Solar is the fastest growing Renewable Energy. Creating investment opportunities in listed global equities

Like wind energy, solar energy has grown significantly over the last decade as a reliable renewable energy source. The main driver of growth has been the global need to produce clean energy to combat climate change caused by carbon emissions. Over the coming decades, solar power will continue to grow at pace and surpass wind energy creating long-term investment opportunities in listed global equities.

Before looking at the investment opportunities and strategy for listed global equities, it is best to look at factors that will help us with our screening process investment opportunities. These factors include the types of solar power, market growth rate, drivers of growth, value chain, and the global state of play for solar energy.

Types of solar power

There are two main types of solar energy: photovoltaics (PV) and solar thermal. Solar PV is the solar panels we see on rooftops and sprawled across fields - it produces electricity from solar energy directly. Solar thermal uses the sun's energy to generate heat, and electricity is generated from the heat.

This article's focus will be on Solar PV, as Solar PV has become the dominant energy source over Solar Thermal. The installation of Solar PV can be done by homeowners, companies, and utilities generating electricity. Homeowners and companies install Solar PV capacity to meet their own energy needs but can feed their excess power back into the energy grid for resale. This part of the Solar PV market is known as the distributed segment, and the installed capacity by energy utility companies is known utility-scale.

The core components of a Solar PV system and how it operates is best shown with the diagram below:

Types of Solar Power

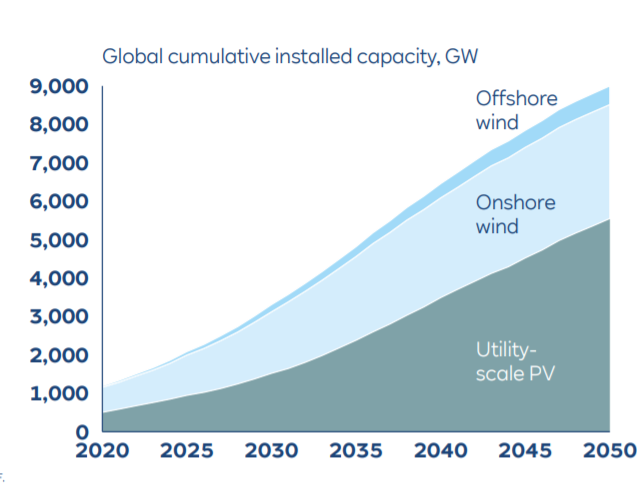

At the end of 2019, the installed wind power capacity was 651 GW vs 629 GW for solar Utility-scale PV power. As shown in the below chart, solar will grow faster than wind (onshore and offshore combined) to overtake the latter before 2025.

Source: New Energy Outlook 2019 BNEF

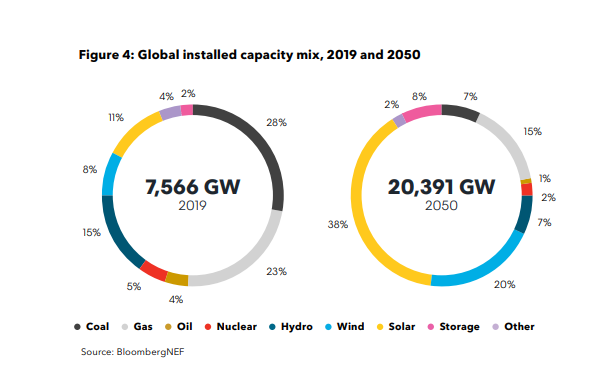

In terms of worldwide power capacity, Bloomberg NEF predicts solar will grow from 11% of the total installed capacity of power generation in 2019 to 38% in 2050. Wind energy will increase from 8% to 20 %, but not at the same rate as for solar energy. The complete breakdown of the installed power capacity mix worldwide in 2019 versus expectations for 2050 is listed below.

Source: Bloomberg NEF

Growth drivers for solar power

The drivers of solar power growth can be found both on the demand and supply side. Demand is being driven by the following:

Rising demand for energy consumption. The need for energy consumption will continue to grow with increasing urbanisation and rising living standards for a more significant proportion of the global population. These long-term trends will increase consumption of electricity and new forms of transportation that require electricity.

