hit in March 2020, stock performance for chemical equities was far worse than any seen in recessionary periods over the last 60 years. Even though the sector balance sheets and cash flows were far better positioned than 2008/2009 and dividends seemed safe even in a draconian trough environment, the valuations were at or near trough levels.

The Alembic study also indicates that as of 31 March 2020, average Western chemical equity dropped 44% YTD and 60% from their 2018 peak, far exceeding the average 28% decline, peak to trough across all recessionary periods going back to the 1960s. It further noted that chemical equities, coming out of a recession, rally 80% on average, significantly outperforming the broader.

Source: Factset

At RC Global Funds Management, we took this as an “exceptional opportunity’ given what we viewed as suggesting limited downside and significant upside. In normal times, both “oil refiners” and “petrochemicals” performed similarly as both were the “downstream” part of the hydrocarbon value chain.

While we reduced our exposure to refiners quite significantly, mainly because jet fuels demand crashed due to biggest aviation downturn we ever witnessed. We increased our weighting to the chemical segment because it served a very diverse range of end industries. From a value investing standpoint, the chemical is highly attractive, with:

- Exceptional strong balance sheets

- High free cash flow generation more than ample to fund consistent dividend growth

- Improving return of equity

We further noted that through consolidation and transformation the industry is becoming very competitive and highly efficient. Other than ensuring attractive financial metrics our final stock selections also take account of:

- Management is focused on adding value and taking action on ESG and sustainability

- Robust business model

- Having a competitive edge over their peers in their respective segment

Currently we have a 14% weighting in the chemical segment as shown below:

Global Infra-Energy Fund Chemical Portfolio

| holdings # |

Weighting % @ 4 June 2021 |

|

|---|---|---|

| Petrochemicals | 4 | 3.7% |

| Diversified | 4 | 4.8% |

| Specialty | 2 | 2.1% |

| Industrial Gases | 2 | 2.8% |

| Fertiliser | 1 | 1.0% |

Average Key Metrics of the Chemical Portfolio

| Market Cap | $42.4 | US billion |

|---|---|---|

| FY1 | PE | 16.6X |

| FY1 | EV/EBITDA | 8.9X |

| FY1 | Free Cash Flow Yield | 4.7% |

| FY1 | Dividend Yield | 3.7% |

| FY1 | Net debt/EBITDA | Nil |

Key Takeaway

The essential nature of the chemical sector and the diverse range of end-users makes it an attractive sector for investing. The chemical sector can be resilient in downturns and prosperous over the long-term through structural growth drivers, which is a key reason for the high weighting in our Global Infra-Energy Fund. A key component to make the most of the investment opportunities is to have a deep understanding of the end-users of the chemical companies and the products they are producing for them. It was a vital tool for stock selection and portfolio allocation post- COVID-19, where there have been high levels of uncertainty with future economic activity.

Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.