Reduce carbon emission. Our society has to accelerate energy transition from fossil-fuel power generation to renewable energy to decrease global warming. Solar and wind power generation are seen as the significant replacements for fossil-fuel power generation.

Affordable for the end user. At the end of 2019, Levelized Cost of Energy (LCOE) for large scale solar was $0.068/kWh, compared to $0.378 in 2010. The cost of large-scale solar projects (per kilowatt installed) even dipped below $1,000 for the first time last year, to $995. Such significant cost reduction has made solar power competitive compared to all fossil fuel power generation sources.

The following critical factors will drive the supply side:

Competitive supply chain. Over the last ten years, we have seen many companies to become world leaders. Especially on the Solar PV manufacturing side, where competition has been so intense, we have witnessed market leaders' bankruptcy such as Suntech and SunEdison Inc. The fierce competition has led to market shake out with consolation under way, but competition remains strong due to the growing size of the market.

Lower Production Costs. IRENA predict Solar PV Installation will grow almost 6-fold over the next ten years reaching a cumulative capacity of 2840 GW. The increase in volume will provide further economies of scale with Solar PV installation driving costs down to competitive prices for more significant investment return. To add to economies of scale, it already has been observed through the Swanson’s law (learning curve) that price of solar PV modules will drop to 20 percent for doubling of the cumulative shipped volume.

Innovation . To gain a competitive advantage and take market share innovation has been a critical point of difference for companies with in the value chain. There has been rapid innovation with increasing energy efficiency for solar panel’s over last two decades. Others areas of innovation that will drive the growth of Solar PV energy are improved energy storage systems, real-time smart monitoring, and advance module technologies.

Global state of play

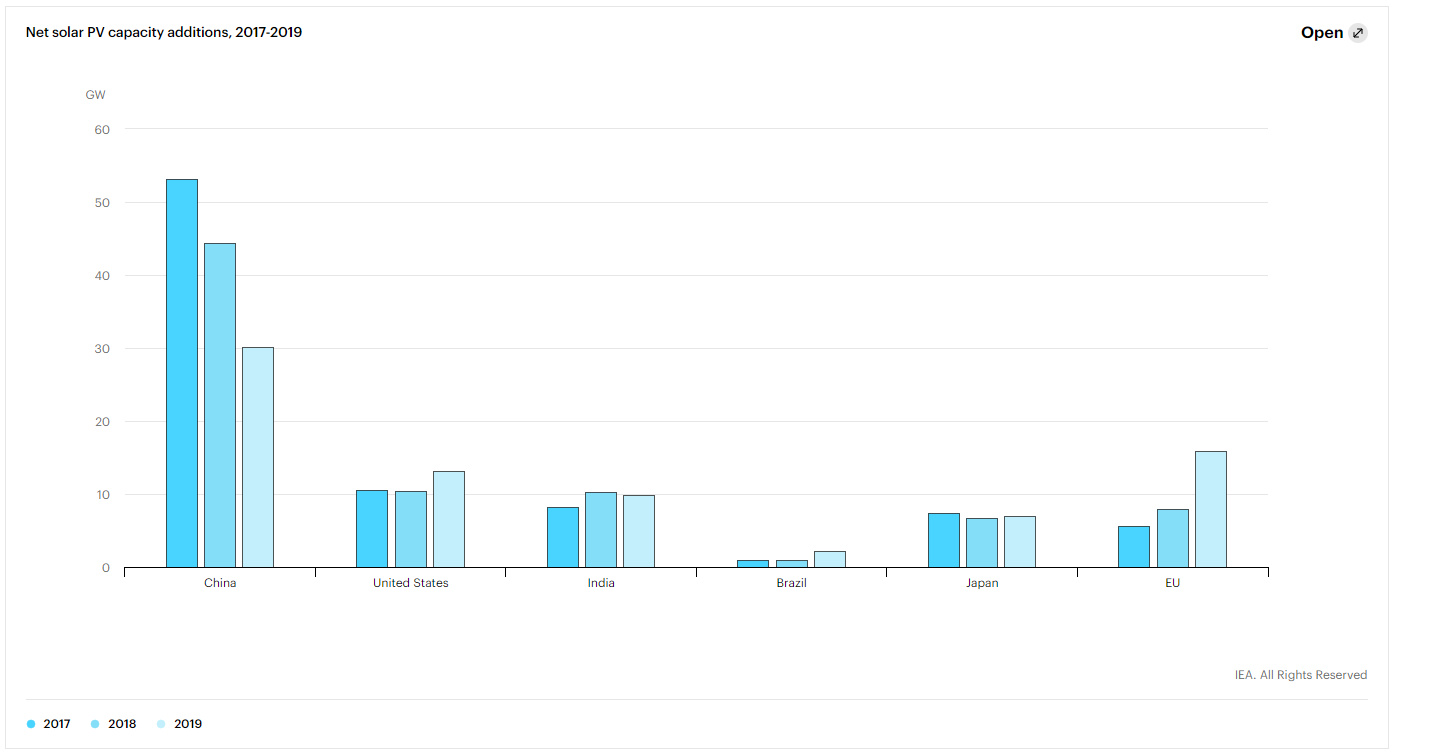

For the period 2017 -19, the global solar market installations were dominated by China, followed by the US and Europe, as seen below.

For the period 2017 -19, the global solar market installations were dominated by China, followed by the US and Europe, as seen below.

Even though China has dominated the growth of Solar PV additions growth has slowed in 2018 and 2019 because it temporarily froze Solar PV subsidy allocations and announced the transition to competitive auctions in 2018. The downward trend is expected to reverse with Solar PV developers likely to rush to meet subsidy deadlines, which is expected to occur when solar energy gets closer to grid-parity with coal power.

In 2018 and 2019, the US and Europe made a significant addition to their installed capacity with the majority being utility-scale additions. The upward trend should continue higher with favourable government policy to encourage solar power generation.

Another area we like to highlight in the global market is China's domination in the Solar PV value chain from polysilicon to panels.

Where are the investment opportunities?

The solar industry builds and installs devices to capture the energy from the sun and convert it into electric power. The supply chain encompasses a wide variety of companies that play the following functions:

- Manufacturing components and panels

- Installing solar panels

- Operating solar energy generating facilities

- More diversified utilities including those that specialise in just renewables

Similar to the wind power market, there are two broad categories of companies, and many of these are listed:

- Upstream solar companies - manufacturers of the various components of the value-chain which cover the first two groups mentioned above

- Downstream - Solar-farm developer/infrastructure vehicles /utilities. Some specialise in solar only, some all renewables and others are more diversified and integrated utilities with increased renewable focus (including solar) -all of these forms the second group

We have identified over US$180 billion of listed solar energy equities, most of which are manufacturers of solar panels, including power optimisers and microinverter. Others are polysilicon, wafer, cells and glass producers

Another US$60 billion are "Renewable Energy" Utilities. This excludes many of the largest utilities which operate not just solar power farms and wind farms.

Solar-related stock performance

They had vastly outperformed both the broader market and fossil fuel stocks in 2020. This follows years of underperformance by most solar energy stocks and in the year when it was feared that the pandemic would grind the industry to a halt. Instead, solar stocks have exploded. While it's important to understand what has happened, it pays more to predict what's sustainable in the coming years and could keep driving solar stocks higher.

No negative impact from the Pandemic

Back in March, there was worry that the COVID-19 pandemic would be a huge burden for the solar industry in 2020. Residential solar sales could be impacted because companies wouldn't be able to sell door-to-door, manufacturing could be shut down, and costs could rise to keep workers and customers safe.

But that's not what happened. In fact, the construction industry was booming in 2020, so residential solar has been relatively healthy. Outdoor working conditions were also deemed relatively safe, so for solar projects worldwide, its business as usual.

As expectation grew that pro-climate change Joe Biden will win the US Presidential Election, investors bought the sector on the promise of favourable policies toward the solar industry.

Lastly, these stocks' financial performance has been improving – both revenue growth and even margin expansion.

Our criteria for selecting stocks for solar exposure

For Upstream or product makers, we believe the following macro factors should be considered first:

- Supply-demand situation

- Competitive landscape

- Technology shift to higher efficiency products

Based on our assessment of different product segments, we concluded the most attractive element to be "polysilicon" in preference over the module, cell, wafer and glass makers.

Unlike other sub-segments (solar glass, wafer and module) with ongoing capacity expansion, we expect polysilicon to see tight supply until 2022. Hence this segment is not at risk of oversupply and will be better positioned than other solar products in the next two years.

In addition, market fragmentation is low, thus benefiting the larger players in the polysilicon segment.

As for the Downstream or solar farm operators, we are cautious with them in general, especially in the Chinese market. Delay in subsidy collection on one hand and a rush to install more capacity, on the other hand, are putting cash flow and balance sheet under lots of pressure for many operators. We see them as less attractive than the first group and believe one has to exercise extra caution investing in this area -company financials matter most for us at RC Global Funds Management.

Our Investment Strategy

Given the anticipated growth ahead for the solar industry, many well-positioned companies in various segments should thrive. To succeed, they need both a well-defined strategy and financial flexibility to execute their plans.

In line with our approach to other megatrends, our exposure to the solar energy market is via a low-risk investment strategy that provides both long-term capital growth as well as income generation in the form of sustainable dividends, backed up by –free cash generation and strong balance sheets. We have been very selective in picking the right stocks for our portfolios as many of the companies in our universe, including most of the best performers last year, do not pay dividends. Some have too much debt; hence they also do not meet our investment criteria.

Our current exposure to the solar energy market

As mentioned before, we like polysilicon makers for the upstream group, and our top choice here is Wacker Chemie Germany. A diversified chemical company ranks top three globally in polysilicon production capacity – a vital material for the solar energy industry. The company has been paying dividends since it went public in 2006.

For the downstream group, we prefer the diversified utilities in Europe and the US– many of them have a high percentage of their generating capacity from renewable sources. Our top preferences include:

| Stock | Installed Solar Capacity | |

| Enel Italy | 3.3 GW | |

| NextEra Energy US | 4.7 GW | |

| Dominion Energy US | 3.1 GW | |

| Iberdrola Spain | 2.2 GW | |

| Datang Renewable China | 0.2 GW | |

| Xinyi Energy Holding China (Listed in Hong Kong) | 0.1 GW | |

| RWE Germany | 0.17 GW |

Some are still small in solar such as RWE which is No 2 in offshore wind power. NextEra Energy is the largest owner of solar PV capacity outside of China in a "highly fragmented" global market with 4.7 GW of installed capacity at the end of 2019; others like Enel are catching up fast.

We also have two Chinese utilities, and the first one is Xinyi Energy Holding a pure solar utility. One of the very few private sector players with rock-solid balance sheets and attractive dividend yields.

Our second holding is Datang Renewable a renewable utility, predominantly a wind power operator (9.3 GW) with a small but growing solar capacity (0.2 GW).

Hence in total, approximately 9.2% of the portfolio has exposure to solar power; the seven utilities together have 13.76 GW of solar capacity, representing nearly 2.2% of the global installed capacity of 625 GW at the end of 2019.

Average metrics of our "Solar Power" portfolio within the Global Infra-Energy Fund .

| Market Cap | $55 US billion | |

| FY1 | EV/EBITDA | 12.1 X |

| FY1 | Dividend Yield | 3.0% |

| FY1 | Net debt/EBITDA | 3.0 X |

Key Takeaway

Solar is leading the charge for renewable energy sources to replace a large majority of fossil fuel power generation by 2050. The continued growth is creating a long-term investment opportunity for companies operating in the Solar PV industry. In listed global equities, the investment universe can be found in companies that are manufacturing/installing solar panels and operators of the solar power generation facilities. At RC Global Funds Management, we are very bullish on solar energy but have taken a low-risk approach with stock selections focusing on market segments in manufacturing that have seen consolidation, and power generation utilities that are established providers with strong balance sheets to increase capital investment for additional capacity.

Like what you're reading? Subscribe to our top insights.

Follow us on Linkedin.

Roy Chen

Chief Investment Officer for the RC Global Infra-Energy Fund

3 Comments

-

Dave Austin 1 day ago

Dave Austin 1 day agoAs a Special Education teacher this resonates so well with me. Fighting with gen ed teachers to flatten for the students with learning disabilities. It also confirms some things for me in my writing.

Reply -

Christina Kray 2 days ago

Christina Kray 2 days agoSince our attention spans seem to be shrinking by the day — keeping it simple is more important than ever.

Reply

Post a comment

Like to organise a meeting

To discuss investing in our global managed equity funds.